Exploring Your Eligibility for Financial Aid in Graduate School

Embarking on a journey towards higher education can be both exciting and daunting. Many individuals contemplating advanced learning might wonder about the various resources available to lighten the financial load. It’s an important consideration, as tuition fees and living expenses can quickly add up.

Various options exist to alleviate some of the burden associated with this pursuit. From government programs to institutional scholarships, numerous avenues can assist aspiring scholars in funding their educational endeavors. Understanding eligibility criteria and the application process is crucial for those wishing to explore these beneficial programs.

With thorough research and preparation, the prospect of receiving assistance may become a reality. It’s essential to navigate through the various possibilities, uncovering what may be accessible to help achieve academic goals. After all, investing in knowledge is a valuable step towards personal and professional growth.

Understanding Financial Aid Options

Navigating the realm of support resources for higher education can sometimes feel overwhelming. With so many avenues available, it’s essential to familiarize yourself with the various types of assistance that can help ease the burden of expenses associated with advanced studies.

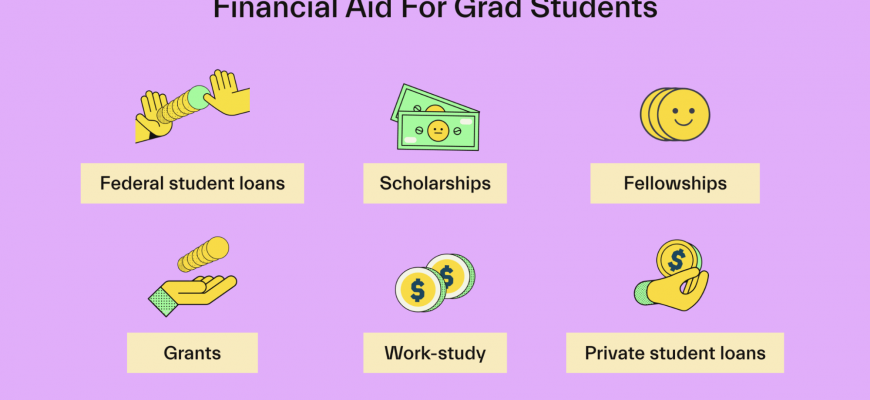

Several categories exist that prospective students should explore:

- Grants: These are typically need-based awards that don’t require repayment. They are often funded by the government or educational institutions.

- Scholarships: Competitive awards based on academic merit, talents, or specific criteria. They can come from various sources, including private organizations and colleges.

- Loans: Funds borrowed to finance education that must be repaid, often with interest. Different types come with varying terms and conditions.

- Work-study programs: Employment opportunities provided by educational institutions that allow students to earn money while studying.

Researching each option can reveal potential sources of support that align with individual circumstances. Understanding eligibility requirements will help streamline the process and facilitate informed decisions. It’s a good idea to reach out to university financial offices for guidance tailored to specific programs.

In addition to traditional sources, keep an eye out for alternative methods such as employer tuition assistance and crowdfunding campaigns, which have gained popularity in recent years.

Ultimately, an informed approach will lead to a clearer path in accessing the necessary resources to cover educational costs, setting the stage for a successful academic journey.

Eligibility Criteria for Graduate Funding

Entering the world of advanced studies can be a thrilling yet daunting experience, especially when navigating the available resources. Understanding what it takes to access various forms of support is crucial for prospective students. There are several factors that come into play, determining whether a candidate meets the necessary requirements to receive assistance aimed at easing education costs.

Academic performance often plays a significant role, as many programs look for individuals with strong grades or impressive test scores. Additionally, the field of study may influence eligibility; some areas, particularly those in high demand, might offer more opportunities for funding. Documentation of past experiences, such as relevant work or research, can also enhance prospects, showcasing a strong commitment to the chosen discipline.

Another important aspect is the financial situation of the applicant. Many funding sources consider income levels or other financial obligations when assessing a candidate’s suitability. Scholarships and grants often prioritize those in greater need, while loans may have different criteria. Lastly, citizenship or residency status can be a key element; certain benefits are available only to locals, influencing the options at hand.

Alternatives to Traditional Financial Aid

When it comes to supporting your studies, there are various paths beyond the usual options. Many students explore unique solutions that can help ease the burden of tuition and related expenses. These alternatives can offer flexibility and opportunities tailored to your personal situation, making it essential to consider all available resources.

Scholarships are a popular choice. Unlike loans, these funds do not have to be repaid. Many organizations and institutions provide scholarships based on merit, need, or specific criteria related to your field of study. It’s worth researching various options that might align with your qualifications or passions.

Grants can also be beneficial. Similar to scholarships, they do not require repayment and are often provided by the government, private entities, or educational institutions. Look into options that may be available based on your background or intended area of research.

Assistantships present another exciting avenue. Many universities offer teaching or research opportunities that come with a stipend and sometimes cover tuition costs. Taking on a role in your department not only helps financially but also fosters professional development and networking.

Additionally, consider crowdfunding. While it may seem unconventional, platforms dedicated to educational funding allow individuals to share their stories and seek support from friends, family, and even strangers who resonate with their goals. This option requires dedication but can lead to meaningful connections and funding.

Lastly, part-time work can provide a steady income while studying. Balancing a job with academic responsibilities might be challenging, but it grants independence and practical experience. Whether it’s on-campus employment or remote freelance gigs, the possibilities are vast.

Exploring these diverse alternatives can lead to innovative strategies for managing your education expenses. Every option has its advantages, so take the time to research what best fits your needs and aspirations.