Understanding the Concept and Significance of Credit Coupons in Financial Transactions

Have you ever stumbled upon a little piece of paper or a digital code that promises discounts or perks when making a purchase? These handy tools are designed to enhance your shopping experience, allowing you to enjoy some relief from your spending. They offer an intriguing way to stretch your budget and feel a bit more satisfied with your purchases.

These financial instruments often serve as a token of appreciation from businesses, encouraging customers to return for future transactions. They can be found in various forms, from physical slips to online codes, and can be truly beneficial when you know how to use them effectively. Understanding these offers can unlock a world of savings and add a touch of excitement to your retail adventures.

Whether you’re a frequent shopper or someone who enjoys the occasional splurge, grasping the essence of these incentives can help you make more informed choices. Let’s dive deeper into how these tools work and how they can be a valuable addition to your shopping strategy.

Understanding Interest Payments in Finance

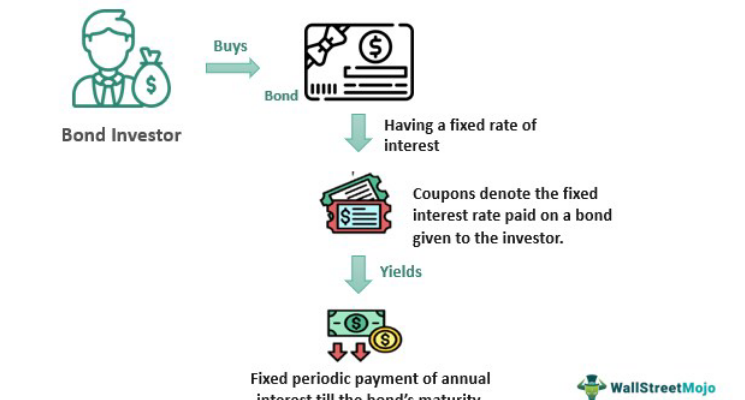

When it comes to financing, one of the key elements people often discuss is the periodic payments that borrowers make to lenders. These payments represent a return on the investment made by the lender and can significantly influence the overall financial landscape. Knowing how these payments work can help you make better decisions regarding loans and investments.

Essentially, these payments are calculated based on the amount borrowed and the agreed-upon rate. They typically occur at regular intervals, providing a predictable flow of income for the lender. For individuals and businesses alike, understanding these terms can lead to more informed borrowing choices. It’s essential to grasp how variations in rates and payment schedules can impact your financial situation.

Investors also look at these arrangements as a means to generate steady income. The appeal lies in their structured nature, often attracting those who prefer stable returns over the volatility associated with stocks. Knowing how to interpret these arrangements can position you better in the market.

Overall, whether you’re a borrower looking for the best terms or an investor seeking reliable income, grasping the ins and outs of these financial arrangements is crucial. With this knowledge, you can navigate the world of loans and investments with greater confidence and acumen.

How Reward Vouchers Operate Explained

Understanding how these financial instruments function can help you make more informed decisions. Essentially, they offer a form of benefit or incentive that can be redeemed under certain conditions. Here’s where the magic happens!

Here’s a breakdown of the fundamental principles behind these financial tools:

- Issuance: These financial rewards are often provided by financial institutions to entice users to engage with their services.

- Redemption: Holders can use them to reduce the total amount owed or receive additional perks, depending on the terms outlined when they were issued.

- Expiration: Be aware that these incentives often come with a timeline, meaning they might lose their value if not utilized within a specific duration.

It’s essential to read the fine print associated with these financial incentives. Understanding the terms and conditions can prevent any nasty surprises down the road.

- Eligibility: Not everyone qualifies to receive these benefits. Certain criteria must be met.

- Limits: There may be caps on how much can be reduced or the maximum benefit that can be accessed.

- Usage: These incentives can often be combined with other promotions, amplifying their value.

In summary, navigating the world of financial rewards can be straightforward if you familiarize yourself with how they operate. By leveraging these tools wisely, you can maximize your advantages and potentially save a significant amount of money.

Benefits of Using Discount Vouchers Today

In today’s fast-paced commercial world, leveraging special offers has become an essential strategy for savvy shoppers. These tools not only enhance your purchasing power but also create exciting opportunities to enjoy products and services at a fraction of the original cost. Understanding their advantages can transform your shopping experience and boost your savings significantly.

One of the most appealing aspects of utilizing these promotions is the immediate cost reduction. Shoppers can access incredible deals that allow them to buy more while spending less. This is particularly beneficial for families or individuals looking to stretch their budgets without sacrificing quality. Every discount leads to a more satisfying shopping journey, transforming how you view everyday expenses.

Additionally, the variety of offerings available ensures that there’s something for everyone. Whether you’re eyeing fashion items, electronics, or dining experiences, the options abound. This versatility means that users can tailor their purchases to their personal preferences, adding a touch of personalization to their retail endeavors.

Another significant benefit is the thrill of discovering new brands or services that you might not have explored otherwise. Promotions often introduce shoppers to lesser-known entities, expanding your horizons and potentially leading to memorable experiences and great additions to your regular shopping list. It’s a win-win – you save money while broadening your tastes.

Lastly, utilizing these money-saving options can be a fantastic way to build a habit of smart spending. As you become accustomed to seeking out offers, you’ll likely develop a more strategic approach to budgeting and shopping in general. This newfound awareness can lead to healthier financial habits and a more mindful consumer attitude.