Exploring the Possibility of Conducting a Credit Check on Another Individual

Understanding the financial trustworthiness of individuals often plays a crucial role in various situations, from lending agreements to rental opportunities. The curiosity around whether it is feasible to gain insight into another person’s financial history without their direct involvement raises several questions. This article delves into what is permissible and the ethical considerations surrounding such inquiries.

While knowing someone’s financial patterns might seem advantageous, navigating through the legal and moral implications can be quite intricate. Numerous factors come into play, including the methods utilized to obtain this information and the reasons behind wanting to access it. Discussing these aspects is essential for anyone contemplating embarking on this route.

Furthermore, it is vital to recognize that trust should always be the foundation of any interaction, especially when dealing with sensitive information. Understanding the balance between curiosity and privacy rights can ultimately shape the way these inquiries are approached. With that in mind, let us break down the key elements of this nuanced topic.

Understanding Credit Checks for Others

When it comes to assessing another individual’s financial trustworthiness, there are various factors to consider. Delving into the evaluation process can be quite enlightening, revealing not only the necessary procedures but also the ethical implications behind them. It’s essential to grasp how these evaluations operate and what they mean for both parties involved.

Initially, it’s vital to recognize the different types of assessments available. These inquiries can be performed for various reasons, ranging from rental applications to loan approvals. Each scenario may require a distinct approach and level of scrutiny. Nevertheless, transparency is key, and the person being evaluated should typically be informed prior to any actions taken.

Privacy acts as a cornerstone in this discussion. Respecting the boundaries and rights of others cannot be overstressed. Many jurisdictions necessitate explicit consent before proceeding with any assessment, ensuring that individuals maintain control over their information. This protective measure not only fosters trust but also aligns with ethical practices.

The repercussions of these assessments can be far-reaching. A negative report may influence future opportunities for the individual, impacting their ability to secure housing or obtain financing. Therefore, it’s crucial to tread lightly and consider the implications of gathering and sharing such sensitive data.

Ultimately, understanding the dynamics involved in investigating another’s financial background involves more than just knowing the steps. It calls for an awareness of the responsibilities accompanying such actions, both legally and ethically. This comprehension paves the way for fair dealings and positive relationships moving forward.

Legal Implications of Checking Credit

When it comes to exploring the financial history of another individual, there are significant legal considerations to keep in mind. Engaging in such activities isn’t simply a matter of curiosity; there are rules and regulations in place to protect personal information. It’s crucial to understand that accessing someone’s financial background without their consent could lead to serious consequences.

Privacy laws are designed to safeguard sensitive data, and violating these can result in penalties or even criminal charges. Organizations typically need a legitimate reason, such as evaluating a loan application or employment screening, to justify the inquiry. In these situations, obtaining written permission from the individual is often necessary to comply with legal standards.

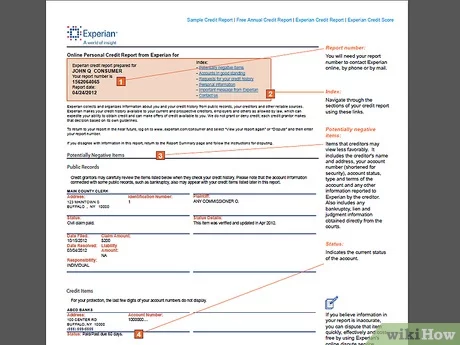

Additionally, the Fair Credit Reporting Act (FCRA) plays a pivotal role in regulating how financial information can be obtained and utilized. This act ensures that individuals have control over their personal data and provides them with the right to dispute inaccuracies. Mismanaging this process can not only harm the individual in question but can also expose the inquirer to legal action if proper procedures are not followed.

In summary, while it might seem straightforward to look into another’s financial records, the legal framework governing these actions is complex and must be navigated with care. Understanding the implications and responsibilities involved is essential to avoid unintended legal repercussions.

How to Obtain Permission for a Check

When considering an assessment of another person’s financial background, getting their consent is essential. This step not only respects their privacy but also builds trust between parties involved. It’s important to approach the situation thoughtfully to ensure everyone feels comfortable with the process.

Start by having an honest conversation. Explain the reasons behind your request and how the information will be used. Transparency goes a long way in alleviating concerns. Most individuals will appreciate the straightforwardness and may be more willing to grant approval.

Another useful tactic is to provide assurance regarding the confidentiality of the details obtained. Emphasize that the findings will be kept secure and used solely for the purpose you described. This can encourage the other person to feel more at ease about sharing their information.

Finally, consider preparing a written authorization form. This document should clearly outline what will be accessed and how it will be utilized. A signature can formalize the agreement, making both parties feel more secure about the arrangement. With the right approach, obtaining permission can be a smooth and respectful process.