Understanding Credit Ratings and Their Importance in Financial Decision Making

When it comes to financial interactions, understanding how individuals and organizations are perceived is crucial. It’s not just about numbers; it’s about the confidence that lenders and investors place in borrowers. These evaluations play a pivotal role in determining the terms of financial agreements and the overall landscape of trust in the economic world.

In this section, we explore the various factors that contribute to these assessments, shedding light on what influences perceptions of reliability and responsibility. From payment behaviors to overall financial health, numerous elements come into play when determining how trustworthy an entity is deemed.

Understanding these mechanisms not only helps consumers and businesses make informed decisions but also highlights the importance of maintaining a solid reputation. Join us as we delve deeper into the dynamics of these evaluations and their far-reaching impacts on the financial ecosystem.

Understanding Ratings Explained

When we talk about the evaluation of a borrower’s trustworthiness, we’re diving into a fascinating world that helps lenders gauge how likely someone is to repay their obligations. It’s a complex system, but at its core, it helps to reflect the financial behavior and history of individuals and organizations. Think of these assessments as a form of report card for managing money, influencing everything from loan approvals to interest rates.

The importance of these evaluations cannot be overstated. Lenders use this information to make informed decisions, while borrowers can understand where they stand in the eyes of financial institutions. Good scores can open doors to better financing deals, while poor evaluations may lead to higher costs or even denial of services. It’s a snapshot of financial health that carries significant weight.

There are numerous components that contribute to this assessment. Factors like payment history, amounts owed, types of credit used, and the length of credit history are all taken into account. In essence, these elements paint a picture of how responsibly one manages their financial commitments. Being aware of these factors can empower individuals to improve their standing and make smarter financial decisions.

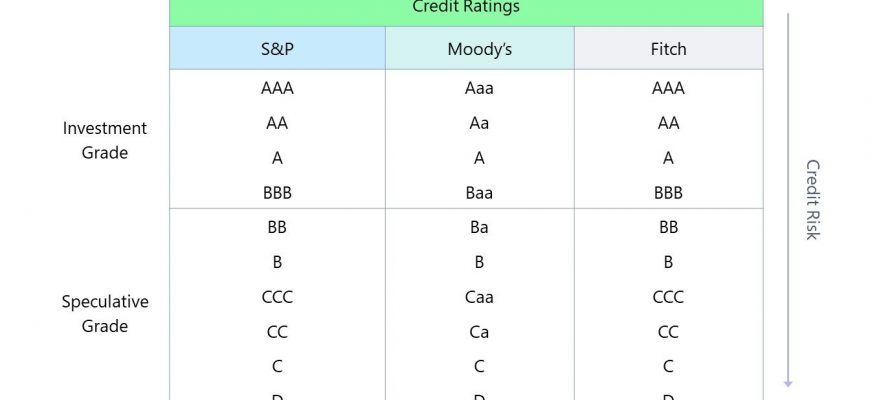

It’s also worth noting that different agencies may use varying methodologies for assessments, leading to different outcomes for the same individual. This diversity is why it’s crucial to stay informed and understand the basics of how your financial actions influence these evaluations. Ultimately, an informed approach is key to mastering the art of financial credibility.

Impact of Credit Scores on Loans

Your financial reputation can play a significant role in getting approved for financing options. Lenders often assess how trustworthy a borrower is before deciding on loan amounts and interest rates. This evaluation process helps them understand the risk involved in lending money and whether the borrower is likely to meet their repayment obligations.

A positive assessment can lead to lower interest rates and better terms, making it easier to manage repayments. Conversely, a poor assessment can result in higher costs, and even outright rejection of applications. This dynamic can influence not only the affordability of loans but also the total amount that one might qualify for.

Understanding how this evaluation works can empower individuals to take proactive measures to enhance their financial image. Timely payments, responsible credit utilization, and avoiding excessive inquiries can contribute to a favorable assessment, ultimately paving the way for more attractive loan opportunities. It’s always wise to stay informed and take steps to build a solid financial foundation, as this can have lasting implications for future financial endeavors.

Improving Your Creditworthiness Tips

Enhancing your financial reliability can open doors to better opportunities, whether you’re looking for loans, mortgages, or even renting a home. It’s all about building a solid reputation with lenders and ensuring they see you as a trustworthy individual. Here are some practical suggestions to help you boost your standing.

1. Stay on Top of Payments: Always make sure your bills are paid on time. Late payments can significantly harm your financial image. Set up reminders or automatic payments to never miss a deadline.

2. Keep Balances Low: Ideally, your outstanding balances should be a small portion of your available credit. Aim to keep your usage below 30% of your total limit to show that you can manage your resources responsibly.

3. Regularly Check Your Reports: Review your financial disclosures periodically. Look for errors or discrepancies that could harm your image. Disputing inaccuracies can swiftly correct your standing.

4. Build a Diverse Portfolio: Having a mix of different types of accounts, like installment loans and revolving credit, can enhance your profile. This demonstrates that you can handle various forms of financial responsibilities.

5. Limit New Applications: While it might be tempting to apply for multiple accounts, try to space out your applications. Too many inquiries in a short time can be a red flag for lenders.

6. Maintain Old Accounts: Keeping older accounts active can positively affect your standing. A lengthy credit history signals reliability, so think twice before closing any older accounts.

By applying these tips consistently, you can build a more favorable financial image and secure better terms for any future financial ventures. Remember, it’s a journey, not a sprint!