Exploring the Options and Benefits of Car Financing

The journey toward owning a new set of wheels can be exciting yet daunting. As many individuals embark on this adventure, the vital question of how to fund such a significant investment often arises. Thankfully, there are various methods available that can alleviate the financial burden, letting you enjoy the thrill of driving your dream vehicle without breaking the bank.

Exploring the options involving external funding sources can open up a world of possibilities. With the right approach, you can secure the necessary funds to bring your aspirations to life. It’s essential to weigh the pros and cons, ensuring that the choice you make aligns with your personal circumstances and future goals.

Whether you lean towards traditional establishments or innovative alternatives, understanding the mechanics of these financial solutions can empower you to make informed decisions. With a little research and planning, you’ll be on your way to hitting the road with confidence and satisfaction.

Understanding Vehicle Financing Options

When it comes to acquiring a new set of wheels, it’s important to explore the various pathways available to make that dream happen. There are multiple avenues you can take, each with its own perks and pitfalls. Whether you’re eyeing a brand-new model or a reliable used option, understanding these alternatives can empower you to make the best choice for your financial situation.

One popular method is a traditional loan, where you borrow a lump sum from a lender and repay it over time, usually with interest. Another option involves leasing, which allows you to drive a vehicle for a set period and return it at the end without the worries of ownership. Additionally, some folks turn to in-house financing offered directly by dealerships, which can simplify the process but may not always come with the best terms.

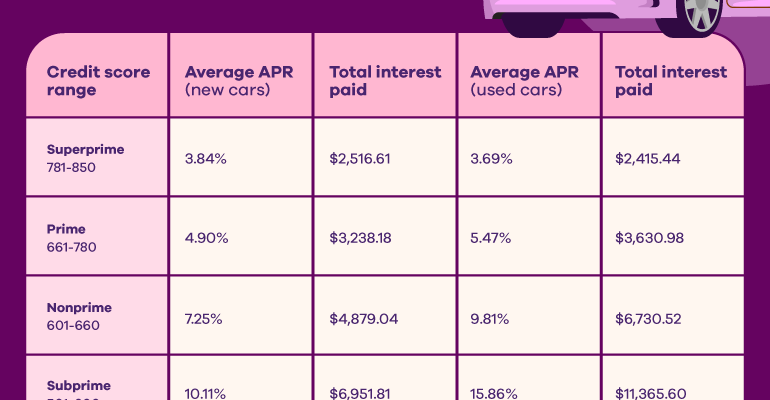

Choosing the right financing strategy hinges on factors like your budget, how long you plan to keep the vehicle, and your personal preferences. Take the time to research different offers, compare interest rates, and assess your financial capacity to ensure that you find an option that fits your lifestyle.

How to Improve Your Score

Enhancing your financial reputation is crucial for obtaining loans with favorable terms. A solid standing can open doors to better opportunities and save you money in the long run. Here are some actionable tips to elevate that number and achieve your financial goals.

1. Monitor Your Reporting

Start by regularly checking your financial records. Mistakes can occur, and spotting them early can make a significant difference. If you find inaccuracies, address them promptly with the relevant agencies. Keeping tabs on your status empowers you to understand where you stand.

2. Timely Payments

Always pay your bills on time. Late payments can significantly hinder your progress. Setting up reminders or automatic payments can help ensure you never miss a due date. Consistency demonstrates reliability and boosts your standing.

3. Maintain Low Balances

Try not to use the entire limit available to you. Keeping your usage below 30% can positively impact your assessment. This practice shows lenders that you manage your funds wisely and are less likely to overextend yourself financially.

4. Limit New Applications

Applying for multiple loans in a short period can raise red flags. Instead, space out your applications to avoid too many inquiries at once. Each request can affect your rating, so be strategic when seeking new financial options.

5. Build a Diverse Portfolio

Having various types of accounts can enhance your standing. Mixing secured loans, revolving accounts, and installment loans demonstrates your ability to handle different financial responsibilities effectively. Just be sure to manage them wisely.

Improving your rating is a journey, not a sprint. With dedication and careful planning, you can create a stronger base for future financial ventures.

Benefits of Choosing a Loan Provider

Selecting the right lender can make a significant difference in your financing journey. With various options available, it’s essential to understand what sets each one apart. Here are some key advantages you might discover by opting for the right source of funding.

- Flexible Terms: Many lenders offer a range of repayment schedules, allowing you to choose one that fits your financial situation comfortably.

- Competitive Rates: A reputable provider often presents attractive interest rates, helping you save money over time.

- Personalized Service: You can expect tailored assistance based on your unique circumstances and needs, making the entire process smoother.

- Quick Approval: Some organizations prioritize fast application reviews, enabling you to get funds when you need them most.

- Transparent Processes: Trustworthy lenders often provide clear information about their policies, ensuring you understand your obligations right from the start.

By considering these factors, you can select a lender that aligns with your expectations and financial goals, paving the way for a more manageable financial experience.