Understanding Financing Options for Leasing a Car

When it comes to acquiring a new vehicle, many individuals find themselves exploring various avenues to make this important investment more manageable. The landscape of automotive financing offers numerous choices, each designed to cater to different needs and preferences. Understanding these options can empower you to make an informed decision that aligns with your financial situation.

One popular approach that has gained traction involves securing funds to drive away in a new ride without the long-term commitment of ownership. This method often appeals to those who prefer flexibility and lower monthly payments, making it an attractive alternative for many. It’s crucial to delve into how this choice works and which factors to consider before making a decision that could impact your financial health.

As you navigate the intricate world of automotive funding, key elements such as expenses, terms, and potential benefits come into play. Familiarizing yourself with the available options allows you to tailor your approach and choose a solution that best fits your lifestyle. Let’s take a closer look at how to maximize your experience while making the most of your transportation needs.

Understanding Vehicle Rental Financing Options

Diving into the world of vehicle rentals can be quite an adventure, especially when it comes to figuring out the financial aspects. It’s essential to grasp the various pathways available to help manage payments effectively. Each option comes with its own set of benefits and considerations, allowing you to tailor your choice based on personal preferences and circumstances.

One popular choice involves opting for a structured payment plan that allows you to enjoy a vehicle without the immediate burden of ownership. This method can often require a lower upfront investment, making it accessible for many. Additionally, there are alternative arrangements that may offer more flexibility or incentives, such as lower monthly expenses or the ability to upgrade to the newest models more frequently.

As you explore these financial solutions, it’s crucial to assess factors like duration, mileage limits, and maintenance responsibilities. Understanding these elements can significantly impact your overall experience. By comparing various offerings and evaluating your needs, you can make an informed decision that aligns with your lifestyle and budget.

Benefits of Leasing vs. Purchasing a Vehicle

When it comes to getting behind the wheel, there are a couple of popular routes you can take. One option allows you to enjoy a new ride without the long-term commitment, while the other gives you outright ownership. Each choice has its own perks, and it’s essential to weigh them based on your lifestyle and preferences.

Leasing typically offers lower monthly payments, making it easier to drive a more expensive model without breaking the bank. You often have access to the latest technology and safety features every few years, which can enhance your driving experience. Additionally, many agreements come with warranties that cover maintenance costs, saving you money in the long run.

On the other hand, purchasing a vehicle is an investment that can pay off in the long term. Once the payments are complete, you own the vehicle outright, granting you the freedom to drive it as long as you like without worrying about mileage restrictions. This can be especially appealing for those who plan to keep their vehicle for many years, as it can lead to significant savings in the future.

Ultimately, the choice between these two options boils down to personal preference and financial goals. Whether you prefer the flexibility of a temporary arrangement or the satisfaction of ownership, both paths have their unique benefits that can align with different lifestyles.

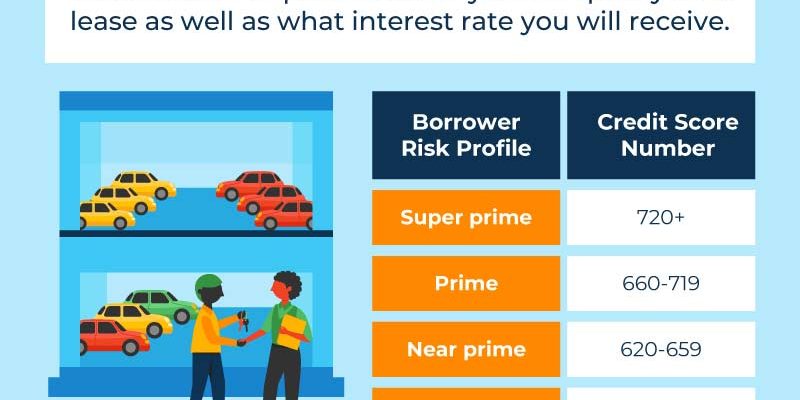

How Scores Influence Rental Agreements

When it comes to securing a rental vehicle, one factor often plays a pivotal role in the entire process: your personal score. This number serves as a reflection of your financial behavior and responsibility, and it can significantly impact the terms of your rental arrangement. Understanding its influence can help you navigate the options available to you.

A higher numerical value typically leads to more favorable conditions, such as lower monthly payments and reduced upfront costs. On the other hand, a lower score can result in stricter requirements and potentially higher expenses. Lenders assess your history to gauge the risk of lending to you, ultimately shaping the type of agreement you may receive.

It’s worth noting that different providers have varying thresholds, so it’s a good idea to shop around. If you find yourself concerned about your standing, taking proactive steps to improve it–like paying bills on time and reducing outstanding debts–can put you in a better position for obtaining a favorable arrangement. Stay informed, and you’ll feel more empowered when making your decision.