Understanding the Differences Between Dependent and Independent Status for College Financial Aid Applications

Navigating the world of higher education can be overwhelming, especially when it comes to understanding various forms of support available to students. A key concept that often surfaces in conversations about obtaining assistance revolves around how an individual’s family background influences eligibility. The classification of a student based on their familial situation plays a significant role in determining the types of resources they can access.

It’s crucial to recognize that not all students find themselves in the same boat. Some young adults may qualify for certain benefits due to their reliance on parental figures, while others may not have the same familial ties and must rely solely on their own resources. This distinction affects everything from the types of resources available to the specific requirements that must be met to receive them.

In this article, we’ll delve into the nuances of these classifications and explore how they impact the journey of students seeking assistance. By shedding light on these differences, we hope to empower readers to make informed choices as they venture into the realm of educational funding.

Understanding Dependent and Independent Students

When it comes to navigating the world of education funding, distinguishing between two categories of students is essential. Each group faces different considerations, especially when applying for various forms of assistance. This distinction can significantly impact the support one can receive, ultimately influencing the path to achieving educational goals.

Essentially, one group includes individuals who rely on their guardians for financial support, while the other consists of those who manage their own finances. This classification plays a crucial role in determining eligibility for scholarships, loans, and grants. As you explore the options available, knowing which category you fall under can help you better strategize your funding approach.

For those who are supported by their families, various aspects come into play, including household income and resources. On the other hand, students who navigate life independently often face unique challenges, but they also enjoy the benefits of being recognized for their self-sufficiency. Understanding these differences will empower you to make informed choices and maximize your resources.

Navigating the funding landscape can be complex, but grasping the nuances between these two groups simplifies the process. Awareness of your situation allows you to target suitable opportunities effectively, ensuring you receive the best possible support on your educational journey.

Eligibility for Support Based on Status

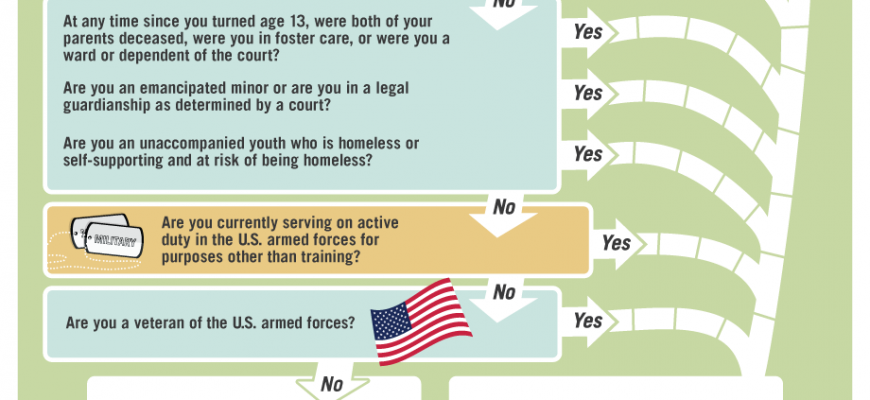

Understanding who qualifies for different types of support can be a bit tricky, but it’s essential for making the most out of available resources. Generally, individuals are categorized based on a few key factors, such as age and financial responsibility. This classification affects the level and type of assistance they can receive, so it’s worthwhile to dive into how these groups differ in terms of access to resources.

For those who are considered part of the first group, eligibility is often tied to parental income and assets. This means that the financial picture of parents plays a significant role in determining the level of support an individual can qualify for. Typically, the lower the household income, the greater the potential for various forms of assistance, ensuring that those who are more financially challenged have access to necessary resources.

On the other hand, the second category allows individuals to apply for resources based on their own circumstances. Here, factors like personal income, employment, or even special circumstances come into play. Individuals in this situation may find themselves eligible for a broader range of options since they are not tied to parental financial information. This can open doors to different opportunities for those managing their own finances.

In both scenarios, staying informed about the available programs and understanding the requirements is crucial. Each category comes with its own set of guidelines and benefits, making it important for individuals to assess their own situations accurately. Knowing where one stands can empower applicants to make better decisions and maximize their opportunities for support.

Impact of Dependency on FAFSA Applications

The way individuals qualify for assistance can heavily influence their application experience and the amount they might receive. When filling out forms to determine eligibility, circumstances such as one’s living situation and financial autonomy play a pivotal role. Understanding these nuances can not only streamline the process but also maximize potential benefits.

When characterized by certain personal situations, applicants can be treated differently in terms of required information and calculations related to their finances. For instance, those categorized under one group may need to disclose their parents’ income, while others can focus solely on their own earnings. This variance often affects how much support one can ultimately obtain, making it crucial to grasp these differences early on.

Moreover, knowing where you fit into this framework can influence the types of opportunities presented, including scholarships and grants. Some resources are specifically designed for individuals based on their overall financial involvement, creating yet another layer of significance in how applications are approached. Ultimately, recognizing the impact of personal circumstances can lead to a more tailored and beneficial experience, enhancing prospects for success.

The process can seem daunting, but familiarity with these distinctions can empower applicants to navigate their options effectively. Being informed isn’t just about knowing the rules; it’s about leveraging them for a brighter financial future.