Is it Possible to Use a Credit Card with Cash App for Transactions and Payments?

In today’s fast-paced world, digital financial solutions have become indispensable for managing personal assets. The convenience of transferring funds, paying bills, or even shopping online has transformed how individuals interact with their finances. Among the multitude of available services, many are curious about the possibility of using specific payment methods within various mobile platforms, enhancing their experience and capabilities.

The discussion surrounding payment possibilities often leads to questions about linking traditional funding sources to modern solutions. Many users are eager to understand how to expand their financial activities through various means, ensuring they make the most of the available functionalities. Those who seek clarity on this subject may find themselves navigating a range of options, each with its own unique features and considerations.

Understanding the intricacies of these interactions can prove beneficial. With so many choices at our fingertips, it’s vital to explore and clarify any uncertainties. As technology continues to evolve, staying informed about the range of functionalities offered by mobile financial services becomes increasingly important for all users looking to optimize their financial experiences.

Using Credit Instruments on Digital Payment Platforms

In today’s fast-paced world, the convenience of managing funds through mobile solutions has become a necessity. Many individuals seek ways to fund their transactions seamlessly. One popular option allows users to link financial instruments to facilitate quick payments or transfers.

Adding a financial instrument offers users flexibility by enabling them to conduct transactions without needing to rely solely on bank balances. It provides an alternative method to perform various activities, from sending money to friends to making purchases without delay.

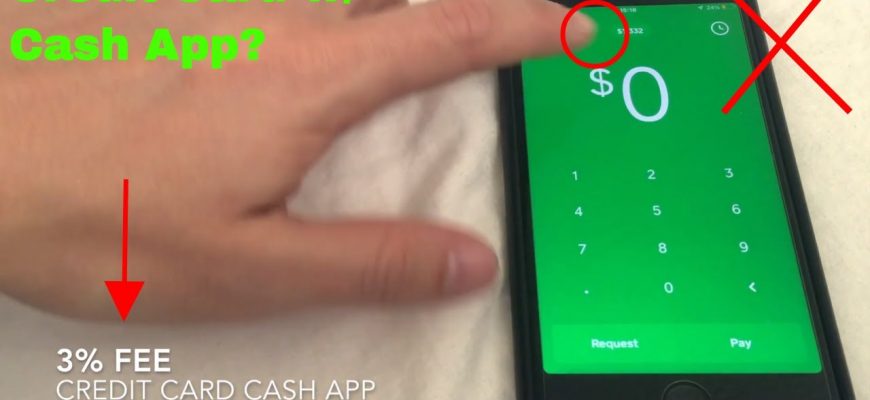

However, it’s essential to be aware of potential fees that might come into play when utilizing these facilities. Some platforms impose charges for using certain payment methods, so it’s wise to check the terms before proceeding.

Security is another crucial aspect to consider. Ensuring that personal financial details are kept safe is paramount. Many platforms implement robust measures to protect users from fraud, giving peace of mind when interacting online.

Overall, leveraging financial tools within modern transaction frameworks can enhance the user experience, streamline payment processes, and provide additional convenience in managing personal finances.

Benefits of Linking Plastic Payment Methods

Connecting a financial instrument for digital transactions can bring a variety of advantages to users. This integration not only enhances usability but also offers added layers of convenience and flexibility. By opting for this connection, individuals gain access to a range of features designed to streamline monetary exchanges and potentially improve financial management.

One major perk of this setup is the ability to earn rewards. Many financial institutions offer cashback, points, or travel perks with every purchase. This means that everyday transactions can lead to meaningful benefits, helping users make the most out of their expenses. Moreover, these perks can accumulate, providing users with opportunities for discounts or special offers.

Security is another important consideration. Transactions conducted through a linked payment method often come with robust fraud protection measures. This ensures that personal information remains safe while providing peace of mind during online purchases and money transfers.

Additionally, managing funds can become much simpler. Users can easily keep track of their expenditures, allowing for better budget management. Real-time updates and notifications help individuals stay informed about their financial activity, making it easier to adjust spending habits accordingly.

Lastly, the ease of access to funds is a significant benefit. Linking a financial instrument allows individuals to complete transactions without needing to reach for physical cash, making the entire process smoother. This feature is particularly helpful for those who prefer to avoid the hassle of carrying cash or visiting ATMs.

Potential Fees and Limitations

When using digital platforms for transactions, it’s essential to be aware of possible charges and restrictions that may apply. These factors can impact your experience, so understanding them is crucial for informed decision-making.

Here are some noteworthy aspects to consider:

- Transaction Fees: Some services impose a fee for specific financial activities, particularly when using credit cards for funds transfer.

- Withdrawal Limits: There may be restrictions on how much money you can take out in a single transaction or within a set timeframe.

- Daily Spending Caps: Platforms might enforce daily limits on the amount you can spend or send, affecting larger transactions.

- Account Verification: Certain features become available only after completing identity verification, which could temporarily limit your access.

- International Transactions: Sending funds abroad may incur additional fees or limitations based on the recipient’s location.

Being knowledgeable about these possible fees and limitations ensures that users can navigate the service effectively and avoid surprises down the line. Always check the fine print and stay updated on any changes that might affect your transactions.

How to Add Your Payment Method

Linking a payment option to your account is a straightforward process that opens up many opportunities for transactions. By completing this step, you’ll be able to send and receive funds seamlessly, making your financial interactions much more convenient.

To start, open the platform and navigate to your profile or settings. Look for the section dedicated to payment methods. Here, you will typically find an option to add a new method. When prompted, enter the required details, such as your number, expiration date, and security code.

After inputting your information, double-check to ensure everything is accurate. Once confirmed, submit your details. In some cases, a verification phase may occur, so keep an eye out for any required confirmations via text or email.

With your payment option now linked, you’re all set to enjoy hassle-free transactions in no time! Don’t forget to explore other features offered by the platform to enhance your experience even further.