Comprehensive Guide to the Credit Card Calendar for the Year 2025

As we look ahead to the next phase of our financial journey, it’s important to have a well-structured plan. The concept of tracking spending and managing expenses can be a game-changer in achieving financial stability. By setting clear goals and having an organized approach, we can make informed decisions that empower us in our everyday lives.

In the coming year, individuals will benefit from a carefully mapped-out approach that aligns their spending habits with their financial aspirations. This can involve understanding the peak times for expenses, recognizing patterns, and adjusting strategies accordingly. A proactive mindset can lead to greater financial awareness and control.

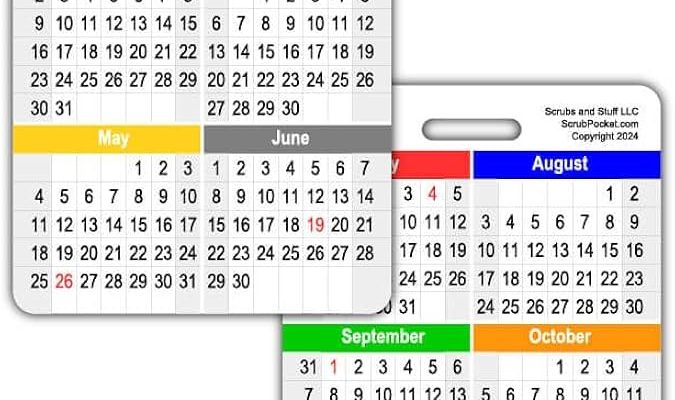

Moreover, keeping tabs on important dates and payment schedules is crucial for avoiding unnecessary fees and managing budgets effectively. Utilizing tools and resources designed for this purpose allows for streamlined management of finances, making it easier to stay on top of everything. Embracing this organized way of handling finances can result in a more balanced and fulfilling lifestyle.

Understanding Payment Timelines

When it comes to managing your finances, knowing how payment schedules work can make all the difference. Understanding when your obligations are due, how interest accrues, and what grace periods might apply can help you stay on top of your financial game. An organized approach can also prevent those pesky late fees that put a dent in your budget.

First, let’s talk about due dates. Typically, you’ll find that statements are issued on a monthly basis. This gives you a snapshot of your spending and shows the amount you owe. Remember, the due date is the deadline for making payments without incurring additional charges.

Next, you should be aware of the role that billing cycles play. These cycles can vary, usually lasting around 30 days, and they determine when transactions are recorded and when payments are expected. Keeping track of these cycles helps you plan your finances more effectively.

Lastly, it’s important to consider the grace periods that some institutions offer. This is the window of time after a payment due date within which you can pay off your outstanding balance without incurring interest. Knowing if a grace period applies can be a valuable tool for managing your payments wisely.

Key Dates for Managing Your Debt

When it comes to handling financial obligations, timing plays a crucial role. Knowing specific dates throughout the year can help you stay on top of payments, avoid late fees, and manage your overall financial health. This isn’t just about due dates; it’s about strategic planning to ensure you’re in control of your finances.

One of the most important points in your timeline is the end of each billing cycle. Mark this date on your planner, as it indicates when your statement will be generated. Reviewing this document promptly can help you catch any discrepancies and assess your spending habits.

Another critical date to consider is the deadline for payments. Missing this can lead to penalties and increased interest rates. Setting reminders a few days in advance can ensure you’re prepared to settle your balance on time.

Additionally, many institutions offer promotional periods with lower interest rates or no fees. Keep track of when these promotions begin and end. Taking full advantage of these offers can significantly reduce your financial burden.

Lastly, don’t forget annual fee renewal dates. Keeping an eye on these will help you decide if you want to maintain that particular account or switch to a more favorable option. Regularly reviewing your financial commitments is the key to making informed decisions.

Maximizing Rewards Throughout 2025

This year presents fantastic opportunities to enhance your earning potential through various spending tactics and strategic planning. By taking advantage of available programs, you can increase your benefits with every transaction. It’s all about knowing where to spend and how to optimize your points accumulation.

First and foremost, research the programs associated with your accounts. Each offers unique advantages, such as bonus points for specific categories or seasonal promotions. Stay informed about any temporary boosts in rewards and align your purchases accordingly. For instance, if a supermarket offers double points in a particular month, plan your grocery shopping to maximize those rewards.

Moreover, consider combining different rewards programs. Some merchants allow stacking offers, meaning you can receive multiple rewards for the same purchase. This strategy not only amplifies your earning potential but also helps create a more diverse rewards portfolio. Be sure to check for digital coupons or loyalty offers that can complement your regular spending.

You should also track your rewards progress throughout the year. Keeping an eye on your balance ensures you won’t miss out on expiration dates or thresholds for bonuses. Utilize mobile apps or spreadsheets to record your gains, which can motivate you to meet specific goals while shopping.

Lastly, don’t forget to reevaluate your strategies periodically. As new offers emerge, and your spending habits evolve, adjusting your approach can help sustain or even enhance your earning capabilities. Make it a routine to revisit your plans every few months to ensure you’re making the most of all that’s available.