Engaging in Online Credit Disputes – A Comprehensive Guide to Navigating the Process

In today’s fast-paced world, navigating the intricate web of financial records can often feel overwhelming. Mistakes can crop up, whether due to human error or technical glitches, leaving individuals perplexed and frustrated. Fortunately, there’s a way to address these concerns without wading through endless paperwork or waiting for days on end.

With the rise of technology, seeking resolutions has never been easier. Individuals can now engage with services that empower them to take control of their financial narratives from the comfort of their homes. This shift provides a sense of autonomy and speed, enabling users to initiate the process and track progress in real-time.

Understanding the nuances of addressing inaccuracies can be crucial. Each step taken in the virtual landscape brings people closer to clarity and peace of mind. With the right tools and guidance, anyone can effectively navigate this terrain and emerge victorious, ensuring that their financial reputation remains intact.

Understanding Issues and Their Importance

When it comes to managing our financial health, the accuracy of our records plays a pivotal role. Sometimes, discrepancies can pop up, leading to confusion or potential problems. Navigating these inaccuracies is essential for maintaining a solid financial reputation and ensuring future opportunities. Recognizing their significance can empower individuals to take charge of their financial narratives.

Addressing these concerns not only helps in rectifying errors but also fosters a sense of responsibility towards one’s financial standing. It’s crucial to be proactive, as overlooking these matters can result in long-term repercussions. By understanding the mechanisms behind these discrepancies, individuals can better position themselves for financial success and peace of mind.

Ultimately, being informed and engaged in this process can make all the difference. Empowering oneself with knowledge in this area not only promotes a clearer understanding of one’s own financial journey but also contributes to a broader awareness about the importance of accuracy in financial documentation.

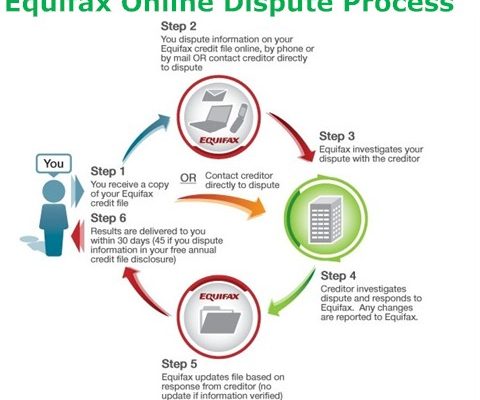

Steps to File an Online Credit Dispute

If you find yourself in a situation where something on your financial report doesn’t sit right with you, it’s time to take action. The process of addressing inaccuracies can seem daunting, but it doesn’t have to be. With a few straightforward steps, you can efficiently resolve the issue from the comfort of your home.

1. Gather Your Information: Before jumping into the submission process, collect all relevant documents. This includes your reports, any correspondence, and supporting evidence. Having everything organized will save you time and hassle.

2. Access the Reporting Agency’s Website: Visit the official site of the agency that compiled your report. Look for the section dedicated to addressing errors. This is usually easy to find on the homepage or within their service options.

3. Locate the Discrepancy Submission Form: Once you’re on the right page, search for the form or process to challenge the information. This may be labeled differently but usually indicates a way to report issues or inaccuracies.

4. Fill Out the Required Details: Carefully enter the necessary information as prompted. Make sure to provide accurate personal data and clear information about the item you’re questioning. Precision is key to ensuring your claim is understood.

5. Attach Supporting Documents: If you have evidence to back up your claim, such as receipts or previous communications, attach those files where indicated. This will add credibility to your assertion and help expedite the review.

6. Review and Submit: Before finalizing, take a moment to review all the information you’ve provided. Double-check for any errors or omissions. Once you’re sure everything is correct, submit your request and keep a record of the confirmation.

7. Monitor for Updates: After submitting, keep an eye on the status of your request. Most agencies will provide a timeline for when you can expect a resolution. Patience is essential, but follow up if necessary.

Addressing inaccuracies doesn’t have to be a headache. By following these steps, you take control of your financial narrative and ensure that everything is in order.

Common Mistakes to Avoid During Disputes

When navigating the process of challenging inaccuracies in financial records, many individuals trip up on certain pitfalls that can complicate their efforts. Recognizing these frequent errors can significantly enhance your chances of a favorable outcome. Let’s take a closer look at some of these missteps that you should steer clear of.

One of the biggest mistakes people often make is failing to gather sufficient evidence. Approaching the situation with only vague claims without supporting documentation weakens your position. Always collect all relevant statements, letters, and any other materials that bolster your case.

Another common blunder is hasty communication. It’s essential to take your time to articulate your points clearly and concisely. Rushed messages can lead to misunderstandings, which might derail your efforts. Thoughtful, well-structured correspondence goes a long way in ensuring that your concerns are taken seriously.

Many also overlook the importance of following up. Once you send in your materials or comments, keeping track of the timeline and ensuring that you check on the status is crucial. Lack of follow-up can result in missed opportunities to clarify or escalate your situation.

Some individuals may let emotions guide their responses. While it’s natural to feel frustrated, approaching the matter with a level-headed demeanor is imperative. Emotion-driven reactions can cloud your judgment and lead to unnecessary complications.

Lastly, don’t underestimate the value of understanding the policies and procedures in place. Familiarizing yourself with the specific guidelines can help you avoid unnecessary errors and streamline the entire process. Being informed equips you to make better decisions at every step.