Insights into CPF Contribution Changes and Guidelines for 2025

In an ever-evolving financial landscape, it’s essential to stay informed about the emerging trends and guidelines that affect personal savings and retirement strategies. As we approach the next phase in fiscal management, many individuals find themselves contemplating how best to prepare for the years ahead. This is particularly true when it comes to evaluating our long-term financial health and ensuring we have adequate mechanisms in place for stability and growth.

Exploring the changes in regulatory frameworks that govern individual savings can be both exciting and daunting. Staying up to date with the latest developments will empower users with the knowledge necessary to make informed decisions. With a proactive approach, we can align our financial habits with the anticipated shifts in policy, allowing for a more secure and stable economic future.

Moreover, understanding the intricacies of these evolving practices can be a game-changer for many families. Whether it’s maximizing benefits or adjusting savings methods, the choices we make now can set us on a path to success. Let’s dive deeper into the upcoming changes and how they might impact you and your financial journey in the years to come.

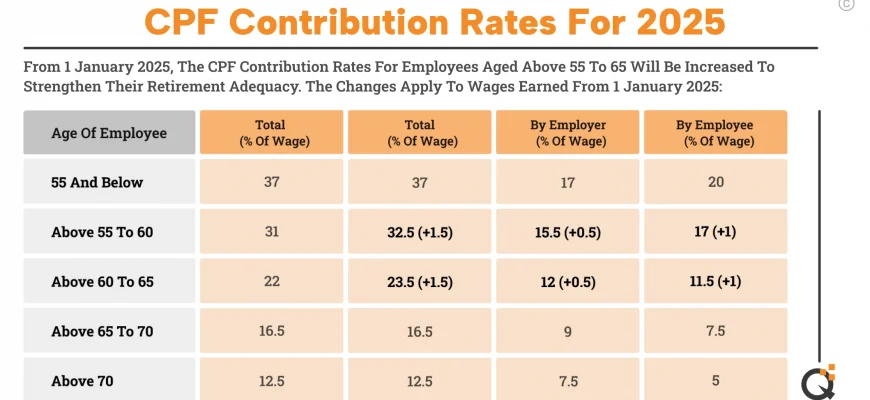

Understanding Changes in Social Security Funding in 2025

As we look ahead, adjustments to the mandatory savings framework are set to impact many individuals. These modifications aim to enhance the financial well-being of citizens, ensuring that adequate funds are available for retirement, healthcare, and other essential needs. It’s important to stay informed about what these changes entail and how they might affect your future financial planning.

Key adjustments are designed to align with the evolving economic landscape and demographic shifts. While the specifics may vary, these reforms generally focus on increasing the amount set aside, revising age thresholds, and altering rates applicable to different income brackets. Such strategies are typically implemented to foster a sustainable system that supports everyone in the long run.

Understanding these shifts is crucial for proactive financial management. Individuals should familiarize themselves with the potential implications on their personal savings strategies. With the right knowledge, you can navigate these changes effectively, ensuring a secure and stable financial future for yourself and your family.

Staying updated on legislative announcements and guidelines will help you adapt your approach. Engaging with financial advisors and utilizing online resources can provide clarity and support throughout this transition. Remember, being informed is the first step towards making confident and advantageous decisions about your financial journey.

How to Optimize Your Savings for the Future

When it comes to securing your financial future, making the most out of your savings is essential. You want to ensure that your hard-earned money is working for you, rather than sitting idle. In this section, we’ll explore some effective strategies to maximize the growth of your financial reserves, enabling you to enjoy greater peace of mind as you plan for life’s milestones.

First off, consider setting clear goals for your savings journey. Are you aiming to buy a home, fund your child’s education, or perhaps retire comfortably? By defining specific objectives, you can select the right instruments and plans that align with your aspirations.

Additionally, take advantage of any available incentives. Many programs offer tax relief or matched funding, which can significantly enhance the amount you are able to save over time. Research what options are available to you and don’t hesitate to utilize them to boost your overall savings.

Moreover, it’s wise to be proactive in managing your portfolio. Regularly review your financial plan to ensure that it continues to meet your needs, especially as your life circumstances change. Diversification is key; look into a range of options such as stocks, bonds, or even high-yield savings accounts to spread risk and increase potential returns.

Lastly, don’t forget the power of compound interest. By allowing your savings to grow over time with interest on interest, you can achieve significant gains. The earlier you start saving, the more you can benefit from this potent financial principle. Remember, consistency is crucial, so aim to contribute regularly to your savings, no matter how small the amount.

Impact of Increased Contributions on Workers

As financial demands grow, many employees find themselves facing higher deductions from their paychecks. These changes can bring a mix of benefits and challenges that can significantly influence workers’ lives and future planning.

Let’s break down how this shift may affect individuals:

- Immediate Budget Changes: Workers might need to adjust their monthly budgets, as less disposable income can limit spending on essentials.

- Long-Term Security: On the plus side, these additional funds often lead to increased savings for retirement, providing greater financial stability in later years.

- Increased Awareness: Employees may become more proactive in understanding their financial situations, leading to better planning and saving habits.

- Potential for Stress: The initial adjustment can create stress for many, especially if they struggle to make ends meet with reduced take-home pay.

Finding a balance between current needs and future goals is crucial. Understanding the implications of these increased rates can help workers navigate the changes more effectively, ensuring both immediate and long-term benefits.