An Overview of the Child Tax Credit Changes and Expectations for the 2025 Tax Year

The financial landscape for families is always evolving, and it’s essential to stay informed about available assistance options. In the upcoming cycle, numerous programs are set to support households, particularly those with dependents. These initiatives aim to alleviate some of the burdens associated with raising children while enhancing overall economic stability.

As we look forward, many parents are eager to understand how these benefits will play out in their budgets. With a focus on enhancing the wellbeing of their loved ones, families can anticipate innovative measures designed to ease financial pressures. It’s important to explore the specifics of what will be offered, as these allowances can make a significant difference during challenging times.

Whether you’re a seasoned filer or navigating these relief programs for the first time, being informed is crucial. The forthcoming months present an opportunity to maximize your benefits and ensure your family receives the support it deserves. Join us as we delve into the details and uncover what’s on the horizon for households in need of financial assistance.

Overview of the 2025 Child Tax Credit

As we look towards the upcoming financial obligations for families, understanding the support available through various initiatives becomes essential. This segment will shine a light on the assistance designed to ease the fiscal burden for guardians raising dependents. The forthcoming guidelines will aim to provide clarity on what families might expect in terms of benefits and provisions.

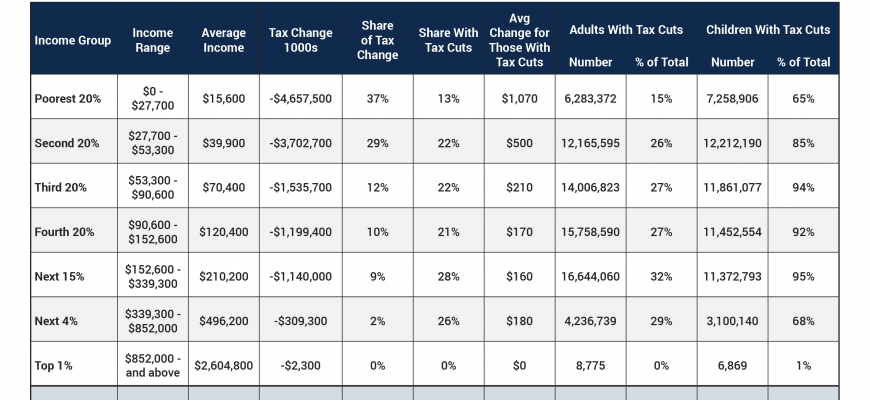

The changes coming in the near future promise to offer enhanced relief to caregivers, particularly those in lower to middle-income brackets. With each revision, there are adjustments that reflect the economic landscape, ensuring that the help is timely and applicable. This upcoming evolution will play a crucial role in fostering a more supportive environment for household stability.

Families can anticipate a series of eligibility criteria and benefit amounts that will likely be tailored to meet diverse needs. It’s worth noting that these advancements are not just numerical increases; they represent a commitment to investing in the well-being of the next generation. With the right preparation, households can effectively leverage these resources to create a brighter future.

As the specifics unfold, it’s important for those who qualify to stay informed and proactive. Engaging with community resources and financial advisors can aid in navigating the complexities of the system. With awareness and the right tools, families can maximize the support designed to empower them through challenging times.

Eligibility Requirements for Families

When it comes to financial support aimed at helping households with little ones, understanding who qualifies is crucial. Each family situation is unique, and various factors can determine eligibility. This makes it essential for families to be well-informed about the guidelines and prerequisites that apply to their specific circumstances.

Primarily, the total income of the household plays a significant role in deciding whether a family can benefit from available assistance. This often encompasses wages, bonuses, and other forms of earnings. Additionally, the age of the dependents is a key factor; there are usually age limits that specify which children are included in the calculations. It’s also important to consider the family structure, including marital status and the number of dependents, as these elements can affect eligibility.

Moreover, residency requirements may be in place, where families need to demonstrate that they reside in a specific geographic area. Understanding these conditions and how they apply to each situation helps families navigate the eligibility landscape effectively. By being aware of these factors, households can make informed decisions and potentially access the financial support necessary for raising their children.

Key Changes and Updates for 2025

This upcoming period brings along some exciting enhancements that families can look forward to. Adjustments made aim to provide better support and relief, reflecting the evolving needs of households. As we dive into the specifics, it’s essential to understand how these modifications might impact your financial planning and overall budgeting.

Significant enhancements include more substantial support amounts, which could lead to increased financial security for many. These alterations are designed to better align with the current economic landscape, making it easier for families to navigate expenses related to raising their loved ones.

In addition, eligibility criteria are undergoing a revision, aiming to widen the safety net and include more households that require assistance. This change is likely to encourage a greater number of families to benefit from the available support, enhancing their financial stability and easing the burden during challenging times.

Moreover, the timing of these adjustments is also noteworthy. The ongoing reforms aim to ensure that families can receive support when they need it most, promoting overall well-being and providing peace of mind.

As you prepare for the upcoming changes, staying informed will be key. Keep an eye on announcements and updates, as they will help you navigate this new landscape effectively and take full advantage of the opportunities available.