Exploring the Possibility of Linking a Credit Card to Your Venmo Account

In today’s fast-paced digital world, managing finances has never been more convenient. Many individuals rely on mobile applications to simplify transactions and keep track of their spending. However, as you navigate through these platforms, you might wonder about the flexibility they offer when it comes to funding sources.

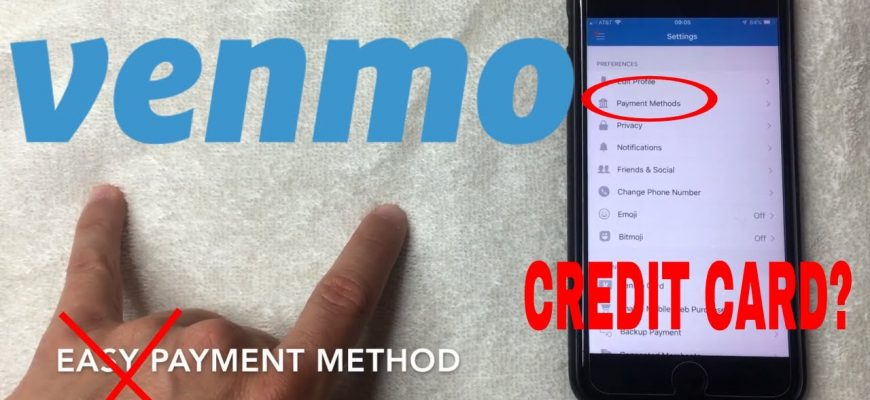

One of the key questions people often ask relates to the possibility of linking various payment options to their favorite financial applications. The ability to use different methods can enhance the user experience and provide additional choices for those looking to streamline their money management.

In this discussion, we will explore whether integrating certain types of payment methods with a popular financial app is feasible. Understanding this functionality is essential for optimizing your financial interactions while enjoying the benefits that come with modern technology.

Understanding Payment Options

When it comes to mobile payment platforms, users often wonder about the various ways to fund their transactions. There are multiple methods available to ensure that sending and receiving money is both convenient and straightforward. Exploring these alternatives can help you choose the best fit for your financial needs.

One popular method involves linking a bank account, making it easy to transfer funds directly without additional fees. Alternatively, some individuals prefer using a financial instrument that allows them to earn rewards or miles, enhancing their spending experience. Each option comes with its own advantages, and it’s essential to weigh them against your personal habits.

Using other payment sources can also impact how quickly funds become accessible. Actions like sending money to friends or splitting bills often reflect on your balance within moments, adding to the platform’s appeal. Recognizing these features can guide users in managing their resources efficiently.

As you navigate your choices, consider the potential risks related to different funding sources, including possible fees or protections. Understanding these aspects will empower you to make informed decisions while enjoying seamless transactions.

Linking Credit Cards to Venmo Safely

When it comes to managing your online transactions, ensuring a secure connection between your payment methods is crucial. Many people find it convenient to integrate financial instruments for seamless operations. However, taking the right precautions is key to safeguarding your monetary information.

First and foremost, verify that the platform follows strict security protocols. Check for encryption features that help protect your sensitive data. Utilizing two-factor authentication can significantly enhance your account’s safety. This additional layer of protection can deter unauthorized access.

Another important point is to keep an eye on your account statements regularly. Reviewing transactions can help you spot any suspicious activity quickly. If something seems off, taking immediate action can prevent further issues.

Furthermore, it’s wise to use a distinct password for your account that isn’t easily guessable. Combining letters, numbers, and symbols can strengthen your account security. Avoid reusing passwords from other sites to reduce risk.

Ultimately, staying informed about best practices for linking financial resources can make a difference in your overall experience. With the right measures in place, you can enjoy the benefits of convenient transactions while minimizing potential risks.

Comparing Venmo and Other Payment Apps

When it comes to digital wallets and money transfer services, there’s a range of options available in the market. Each platform offers its unique features and benefits, catering to different preferences and needs. Let’s dive into how these services stack up against one another to help you make an informed choice.

- User Experience: Many platforms emphasize simplicity, making it easy for users to send and receive funds. The interface is often intuitive, which can be a significant factor for those who value efficiency.

- Transaction Fees: Each service has varying fee structures. It’s essential to consider whether there are charges for instant transfers or if they offer free services for basic transactions.

- Social Features: Some applications integrate social networking aspects, allowing users to share transactions or split bills in a fun and interactive way. This can enhance the user experience, particularly among younger demographics.

- Transfer Limits: Different platforms impose different limits on how much money can be sent in a single transaction or within a specified timeframe. Be sure to check these limits to find a service that suits your needs.

- Security Measures: Security is paramount when it comes to handling finances. Look for applications that offer robust security features, such as two-factor authentication and encryption, to safeguard your transactions.

- Integration with Financial Institutions: Some options enable seamless connections with banks, making it easy to withdraw or deposit funds. This integration can simplify managing your finances.

In conclusion, exploring the various platforms reveals that the choice often boils down to personal preferences. Consider what features matter most to you and choose accordingly.