Exploring the Benefits of Child Tax Credits for Families

When it comes to supporting the younger generation, there are various financial advantages designed specifically to help families thrive. These provisions aim not only to lighten the burden on parents but also to create a financial cushion for children as they grow and develop. Many might not be fully aware of how these supports can contribute to a brighter future for their loved ones.

Exploring these benefits reveals a world of possibilities that can significantly ease the financial strain on households. From strategic planning for educational expenses to fostering a stable upbringing, the incentives available serve as a crucial resource. Parents often find themselves navigating complex regulations, but understanding these offerings can make a substantial difference in their financial journey.

Diving deeper into the eligibility criteria and the application process opens up new avenues for families seeking to maximize their resources. Realizing the full potential of these opportunities not only empowers parents but also sets the stage for a more secure and enriching environment for youngsters. With the right knowledge, families can effectively harness these tools to pave the way for future success.

Understanding the Child Tax Credit

Many families may wonder about the financial assistance available to them when raising their little ones. This support can provide some relief, easing the burden of everyday expenses and making it a bit easier to manage the challenges of parenting. It’s important to grasp the nuances that come with this financial allowance to make the most of it.

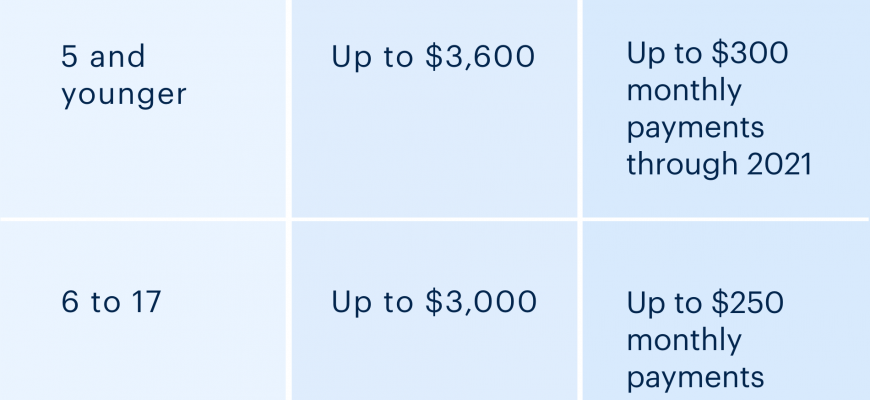

At its core, this financial benefit aims to lighten the load for households with dependents. Various factors play a role in determining eligibility, including income levels and the age of the child in question. By familiarizing yourself with the requirements, you can maximize the potential assistance your family can receive.

One often-overlooked aspect is the impact this financial boost can have on a family’s overall budget. Whether it’s for day-to-day necessities, educational expenses, or opportunities for extracurricular activities, this allowance can help enhance a child’s quality of life. Understanding how to navigate the application process and the latest updates can make a significant difference in a family’s financial planning.

Eligibility Requirements for Families

Understanding the qualifications needed to take advantage of financial assistance can make a significant difference for many households. Knowing what is required can help families navigate through resources designed to support them in raising children. It’s all about ensuring that the right families receive the help they need.

Income Level: One of the primary factors is the family’s income. Generally, there are specific thresholds that determine eligibility, often depending on how many individuals are in the household. This standard helps to ensure that assistance reaches those who truly need it the most.

Dependents: Families must have qualifying dependents to be eligible. Typically, these are children who meet certain age criteria and residency requirements. The more dependents a family has, the greater the potential benefits they might receive.

Filing Status: The status under which a family files their financial documents can also impact eligibility. Different statuses, such as single, married, or head of household, play a role in determining the level of assistance available.

Citizenship: In many cases, citizenship or residency status is a requirement. Families must generally be able to prove their legal residency in the country to access the available benefits.

Tax Responsibilities: Finally, fulfilling certain obligations related to taxation can be crucial. This means that families should have filed their financial returns appropriately in order to qualify for assistance programs.

By paying attention to these criteria, families can better understand how to access available resources that may offer significant support in their parenting journey. It’s always best to check with official guidelines to ensure compliance and to maximize potential benefits.

Advantages of Claiming Dependents

When you have little ones relying on you, there are certain perks that come with that responsibility. Acknowledging those dependents in your annual financial obligations can lead to significant benefits, allowing you to ease some of the financial strain while possibly increasing your overall returns.

First off, acknowledging dependents can improve your chances of receiving added financial relief. Many understand that raising children comes with its expenses, and this recognition helps provide support aimed at offsetting those costs. Feeling some relief from these responsibilities can be a huge boost and help you redirect funds toward other essential needs or savings.

Moreover, listing your dependents can enhance your eligibility for various assistance programs and financial incentives. It opens doors to a range of supports that might not be available otherwise, allowing you to plan for your family’s future with greater confidence.

Lastly, knowing that your dependents are accounted for can lead to a more straightforward filing process. It often means fewer hurdles or complications down the line, letting you focus on enjoying time with your family rather than stressing over paperwork.