Exploring the Child Tax Credit in Michigan for the Year 2025 and Its Impact on Families

As we look ahead to the near future, many households are eager to learn about various financial benefits that can provide a welcome boost to their budgets. With numerous programs designed to alleviate the financial burden on parents and guardians, planning for what lies ahead has never been more crucial. Understanding the specific initiatives that will be available can make a significant difference in managing day-to-day expenses.

The good news is that there are a variety of assistance options aimed at fostering the well-being of younger members of our communities. These incentives not only aim to support basic needs but also to encourage families to invest in their children’s education and overall growth. It’s essential to remain informed about how these provisions can enhance life for both caregivers and their little ones.

In the coming sections, we will explore the key elements of these programs, their eligibility criteria, and how to navigate the application processes. With every detail considered, you’ll be better equipped to take full advantage of what’s available, ultimately leading to a more secure and enriching environment for your family.

Overview of Financial Support for Families in 2025

In 2025, there will be significant financial assistance available to support families raising children. This initiative aims to alleviate some of the economic pressure that parents face, making it a vital component of family welfare programs. It provides an opportunity for households to receive additional funds, helping them manage day-to-day expenses and invest in their children’s future.

This financial aid is designed with the intent to ease the burden on families, enabling them to cover essentials like education, healthcare, and childcare more comfortably. Many families will notice an increase in the aid they receive, reflecting changing economic conditions and the rising costs associated with raising young ones.

Understanding how this assistance works is essential for families to take full advantage of the available resources. There will be clear guidelines on eligibility and the application process, ensuring that those who qualify receive the necessary support in a timely manner. As a result, families will be better equipped to provide for their children while enjoying greater peace of mind in their financial planning.

Eligibility Requirements for Michigan Residents

When it comes to financial benefits aimed at families with little ones, understanding who qualifies is key. Various factors influence eligibility, making it important for residents to stay informed about what is required to receive assistance.

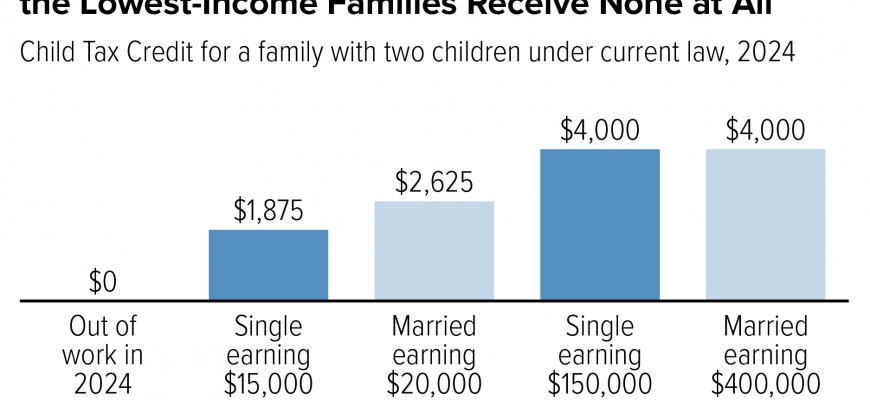

First off, age is a crucial aspect. Generally, to be considered, the young ones must fall within a specific age range. Additionally, the household’s income plays a significant role. There are often caps on earnings, meaning that families with higher incomes may not be able to take advantage of these benefits.

Moreover, residency is a fundamental criterion. Applicants usually need to prove that they are long-term inhabitants of the state, which can include providing utility bills or other documentation that confirms their permanent address. Families that are fostering children or have legal guardianship may also have their own set of regulations to navigate.

It’s also essential to know about filing status. Whether you are married, single, or head of a household can affect your eligibility. Those who meet all these requirements should stay updated, as guidelines can change from year to year!

In summary, various factors such as age, income, residency, and filing status contribute to determining eligibility for these valuable benefits. Familiarizing yourself with these elements ensures that families can take full advantage of the support available to them.

How to Apply for the Benefit

Getting assistance for your little ones can be a straightforward process if you know the steps to take. Many families might feel overwhelmed by the paperwork and requirements, but don’t worry–it’s more about gathering the right information and filling out the forms accurately. This guide will walk you through what you need to do.

Start with the Basics: First things first, collect all necessary documentation. This typically includes identification for your dependents and financial statements for your household. Having everything organized will save you time and hassle later on.

Fill Out the Application: Once you have your documents ready, it’s time to complete the application form. Most states offer an online portal where you can submit your details, making the process efficient. Be sure to double-check each section for accuracy to avoid any delays.

Submit and Follow Up: After submitting your application, keep track of your submission. It’s a good idea to check in periodically, just to ensure nothing is missing or needs further clarification. If questions arise, don’t hesitate to reach out to the appropriate support services for assistance.

Stay Informed: Lastly, stay updated on any changes in guidelines or eligibility requirements. This can help you prepare ahead of time for any future applications. Remember, being proactive will only benefit you and your family in the long run!