Enhanced Payment Solutions for Seamless Grab Top-Ups with Credit Cards

Managing your finances in the digital age has never been more convenient. With various platforms available, users can easily load funds onto their accounts, allowing for seamless transactions and a hassle-free experience. The ability to quickly add money provides a sense of security and flexibility, ensuring you can enjoy services without any interruptions.

Have you ever found yourself in a situation where your balance is low, and you need to renew your funds instantly? Whether you’re on the go or planning a last-minute outing, the ease of reloading your digital wallet can make all the difference. This guide will explore practical options that can enhance your ability to fund your account swiftly and safely.

By utilizing different methods, you can keep your wallet filled and your transactions smooth. No more fumbling around or dealing with complicated processes. Embrace the simple approaches available today, and enjoy the freedom that comes from being financially prepared!

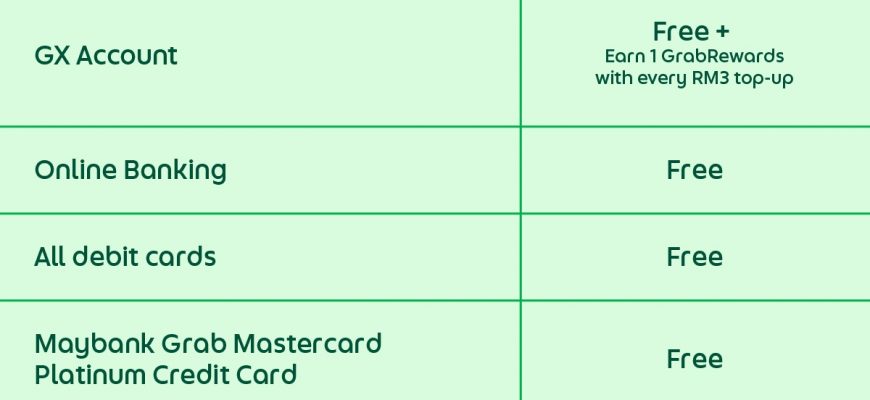

Understanding Grab Top Up Options

When it comes to replenishing your balance for rides and services, you have multiple avenues to explore. Navigating these choices can be a bit overwhelming, but knowing the available methods can make the process smoother. There are various ways to ensure your account is sufficiently funded, allowing you to enjoy seamless travel and services whenever needed.

To begin with, you can utilize mobile banking applications, which provide a quick and efficient means of adding funds. Many users find this method convenient, as it allows them to complete transactions right from their smartphones. Additionally, there are retail outlets where you can physically visit to recharge your account, often providing instant service. This option is particularly useful for those who prefer face-to-face interactions or lack access to online platforms.

Another alternative involves using a designated app. Some applications offer unique promotions or bonuses, giving you added value every time you replenish your balance. Each choice has its pros and cons, so it’s important to consider what works best for your lifestyle and preferences. By exploring these options, you can ensure your travel needs are always met promptly and efficiently.

Advantages of Using Plastic Money

Using a digital payment method offers several perks that can enhance your financial experience. It’s not just about convenience; there are smart strategies to make the most of your spending and saving.

Rewards and Cash Back: Many issuers provide enticing reward systems. You can earn points or receive cash back on your daily purchases, which can add up to significant savings over time.

Security Features: When you opt for electronic payments, you gain access to advanced security measures. With encryption and fraud detection, you can feel safe knowing your transactions are protected.

Expense Tracking: This method often comes with detailed statements and online tools. You can easily monitor your spending habits, helping you to budget more effectively and manage your finances like a pro.

Purchase Protection: Certain purchases come with added security. Many services offer refunds or replacements for defective items, giving you peace of mind when making significant purchases.

Global Acceptance: Whether you’re dining locally or traveling abroad, this form of payment is widely accepted. It eliminates the hassle of exchanging currency or carrying large amounts of cash while on the go.

Making the switch to this modern payment option can lead to smarter financial decisions and a more enjoyable spending experience.

Alternative Payment Methods

In today’s fast-paced world, having various payment options at your disposal can make life a whole lot easier. Whether you’re ordering food, booking a ride, or purchasing services, it’s beneficial to explore different avenues that fit your lifestyle. Diversifying how you pay not only enhances convenience but can also lead to better deals and rewards. Let’s delve into some popular alternatives that can help you seamlessly navigate your transactions.

One option gaining traction is the use of mobile wallets. These digital solutions allow users to store funds securely and make quick payments through their smartphones. You’ll find numerous applications that enable smooth transaction processes, often with the added benefit of promotions or cashback rewards. It’s like having your money at your fingertips without the hassle of physical notes or coins.

Another great choice is bank transfers. This method can be particularly useful for larger transactions, as it often bypasses intermediary fees associated with other payment methods. Many digital platforms now facilitate instant transfers, making it easy to manage your finances from your bank account directly.

If you’re seeking flexibility, e-wallets are definitely worth considering. These services provide a simple way to hold multiple currencies and make payments effortlessly. They’re especially handy for those who travel frequently or shop online, as they can accommodate different currencies without the need for constant conversions.

Finally, prepaid options are a fantastic way to control spending. By loading a specific amount onto a card or account, users can easily track their financial habits while avoiding overspending. This method is great for budgeting, ensuring you only use what you’ve set aside.

With so many choices available, it’s clear that there’s no one-size-fits-all approach. Each individual has unique preferences and requirements, so exploring these alternatives can lead to a tailored and satisfying experience in managing your expenses.