Accessing Your Credit Bureau Report Conveniently Online

In today’s rapidly changing financial landscape, knowing where you stand is more important than ever. Whether you’re planning to make a big purchase, apply for a loan, or simply want to keep your finances in check, accessing your financial overview has never been easier. The ability to review your financial history can empower you, providing clarity and confidence in your monetary decisions.

Many people might feel overwhelmed by the idea of digging into their financial history. However, the process has become quite accessible, and there are various resources available that make it straightforward. Not only can you check the details that lenders might see, but also understand how your fiscal choices impact your overall standing.

Getting a look at your financial standing isn’t just about checking off a box; it’s about taking control of your financial future. With clear insights at your fingertips, you can make well-informed decisions that will affect you in the long run. This journey to understanding the nuances of your finances can be liberating, leading to more responsible planning and smarter spending.

Understanding Your Financial Overview

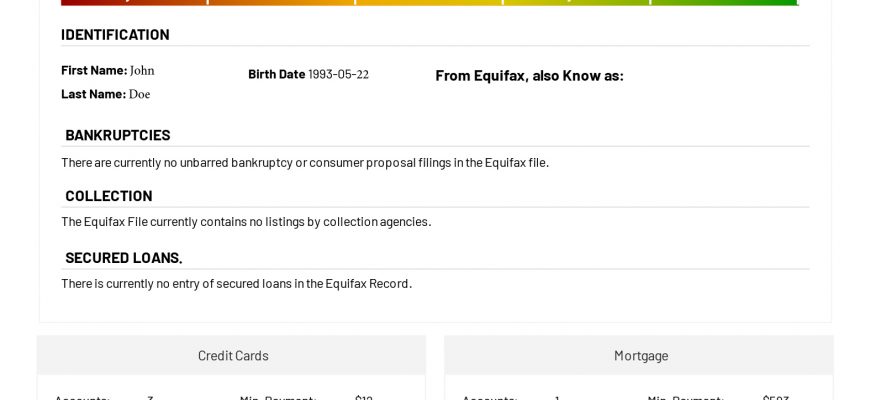

Navigating through your financial summary can feel a bit overwhelming, but it’s essential to grasp its significance. This overview serves as a snapshot of your financial behavior, highlighting your borrowing habits, repayment punctuality, and overall fiscal reliability. Comprehending this key component not only empowers you but also enhances your financial literacy.

When you delve into your financial summary, you will find various sections detailing your past and present financial activities. These sections typically include account types, balances, and payment histories. It’s crucial to familiarize yourself with these elements, as they play a vital role in how lenders perceive you. By understanding these parts, you can better manage your financial health and make informed decisions about borrowing.

Additionally, every detail matters. Mistakes or inaccuracies can significantly impact your standing, so reviewing everything closely is essential. If you spot any discrepancies, it’s your right to challenge them. Keeping your summary accurate ensures you present the best version of your financial self when you need to secure new funding.

Moreover, staying informed about your overview helps you track your progress and set future goals. Whether it’s improving your fiscal habits or planning for a significant investment, understanding your financial landscape will guide your journey. By regularly examining this information, you can proactively address any potential challenges that may arise.

How to Access Financial Records Effectively

Gaining insight into your financial history is crucial for making informed decisions about your future. Knowing how to retrieve this information efficiently can help you manage your finances better and improve your monetary standing. In this section, we’ll explore practical steps to access these valuable documents without unnecessary hassle.

First and foremost, choose a reliable platform that provides the necessary details. Look for reputable services that are known for their accuracy and security. Many of these platforms offer straightforward navigational tools to help you find what you need quickly and easily.

Next, ensure that you have the required identification information ready. This usually includes personal details such as your name, address, and Social Security number. Having this information at hand will streamline the process and help verify your identity effectively.

After you’ve selected a platform and prepared your details, follow the prompts to initiate your request. Most services will guide you through the steps, making it user-friendly, whether you’re accessing it for the first time or revisiting your file. Some might even allow you to download or print the information for your records.

Lastly, it’s a good idea to check your records periodically. Regular reviews can help you stay on top of your financial health and spot any discrepancies early. By being proactive, you can make adjustments as necessary and keep your financial profile in check.

Impacts of Credit Report on Finances

Understanding how your financial history can influence your economic situation is crucial. It’s not just about numbers; it’s about the way those numbers reflect your behavior as a borrower. The information gathered in your financial overview can shape your future, affecting everything from loan approvals to interest rates.

First and foremost, a positive financial history can open doors. When lenders see evidence of responsible borrowing, they are more likely to offer favorable terms. This means lower interest rates and reduced fees, which can save you a significant amount over time.

Conversely, a negative experience in your financial journey could lead to challenges. If your history reflects late payments or outstanding debts, potential lenders might view you as a high-risk borrower. This may result in higher costs when you seek loans, as well as potential denials.

Moreover, your financial background doesn’t just affect lending opportunities. Many landlords, employers, and insurance companies also review this information. A less than stellar history might hinder your ability to rent a home, secure certain jobs, or obtain competitive insurance rates.

In summary, maintaining a solid financial reputation can significantly enhance your economic prospects, while any discrepancies can create hurdles. Paying attention to this aspect of your finances is essential for achieving your goals.