Exploring Financing Options for Your Next Car Loan

Are you dreaming of hitting the open road in a new set of wheels? Making that dream a reality often involves navigating the world of financing options. Understanding how to secure the necessary funds can seem daunting, but it doesn’t have to be. With the right approach, you can explore various avenues to make your automotive aspirations come true.

Before diving into the specifics, it’s essential to grasp the fundamentals of obtaining monetary assistance for your vehicle. Different institutions and lenders offer unique plans, and the terms can vary significantly. Whether you’re eyeing the latest model or a reliable used option, knowing how to access the budget you need is crucial.

In this segment, we’ll break down the process, highlighting factors to consider, the types of arrangements available, and tips to ensure you make informed decisions. By arming yourself with knowledge, you can embark on your journey with confidence and ease.

Understanding Auto Financing Scores

When it comes to financing your vehicle, grasping the nuances of scoring systems is essential. These scores play a pivotal role in determining how favorable your terms will be when seeking funds for that new ride. Knowing how these scores work can empower you to navigate through the purchasing process more effectively.

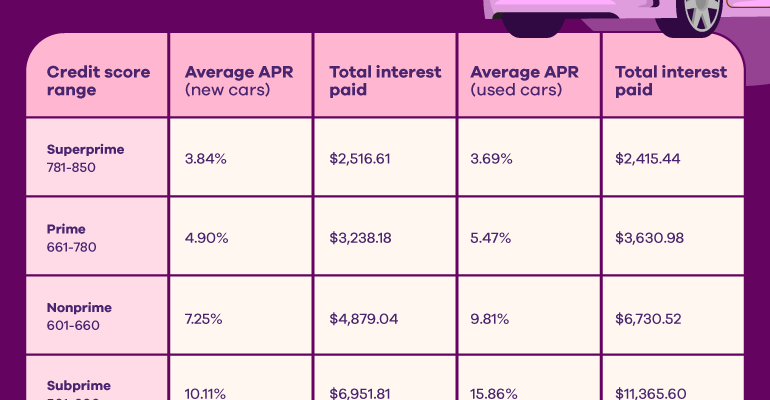

Essentially, these numeric representations reflect your history of managing borrowed funds. Lenders assess this information to gauge the likelihood of you repaying the borrowed sum. A strong score can open doors to better interest rates and more manageable payment options, which is why it’s vital to pay attention to it.

Various elements influence your score. Payment history, the total amount owed, the length of your credit history, types of credit used, and any recent inquiries all contribute to the numbers you’ll see. By understanding each factor, you can take specific actions to improve your standing before you embark on the buying journey.

Monitoring your score regularly can provide insight into your financial health. It can also alert you to errors or areas for improvement, enabling you to rectify issues before they affect your ability to secure funds. In essence, knowledge is power when it comes to achieving the best possible financing options.

Types of Auto Financing Options Available

When it comes to getting behind the wheel, there are several ways to fund your new ride. Each option comes with its own set of advantages and considerations, making it essential to choose the one that aligns best with your financial situation and goals. Let’s explore a few popular alternatives that can help you drive away in style.

Traditional Dealership Financing: This is often the most straightforward route. When you purchase from a dealership, they typically offer in-house financing. This means you can manage everything in one place, and negotiations for terms happen on-site. It’s convenient but be sure to shop around for competitive rates!

Bank and Credit Union Offers: Going directly to a financial institution can be a smart move. Many banks and credit unions provide funding with potentially lower interest rates compared to dealerships. As a member or customer, you might enjoy special deals. Just remember to have your credit score checked beforehand to know what offers you might qualify for.

Lease Agreements: If you prefer driving a new model with the latest features, leasing might be the way to go. This arrangement allows you to use a vehicle for a set time while making smaller monthly payments. At the end of the term, you can return the car or purchase it outright. This option is ideal for those who enjoy variety and don’t want the burden of ownership.

Private Financing: If you’re looking for flexibility, consider borrowing from a private lender or using peer-to-peer platforms. These often offer personalized terms, and you can negotiate directly with the lender. Just ensure that you thoroughly understand their policies and rates before committing.

Home Equity Loans: Another alternative is tapping into your home’s equity. This could provide you with a larger sum at a lower interest rate. However, be cautious, as it puts your home at risk if you fail to make payments. Always weigh this option carefully!

Whichever path you choose, it’s vital to conduct thorough research and compare the offerings. Taking the time to understand each financing choice will help you make an informed decision that suits your budget and lifestyle.

Tips for Improving Your Creditworthiness

Enhancing your financial standing is essential for securing better terms on borrowed funds. Luckily, there are several effective strategies you can adopt to boost your appeal to lenders. By following these tips, you’ll be better positioned to access favorable rates and conditions.

Monitor Your Reports: Regularly check your financial reports to ensure accuracy. Errors can negatively impact your standing. Identify any discrepancies and address them promptly.

Pay Bills on Time: Consistently meeting payment deadlines demonstrates reliability. Set reminders or automate payments to avoid missing due dates, as timely payments are crucial.

Reduce Outstanding Balances: Aim to lower existing debts. Keeping balances below half of your available limits shows responsible usage and can help improve overall performance.

Avoid Unnecessary Inquiries: Limit the number of times you apply for new accounts in a short period. Each request can slightly diminish your standing, so be strategic with your applications.

Establish a Positive Payment History: If you have no existing accounts, consider starting with a secured option or becoming an authorized user on someone else’s account. This can help you build a strong payment record.

Diversify Your Accounts: Maintain a mix of different types of credit, such as installment loans and revolving credit. A balanced portfolio can enhance your overall financial profile.

Keep Old Accounts Open: Longevity can work in your favor. Keeping older accounts active contributes positively to your history, so resist the urge to close them even if they’re not used frequently.

Implementing these strategies can significantly improve your standing over time, making you a more attractive candidate when seeking financial assistance.