Understanding Credit Options Available for Individuals with a 600 Credit Score

Navigating the world of personal financing can sometimes feel overwhelming, especially when it comes to understanding your eligibility for various borrowing options. With a particular level of financial standing, many people often wonder what resources are available to them and how they can leverage their situation to secure funds. It’s essential to explore what avenues exist for those who may not have the highest designation but are still looking to access necessary financial support.

While you may hear a lot about the importance of maintaining an exceptional standing, it’s crucial to recognize that there are still paths available that cater specifically to individuals in a more moderate category. Often, lenders are willing to consider other aspects of your financial history, such as income stability and payment patterns, which can play a significant role in determining your borrowing options.

In this discussion, we’ll delve into practical strategies and solutions that can empower individuals with a fair rating to obtain financing. You’ll discover how to present your profile in the most favorable light, enhance your eligibility for various products, and ultimately work towards achieving your financial goals. Get ready to uncover the possibilities that lie ahead!

Understanding Ratings and Their Impact

Getting a grasp on ratings that measure financial trustworthiness can be quite enlightening. Many individuals find themselves puzzled by how these evaluations affect their lives, whether it’s securing loans, renting homes, or even landing job opportunities. The truth is, these assessments play an indispensable role in personal finance and can influence various aspects of one’s financial journey.

Ratings reflect an individual’s creditworthiness based on their historical behavior with debts and payments. They provide lenders and service providers a glimpse into how reliably someone handles their financial responsibilities. Higher evaluations generally lead to better offers, lower interest rates, and increased opportunities. Conversely, lower ratings can result in higher costs and limited access to essential services.

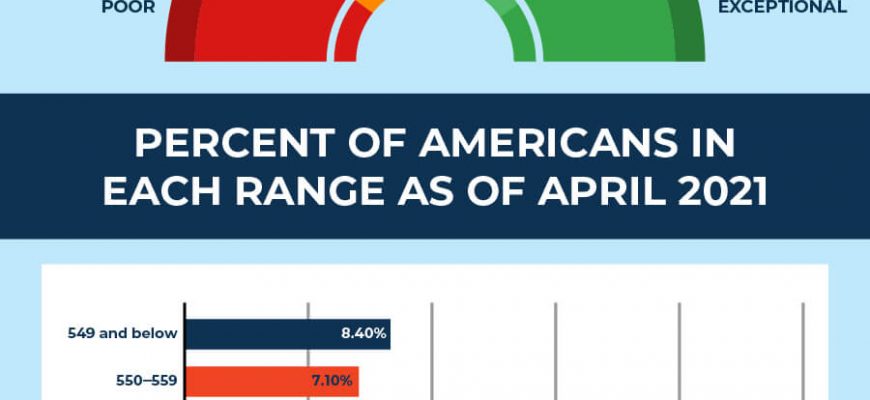

Understanding the hierarchy of ratings can help demystify the process. These metrics are usually categorized into various ranges, which serve as benchmarks to determine eligibility for financial products. Being aware of where one stands and what influences these evaluations empowers individuals to take proactive steps in enhancing their financial profile.

Furthermore, vigilance in monitoring one’s financial dealings can mitigate risks as well. Regular checks can highlight inaccuracies and prompt necessary adjustments. By maintaining positive fiscal habits–like paying bills on time and managing outstanding debts–individuals can gradually improve their standing and, consequently, their financial prospects.

Improving Your 600 Credit Score

Boosting your financial reputation is essential for securing favorable terms on loans and other financial products. Fortunately, there are effective strategies you can adopt to enhance your standing. Let’s delve into a few practical steps you can take to elevate your financial image.

- Pay Bills on Time: Consistently meeting payment deadlines is crucial. Late payments can have a significant negative impact.

- Reduce Outstanding Balances: Aim to lower the amount you owe on any accounts. Keeping balances low on credit lines can positively influence perceptions.

- Limit New Requests: Avoid opening numerous accounts in a short period. Each inquiry can send a red flag.

- Check Your Reports: Regularly review your financial reports for errors. Disputing inaccuracies can quickly improve your situation.

Consider adopting sustainable financial habits. Establishing a routine around budgeting and expenditures can provide a solid foundation. Additionally, maintaining older accounts can benefit you, as longevity often reflects stability.

- Set a monthly budget.

- Use reminders or automate payments.

- Seek guidance from financial experts if needed.

By implementing these steps, you can steadily improve your financial standing and create opportunities for better financial options in the future.

Loan Options for Low Credit Ratings

Finding financial assistance when your rating isn’t stellar can feel like a daunting task. Many potential borrowers worry about their options and whether they will be turned away. Fortunately, there are various pathways available for those who may not have the highest numbers in their profiles. Understanding these alternatives can open up opportunities and help navigate the lending landscape more effectively.

One viable choice could be considering personal loans from lenders who specialize in working with individuals facing similar challenges. These institutions often have more flexible criteria and can tailor options to fit different situations. It’s essential to compare rates and terms from multiple sources to ensure you’re receiving a fair deal.

An alternative approach might involve seeking out secured loans. By putting up collateral, such as a vehicle or savings account, it’s possible to enhance the likelihood of approval. This can also result in better interest rates since the lender has additional security. However, it’s crucial to be cautious, as failing to repay could mean losing your asset.

You might also explore community support organizations and local credit unions. These smaller financial entities often prioritize assisting community members, leading to more personalized service and potentially better terms than larger institutions. Building a relationship with these lenders can be beneficial in the long run.

Lastly, peer-to-peer lending platforms have gained popularity in recent years. These online networks connect borrowers directly with individuals willing to fund loans. This method can sometimes lead to more favorable conditions, as private lenders may be more lenient about risk assessments compared to traditional banks.

In summary, while options may seem limited, various avenues exist for individuals dealing with less-than-ideal financial assessments. By exploring all available resources and understanding the nuances of each choice, it’s possible to find a solution that meets your needs.