Expansion of the Child Tax Credit in 2025 Aiming for Increased Support for Families

As we look toward the future, it’s essential to consider how governments provide essential assistance to households with youngsters. A focus on enhancing financial resources for families is becoming increasingly relevant, creating discussions around upcoming modifications and benefits tailored to help parents manage everyday challenges more effectively.

In recent years, various measures have been introduced to alleviate the financial burden faced by those raising children. This shift reflects a growing recognition of the importance of offering robust support systems that ultimately contribute to the well-being of future generations. Such initiatives aim not only to support families in need but also to stimulate economic growth and community development.

With many parents facing mounting pressures due to the rising cost of living, the forthcoming adjustments promise to bring relief and create a more favorable environment for nurturing children. It’s a topic that resonates deeply and speaks volumes about our collective values and priorities as a society.

Understanding the 2025 Tax Credit Changes

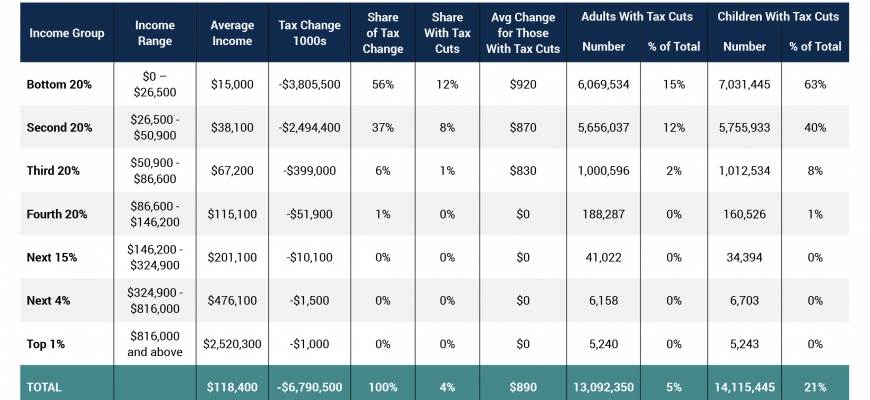

As we move forward, it’s essential to grasp the upcoming modifications in financial assistance aimed at families. These adjustments are part of a broader effort to support households with dependents, ensuring that parents have the means to nurture and provide for their children. The changes reflect a commitment to bolstering economic security and will have significant implications for many families across the country.

One of the noteworthy aspects of these new provisions is the potential for increased financial relief. Families may find themselves eligible for higher amounts than before, which can lessen the burden of raising children, especially in challenging economic times. This assistance is designed not only to alleviate immediate financial pressures but also to promote long-term stability for households.

Additionally, understanding the eligibility criteria becomes crucial. This sector of support will continue to adapt, and knowing who qualifies can significantly impact the financial landscape for many. It’s advisable for parents to stay informed and be proactive in understanding how these shifts may affect their finances.

In conclusion, these upcoming alterations are not merely about numbers; they represent a broader societal dedication to enhancing the lives of families. By familiarizing themselves with the specific details, parents can better navigate the changing landscape and make informed decisions that benefit their households.

Impact on Families and Budgeting

The recent adjustments in financial assistance programs have created a significant shift for households across the nation. For many, this influx of support means the ability to better manage everyday expenses and plan for future needs. Families are finding themselves with a little extra breathing room, which can make all the difference in their overall financial stability.

With increased funds available, parents are now more capable of covering essential costs such as education and healthcare, or even setting aside savings for unexpected events. This newfound flexibility in budgeting allows households to create a more secure financial environment where they can prioritize both immediate needs and long-term goals, such as saving for college or a family vacation.

The impact is particularly notable for those on tight budgets, who often face challenges in making ends meet. Enhanced financial support can transform the way families allocate their resources, helping them shift from a reactive to a proactive approach in managing their finances. In this way, the changes foster a sense of empowerment, enabling parents to invest in their children’s futures with confidence.

Key Eligibility Criteria for Benefits

Understanding the prerequisites for receiving financial assistance can make a significant difference for many families. It’s essential to be aware of specific conditions that determine who qualifies for these benefits. Navigating these requirements can often feel overwhelming, but let’s break it down into simpler terms.

Age of Dependents plays a crucial role in eligibility. Generally, there are particular age ranges that must be met for the individuals in question, ensuring that assistance is directed towards those who most need it. This criterion often focuses on younger populations, aligning with the program’s objectives.

Another important factor is household income. Families must ensure their earnings fall within certain limits to be eligible. These thresholds can change, so staying informed about the latest figures is vital. Lower-income households generally have a better chance of qualifying for the benefits offered.

Residency Requirements are equally significant. Applicants are typically required to reside in a specific area, ensuring that support goes to local populations. This can mean that up-to-date documentation proving residency status is necessary when applying.

Finally, understanding filing status can be a game changer. Whether you’re single, married, or head of a household, this can influence your eligibility as well. It’s important to accurately report your status when seeking to benefit from these programs.

Taking the time to familiarize yourself with these criteria can pave the way for making informed decisions and maximizing the support your family might receive.