Exploring the Child Tax Credit Opportunities for Families in Minnesota in 2025

As families navigate the challenges of raising children, financial assistance plays a crucial role in easing some of the burdens. In recent years, various forms of support have been introduced, aimed at helping caregivers manage expenses more effectively.

In the coming years, Minnesota is set to unveil enhancements to its support programs designed specifically for households with dependents. These initiatives not only aim to alleviate financial pressure but also to foster a stable environment for growth and development.

Exploring these upcoming benefits reveals a commitment to ensuring that families have the resources they need. By diving into the specifics, we can better understand what these changes mean for parents and guardians across the state, empowering them to plan for a brighter future.

Understanding the Changes in Family Financial Assistance

When it comes to financial support for families, recent alterations are set to impact many households in significant ways. These adjustments aim to improve the overall wellbeing of kids and ease the financial burdens parents face. It’s essential to grasp how these modifications could affect your personal situation and what steps you may need to take to maximize benefits.

The new modifications mean increased financial resources for many. With varying amounts based on family size and income levels, these changes may allow parents to better manage daily expenses or even save for future needs. Familiarizing yourself with the new parameters is key to understanding what to expect and how to navigate the application process.

Additionally, the regulations surrounding eligibility might shift, requiring families to stay informed about who qualifies for assistance. Keeping your documentation accurate and up to date can prevent potential issues down the line. Engaging with local advisors or community resources can also provide clarity on these updates.

In summary, being proactive and informed can help families make the most of these beneficial alterations. Exploring available resources and understanding the new landscape can lead to a more secure financial future for your loved ones.

Eligibility Requirements for Families in MN

For families looking to benefit from financial assistance in Minnesota, understanding the requirements is crucial. Generally, support programs in the state aim to provide relief to households. It’s important to meet certain criteria to ensure you qualify for the available benefits.

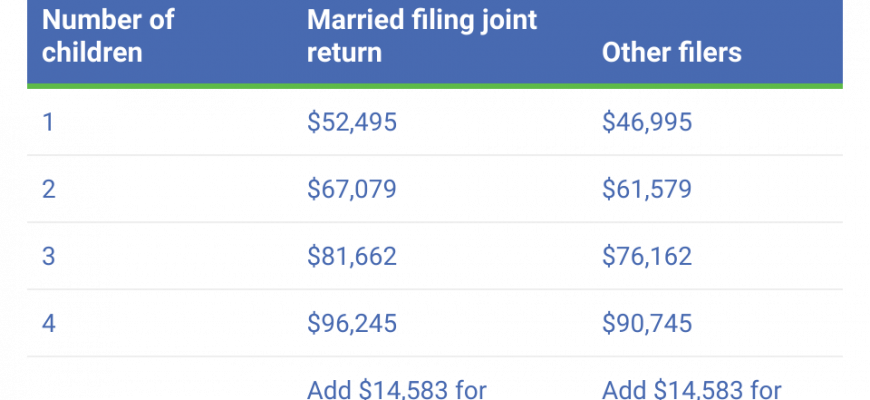

Your household’s income plays a significant role in determining eligibility. Each program has specific income thresholds that families must adhere to. Additionally, the number of dependents in your home can impact the assistance amount, as larger families may receive more support. Another crucial aspect is residency; families must be residing in Minnesota to take advantage of these opportunities.

Moreover, there may be additional factors, such as the age of dependents and filing status of the household. Various scenarios could influence eligibility, so it’s beneficial to review guidelines thoroughly. Ultimately, knowing these requirements can help families navigate the assistance landscape more effectively.

How to Apply for the Benefit in 2025

Accessing financial assistance for families can be straightforward if you follow the right steps. This section will guide you through the process of obtaining support aimed at easing the financial burden of raising children. Whether you’re a first-timer or someone who’s applied before, understanding the procedure is essential for ensuring you secure the funds you deserve.

Begin by gathering relevant documents such as identification, proof of income, and details about your dependents. Having this information ready will make the application smoother. Next, visit the official website or authorized agencies to find the proper forms required for submission. Take your time to fill out each section accurately to avoid delays.

Once your application is completed, check for submission deadlines to ensure you don’t miss out on the opportunity. It’s wise to keep copies of everything you send in, just in case you need to reference them later. After submitting, don’t hesitate to follow up with the relevant offices to confirm they have processed your information. Patience is key, as it may take some time before you receive a decision or any funds.

Lastly, stay informed about any upcoming changes in policies or qualifying criteria that may affect your eligibility. Regularly checking for updates will enable you to maximize the benefits available to you and your family.