Understanding the Income Limits for the Child Tax Credit in 2025

As we look ahead to future developments, many families are eager to navigate the landscape of financial assistance designed to ease the challenges of raising children. Knowing the parameters and requirements of available programs can make a significant difference in planning for both short-term needs and long-term goals. This piece will delve into the essential elements of a certain form of financial support that is anticipated to play a vital role in household budgets.

It’s essential for families to stay informed about how these initiatives are structured, including who qualifies and what financial thresholds are set. Each year brings potential changes, and understanding these dynamics can empower parents to make the most informed decisions possible. With so much at stake, grasping the specifics can lead to better financial outcomes.

In the coming sections, we will explore what parameters are likely to influence eligibility and how to best prepare for any shifts that may occur in the support system. This knowledge will not only help families to budget effectively but also to advocate for their needs more confidently. Let’s dive into what 2025 could mean for your family’s financial planning.

Understanding the 2025 Child Tax Credit

Navigating the realm of financial benefits for families can sometimes feel overwhelming. As we look ahead, it’s important to grasp how upcoming adjustments can impact households across the nation. This upcoming assistance aims to provide essential support to families, ensuring that they can better manage their expenses while raising their young ones.

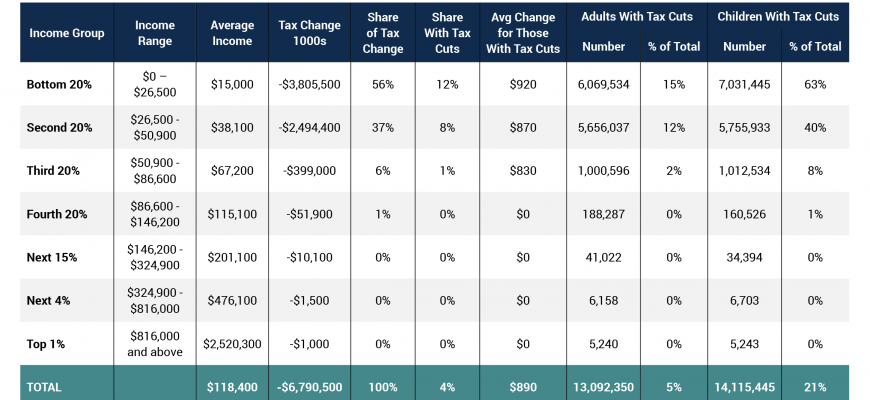

One of the key aspects to focus on is the financial threshold that families must meet to qualify for this support. The regulations concerning who is eligible can change, and often depend on various factors, such as household size and overall earning capacity. Understanding these guidelines will help families anticipate how these provisions might cushion their financial load.

Moreover, adjustments in the benefits can reflect broader economic trends and shifts in societal needs. Families should stay informed about potential enhancements or reductions in assistance levels that could affect their overall financial planning. Engaging with resources and professionals can offer clarity, ensuring families are equipped to make the most of available support.

In summary, being well-informed about forthcoming developments plays a crucial role in making sound financial decisions. Keeping an eye on eligibility criteria and potential modifications can empower families to take full advantage of the resources designated for their benefit.

Income Thresholds for Families in 2025

When it comes to financial assistance for households, understanding the thresholds is crucial. These benchmarks determine who may be eligible for support and how much aid one can receive based on earnings. They play a significant role in helping families budget and plan for their future.

For many families, these thresholds are set at specific levels that often change from year to year. The adjustments reflect economic conditions and the cost of living, aiming to ensure that the program benefits those in need the most. It’s essential for parents and guardians to stay informed about these changes, as they can impact household planning and expectations.

In the upcoming period, families will need to be aware of any updates to these financial levels. Keeping track of relevant announcements can make a substantial difference in understanding what assistance might be available. Being proactive about this information can lead to better financial decisions and security for loved ones.

The Impact of Earnings on Benefits

Understanding how financial levels influence available support can be quite enlightening. Each individual’s or family’s earnings play a crucial role in determining the assistance they can receive. This relationship often outlines the eligibility and the amount of relief that one can access, creating a significant impact on overall well-being.

For many, higher earnings might seem advantageous, yet it can unexpectedly lead to reduced benefits. Conversely, individuals with lower financial assets may find themselves qualifying for more extensive support programs. This dynamic highlights the complex nature of resource distribution and the importance of planning one’s financial trajectory.

It’s noteworthy how various government programs set thresholds. These thresholds serve as critical checkpoints that dictate who can avail themselves of certain resources. Understanding these guidelines can empower families to navigate their options effectively and ensure they are getting the most out of the available support.

Ultimately, the interplay between financial standing and available aid is a topic worth exploring. Recognizing how one’s earnings affect access to assistance can lead to better decision-making and a more secure future for those in need.