Understanding Your Credit Card Statement and Coupon Benefits

Each month, many of us receive a detailed overview of our financial transactions, shedding light on our spending habits and helping us manage our budgets. This document serves as a crucial tool for keeping track of expenditures, identifying trends, and planning for future expenses. It provides a snapshot of where our money is going, enabling us to make informed financial decisions.

But it doesn’t stop there! Along with highlighting your outgoings, this report often includes unique opportunities for savings. These offerings can be enticing, giving you the chance to enjoy discounts or perks when using certain services or making purchases. Understanding how to navigate these offers is essential for maximizing value and enhancing your overall financial strategy.

So, let’s dive deeper into what this financial overview has to offer. By doing so, we can unlock the potential benefits hidden within the pages, ensuring that you make the most out of your financial activities each month!

Understanding Financial Document Discounts

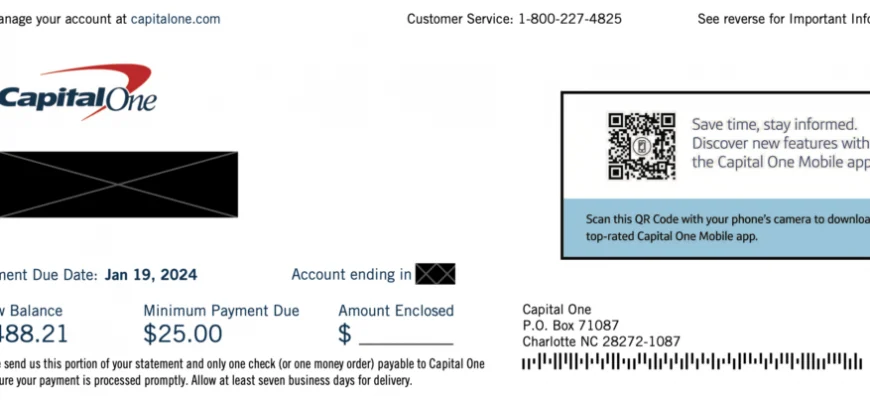

Have you ever received a particular type of document that offers discounts and promotions based on your expenditure? These financial printouts can be quite handy, providing a summary of your transactions and the chance to benefit from various offers. It’s essential to grasp how these documents work and how you can leverage them to maximize your savings.

Essentially, these documents serve as a record of your spending and often come with exclusive deals tailored to your shopping habits. Understanding the structure and available opportunities can open doors to added value. For many, it’s not just about keeping track of finances, but also exploring ways to save while making purchases.

Moreover, it’s vital to pay attention to the details. Often, these documents will contain specific terms and requirements that you should be aware of to fully enjoy the perks. By reading through the information thoroughly, you can identify which offers are relevant to you and how to take advantage of them effectively.

In conclusion, familiarizing yourself with these financial papers can significantly enhance your purchasing experience. With a little effort in understanding their layout and content, you’ll find ample opportunities to enjoy discounts that complement your spending habits.

Advantages of Utilizing Discounts with Billing Records

Engaging with promotional offers that tie in with your monthly financial summaries can be a savvy way to enhance your shopping experience. These opportunities not only help you save money but also encourage you to explore new brands and services that you might not have considered otherwise.

One of the primary perks is the potential for significant savings on products and services you already use. By taking advantage of these opportunities, you can reduce your overall expenses while enjoying the items you love. It’s like getting a little bonus for your regular spending habits!

Moreover, using these offers can motivate you to keep track of your finances more closely. When you know that your monthly reports come with some enticing deals, you’re likely to pay more attention to your expenditures. This awareness can lead to better budgeting and spending practices over time.

Additionally, these promotions often introduce you to new merchants and services, broadening your options as a consumer. Who knows? You might find a favorite new shop or online service just by perusing the discounts available, leading to a more enriching shopping journey.

Lastly, applying these benefits fosters a sense of satisfaction and accomplishment. Knowing you’ve saved some cash or tried something new can enhance your overall experience, transforming routine purchases into rewarding moments. It’s a win-win situation that brings a little extra joy to your everyday spending.

How to Redeem Your Rewards Offers

Everyone loves to save a bit when shopping, and utilizing the special offers that come with your financial tools can make a real difference. Redeeming these perks can often feel a bit overwhelming, but it’s actually a straightforward process once you know the steps. Let’s break it down so you can start enjoying those savings today.

First, make sure to locate the offers you wish to take advantage of. They are usually found in your monthly summary or online account. Once you’ve identified the applicable perks, check the terms and conditions to understand how they work. Some may require a specific minimum purchase, while others might limit usage to select merchants.

Next, it’s time to take action! If your offer is available for immediate use, simply proceed to checkout as you normally would. For those that require a code, make sure to copy it exactly as it appears–little errors can sometimes lead to discounts being missed. Input the code during the payment process and watch your total drop!

Don’t forget to keep track of any expiration dates associated with your perks. You wouldn’t want to miss out because of a timeline oversight. Additionally, some offers may be stackable with other promotions, so keep your eyes peeled for the best deals around!

Finally, always review your transaction afterward to ensure the discount was correctly applied. If there are any issues, don’t hesitate to reach out to customer service for assistance. Happy saving!