Exploring the Future of the Child Tax Credit in 2025 with Insights from Kamala Harris

As we navigate through the complexities of financial support for households, it’s essential to understand the evolving landscape of benefits available to parents. In recent years, there has been a significant push towards enhancing programs that aim to alleviate the burdens faced by families. With new developments on the horizon, many are eager to learn about the forthcoming measures designed to provide some relief and stability.

Looking ahead, the conversation surrounding assistance initiatives is gaining traction, especially among those who are concerned about their economic well-being. It’s not just about numbers and policies; this is about making life easier for those raising children and ensuring that future generations have a strong foundation. The upcoming changes are poised to bring an array of options, making it crucial for families to stay informed and prepared.

With influential figures advocating for reform and enhancement of these supportive measures, it’s a pivotal time for discussion. Understanding what lies ahead can empower families to better navigate their financial landscapes. This guide will delve into the forthcoming changes and what they might mean for households seeking support.

Understanding the 2025 Child Tax Credit

In the upcoming year, families can expect new financial benefits aimed at supporting their caring responsibilities. These initiatives are designed to alleviate some of the economic pressures faced by households, providing extra relief to those raising young ones. With several changes on the horizon, it’s essential to grasp how these enhancements work and how they might impact your budget.

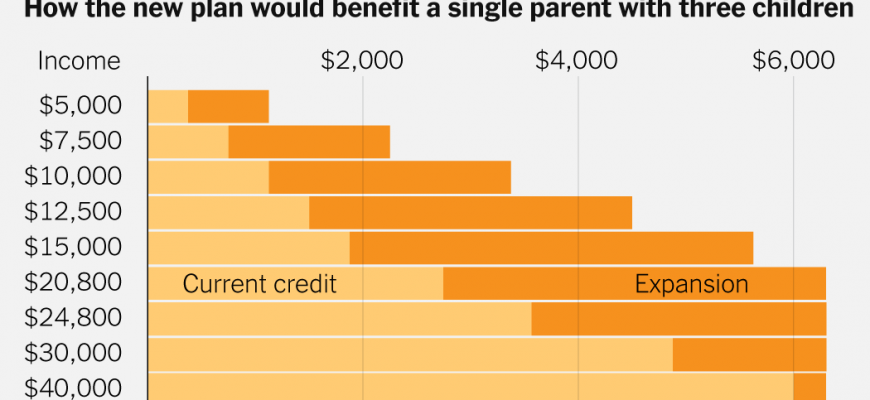

One of the most significant aspects of these adjustments relates to eligibility criteria and the assistance amount available. Families may find themselves qualifying for increased support, which can be a game-changer in managing daily expenses. The aim is to ensure that more parents can access essential resources without facing undue financial strain.

Additionally, the timing and method of distribution of these funds will play a crucial role in how families can utilize this assistance effectively. Understanding when and how to receive these benefits can help in planning household spending and investment in children’s needs. Make sure to stay informed about any documentation or prerequisites required to take full advantage of these offerings.

As you look forward to what the future holds, keeping an eye on these upcoming changes can provide clarity and financial ease for those nurturing the next generation. Engaging with available resources and staying connected with community programs can also ensure you maximize the support offered.

Impact of Kamala Harris on Family Benefits

When discussing recent transformations in support systems for households, one cannot overlook the contributions made by prominent political figures. The influence of such leaders can significantly reshape the landscape of assistance for families, especially those with children. This section explores how the active role of a skilled politician has driven changes that directly benefit countless households across the nation.

Policy Advocacy: A strong advocate for equitable support measures, she has emerged as a voice for the needs of families. Her efforts in promoting various initiatives aim to alleviate financial pressures on parents, enabling them to better provide for their loved ones.

Legislative Changes: The implementation of new policies under her guidance has seen an increase in financial aid options, allowing more families to access the resources needed for childcare and education. This has encouraged a greater emphasis on ensuring that no family is left behind.

Moreover, her leadership and commitment have galvanized discussions surrounding family welfare, pushing the envelope on what is possible in terms of governmental support. By championing these issues, she not only creates awareness but also fosters a community of advocates dedicated to promoting a brighter future for families.

Future Reforms in Tax Policies for Parents

As we look ahead, there is a growing conversation about enhancing financial support for families. The focus is not just on immediate relief but also on sustainable improvements that can positively impact the wellbeing of households with young ones. These changes aim to alleviate financial burdens and create a more balanced economic environment for caregivers.

One of the key areas of potential change is the introduction of more generous allowances aimed at supporting the upbringing of children. By reevaluating existing frameworks, policymakers can work towards solutions that truly address the needs of parents. For instance, increasing financial assistance during crucial developmental years may foster a healthier economic outlook for families navigating various expenses.

Moreover, there is a strong push for simplified processes that allow for easier access to these benefits. Removing unnecessary administrative hurdles can ensure that aid reaches those who need it most without delays. Imagine a system where support is seamless and straightforward, mitigating confusion and making it easier for parents to plan their finances effectively.

In addition, discussions around linking support to broader economic factors suggest a forward-thinking approach. By tying these measures to inflation or cost-of-living adjustments, families would receive ongoing assurance that their financial help keeps pace with the modern economy. This could ultimately lead to a more equitable distribution of resources aimed at boosting family stability.

Ultimately, the vision for future reforms emphasizes a commitment to nurturing the next generation. As conversations continue, the anticipation grows that these changes will create a more supportive infrastructure for parents, ensuring brighter futures for all.