Exploring the Child Tax Credit for New York Residents in 2025

As we look ahead, it’s essential to explore the various forms of financial assistance available to those raising families in the Empire State. In the coming years, these forms of support are expected to evolve, reflecting the changing landscape of economic needs and family dynamics. This article aims to break down the key elements of these upcoming changes and how they can affect your household.

Many families rely on these benefits to help ease the burden of everyday expenses, from education to healthcare. Understanding how these programs work and what you may be eligible for can significantly impact your financial situation. Get ready to dive into important details that can help your family thrive in New York’s unique environment.

As you navigate the complexities of financial assistance, it’s crucial to stay informed about the potential updates and modifications that may come your way. This knowledge not only prepares you to make the best decisions for your family but also empowers you to take full advantage of the resources at your disposal.

Understanding the 2025 Child Tax Credit

Alright, let’s dive into what you need to know about the upcoming financial support aimed at families with little ones. This initiative is designed to lighten the burden on parents, providing an opportunity to enhance their household finances and ensure that kids have what they need for a healthy upbringing.

The upcoming program aims to offer a monetary boost for families, allowing them to cover essential expenses more comfortably. With rising costs of living, many parents are looking for ways to stretch their budgets. This plan intends to offer just that, making it easier to manage daily needs and even save for the future.

As we look ahead, it’s important for families to understand the criteria that will determine eligibility for this support. Factors such as income levels, number of dependents, and filing status can play significant roles in how much assistance one may receive. Staying informed about these details will help families maximize their benefits when the time comes.

In addition to understanding the eligibility requirements, parents should also pay attention to how this initiative might impact their overall financial situation. Knowing when and how the assistance will be disbursed can aid in effective planning. It’s a great chance to take charge of finances and make thoughtful decisions regarding spending and saving.

In conclusion, this forthcoming program represents a significant opportunity for those raising children. By grasping the key elements and preparing in advance, families can empower themselves and enjoy the benefits that come with this financial support. Keep an eye on updates to ensure you don’t miss out on what could be a game changer for your household.

Eligibility Requirements for New York Families

When it comes to financial assistance for families in New York, there are certain conditions that must be met. These guidelines ensure that the support reaches those who need it most. It’s important for families to understand these criteria, as they can make a significant difference in their overall well-being.

To qualify, households typically need to meet specific income thresholds. This means that families with earnings below a certain level can benefit from available programs. It’s essential to check the current figures, as they can vary from year to year.

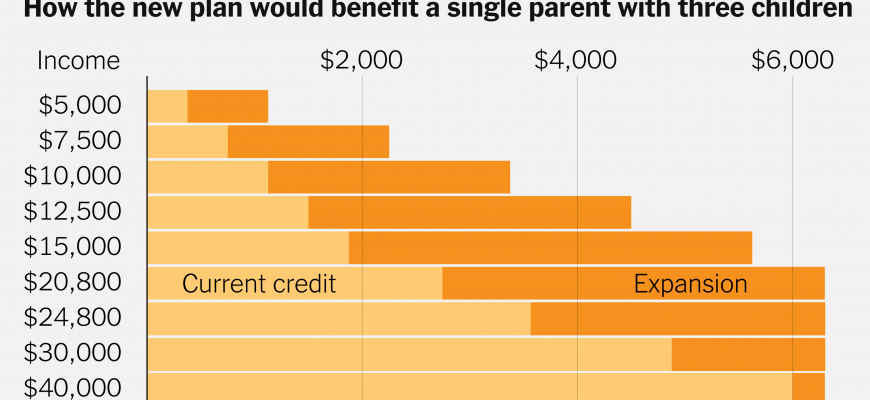

Another key factor in determining eligibility is the number of dependents. Families with multiple dependents may find themselves in a better position when seeking assistance. The more eligible dependents you have, the more support you may receive, which can help alleviate financial burdens.

Additionally, residency is a critical component. Only those who reside in New York and meet local requirements will qualify for the assistance programs available in the state. Ensuring that all household members have the appropriate documentation is crucial to avoid any complications during the application process.

Lastly, there might be other criteria related to the family’s situation, such as enrollment in specific government assistance programs or participation in certain types of educational institutions. By understanding these aspects, families can better navigate the options available to them.

Benefits and Changes in 2025 Tax Legislation

The upcoming year brings a wave of adjustments aimed at supporting families and individuals across various income brackets. These new measures are designed to alleviate financial pressure and promote stability, ensuring that those raising young ones can thrive without the constant worry of rising costs. As we delve into what’s in store, it’s essential to grasp how these shifts will make a difference in everyday life.

One of the standout features of the revised policies is the increased financial assistance provided to households. This enhancement is projected to significantly ease the burden on families, allowing for greater investment in education, healthcare, and overall well-being. Moreover, the modifications aim to target resources more efficiently, ensuring that help reaches those who need it most, enhancing the overall economic landscape.

Additionally, the alterations include a focus on streamlining processes, making it easier for recipients to access available resources. By reducing bureaucratic hurdles, officials hope to foster a more responsive system that caters to the diverse needs of the community. This shift will not only save time but also empower families to make informed financial decisions without unnecessary complications.

In summary, the legislative changes represent a thoughtful response to the evolving needs of society. With increased support and improved accessibility, families can look forward to a more secure financial future, ultimately contributing to a healthier economy and a stronger community.