Streamlining Your Finances with Convenient Online Credit Applications

In today’s fast-paced world, the way we seek financial assistance has transformed dramatically. No longer do we need to rely solely on traditional methods that often involve endless paperwork and long waiting times. Instead, individuals now have the freedom to explore convenient alternatives that promise efficiency and ease.

Imagine a process where you can submit your financial needs from the comfort of your home. With just a few clicks, you can engage with lenders who are eager to review your circumstances and offer solutions tailored to you. This modern approach not only saves time but also empowers you to make informed decisions.

As the landscape of personal financing evolves, it becomes increasingly important to understand the available pathways. Embracing these innovative methods can provide numerous benefits, helping you secure the support you require with minimal hassle. So, let’s dive into how these contemporary approaches can work for you.

Understanding the Online Credit Application Process

When you’re in need of financial assistance, navigating the digital submission process can feel a bit daunting. However, grasping the essentials can make it a seamless experience. This section will walk you through the key steps involved in requesting funds over the internet, highlighting what to expect at each stage.

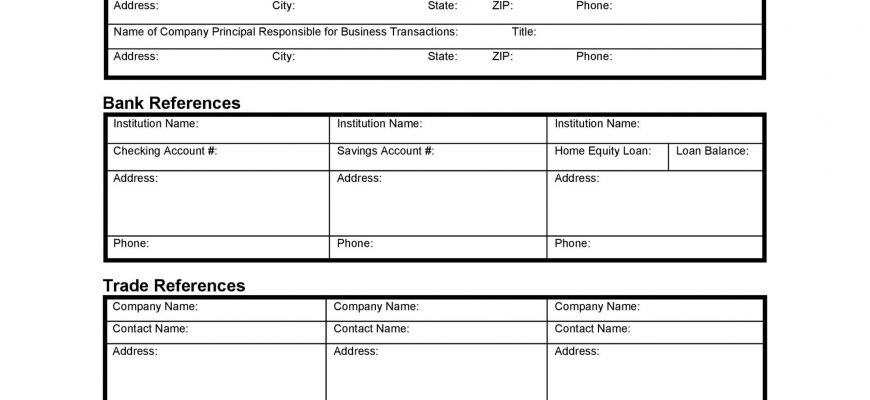

First off, the journey usually begins with filling out a form that gathers your personal and financial details. This pivotal step helps lenders evaluate your eligibility. Make sure to provide accurate information; it’s crucial for a smooth process. Lenders typically ask for specifics such as your income, employment status, and existing obligations.

Once your details are submitted, the evaluation phase kicks in. Lenders will analyze your information to assess risk and determine their decision. This process is often quick, leveraging technology to speed things up. You will typically receive feedback in a matter of minutes or hours, which allows you to plan your next steps accordingly.

If approved, you’ll be sent terms and conditions that outline the agreement. It’s vital to read everything carefully–understanding all the nuances will save you from surprises later. After you accept the terms, funds are usually transferred directly to your bank account promptly, giving you immediate access to the money you need.

In essence, this approach offers convenience and speed, allowing you to address your financial needs without the hassle of traditional methods. By familiarizing yourself with each step, you can navigate the terrain with confidence and ease.

Benefits of Applying for Funding Digitally

Let’s talk about how seeking financial support through digital channels can really simplify your life. It’s like having a whole suite of services at your fingertips, allowing you to navigate your options with ease and confidence. This method brings a range of advantages that can enhance your experience, making the entire process smoother and more efficient.

Convenience is Key – Imagine being able to submit your request at any time, from anywhere. You can kick back on your couch, or even take a coffee break at work, and still complete everything with just a few clicks. No more rushing to the bank during limited hours or waiting in lengthy queues.

Speed and Efficiency – Digital processes often mean quicker responses. Many platforms offer instant feedback, allowing you to know where you stand without unnecessary delays. This can significantly reduce the waiting period that traditional methods usually involve, making it easier to plan your next steps.

Comparative Analysis Made Easy – When searching for suitable options online, you can effortlessly compare various providers. With just a couple of clicks, you can analyze terms, interest rates, and other crucial details, helping you to make informed decisions without any pressure.

Increased Accessibility – For people in remote areas or those with mobility challenges, obtaining assistance can be daunting. However, the web opens doors that might otherwise remain shut. Now, anyone can seek support no matter their location, bridging the gap created by physical barriers.

Enhanced Privacy – Many individuals prefer to handle financial matters discreetly. Engaging through online services can often feel less intrusive, allowing you to manage everything in a way that feels secure and personal, without the stress of face-to-face discussions.

In summary, utilizing digital platforms for your funding needs offers numerous perks that can transform a typically daunting experience into a seamless journey. Why not take advantage of these benefits and streamline the process today?

Common Mistakes in Digital Submissions

Filling out forms through the internet can sometimes be tricky, and many people trip over small details that lead to setbacks. Whether it’s due to misunderstanding the requirements or rushing through the process, these common pitfalls can cause unnecessary delays or denials. Let’s explore some frequent errors folks make when trying to secure funding through digital means.

One major issue is providing incomplete information. It’s easy to overlook a field, thinking it’s not that important, but every detail matters. Rushing through can also lead to typos or incorrect entries, which might raise red flags and complicate the review process.

Another frequent mistake is not double-checking terms and conditions. Users often skim through these agreements, missing critical points that could affect their eligibility or responsibilities. Taking time to read carefully could save many headaches later.

Additionally, some individuals fail to prepare their documentation ahead of time, leading to rushed uploads and potential errors in the files submitted. Ensuring you have everything organized can streamline the whole experience.

Lastly, neglecting to ask questions can also be detrimental. If something isn’t clear or seems off, reaching out for clarification is always a smart move. Ignoring uncertainties can lead to misinterpretations that cloud the process. Avoiding these common mistakes can help pave the way for a smoother experience when seeking financial assistance digitally.