Important Dates and Information on Columbia University Financial Aid for the Year 2025

Navigating the world of educational support can often feel overwhelming, especially when it comes to timing and requirements. As you embark on your academic journey, it’s crucial to be aware of the various opportunities available to help finance your studies. Knowing when to apply for resources can make a significant difference in alleviating the stress of funding your education.

In this section, we’ll explore the important timeline for securing assistance for your educational endeavors. Staying informed about these crucial timeframes will ensure you don’t miss out on potential resources that could help lessen your financial burden. Understanding the nuances of the application process can empower you to make informed decisions about your educational financing.

Whether you’re a prospective student or currently enrolled, being proactive is key. Let’s dive deeper into what you need to know and how to prepare effectively to take advantage of available opportunities. The right timing can pave the way for a smoother academic experience, allowing you to focus more on your studies and less on financial pressures.

Understanding Columbia University Aid Options

Navigating the landscape of support opportunities can be a daunting task for many students and their families. It’s essential to be well-informed about the various resources available, as they can significantly alleviate the costs of education. With a bit of research and guidance, you can uncover the most suitable options tailored to your unique situation.

First and foremost, it’s crucial to explore scholarships that don’t require repayment. These can be awarded based on merit, talent, or even specific fields of study. It’s a great way to offset expenses while showcasing your achievements and dedication.

Then there are grants, which are typically need-based funds provided to assist students who require extra support. These funds can make a considerable difference in managing tuition and living costs, so it’s worth looking into the criteria for eligibility.

Lastly, consider the possibility of loan programs designed to help students spread out their financial obligations over time. While this option entails repayment, it can provide the necessary immediate resources for those who may find themselves in tighter situations.

Ultimately, being proactive and utilizing available tools can help students make informed choices. A well-thought-out approach towards these opportunities can pave the way for a more manageable educational experience.

Key Dates for Financial Assistance Applications

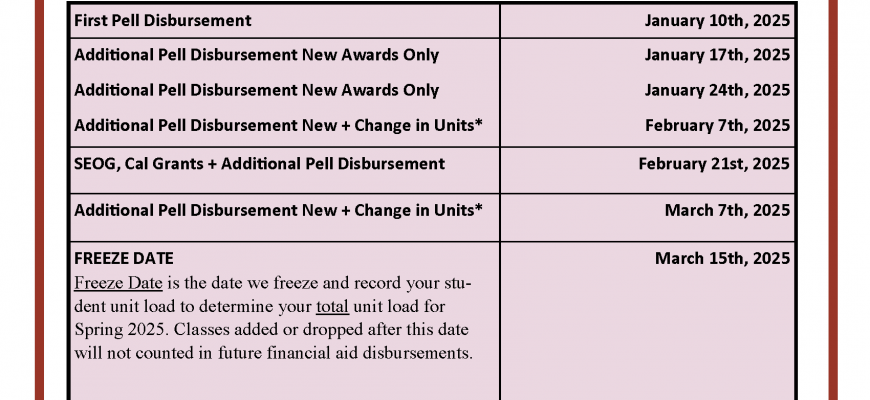

Understanding the timeline for securing support can be quite a task, but knowing the important dates can make the process much smoother. This section will guide you through the crucial moments in the application journey, ensuring that you stay on track. Whether it’s for grants, scholarships, or loans, being aware of the timeframes is essential for a successful application.

Typically, the initial phase involves completing your documentation early in the year. This is when you’ll want to gather necessary materials and start preparing your submissions. Make sure to check for any specific requirements that may come into play, as they can vary greatly.

Next, keep an eye on submission openings, as the application window usually begins in the fall. Getting your forms in on time can greatly increase your chances of receiving assistance, so mark these dates on your calendar.

Lastly, don’t forget about the notification period. After submitting your applications, there’s a wait before decisions are made. Understanding when you can expect to hear back will help you plan ahead for any financial decisions you need to make. Being well-informed is key to navigating this important aspect of your academic journey.

Navigating Scholarship Opportunities for Students

Finding the right funding options can be overwhelming, but it doesn’t have to be. Many learners are unaware of the variety of support programs available that can significantly reduce the cost of their education. These options often come in the form of grants, awards, or scholarships, designed to help aspirants pursue their dreams without the burden of excessive debt.

First things first: it’s crucial to start early when exploring these opportunities. Research is your best friend! Numerous organizations, foundations, and even businesses offer assistance tailored to specific fields of study, backgrounds, or accomplishments. By keeping an eye on various platforms and resources, you can uncover hidden gems that may be right for you.

Networking can also play a pivotal role in your quest. Connecting with alumni or attending informational sessions can provide insights into available programs and how to apply successfully. Don’t hesitate to reach out and ask questions–many are willing to share their experiences and tips.

Lastly, remember to apply widely. Casting a broad net increases your chances of receiving support. Gather all necessary documents, tailor your applications to highlight your unique qualities, and stay organized throughout the process. The effort you invest now may very well lead to a more affordable educational experience.