Exploring the Possibility of Using a Credit Card to Purchase Money Orders

When it comes to transferring funds, people often seek convenient options that fit their financial habits. Many are curious about various avenues available for such transactions, especially those that allow leveraging existing financial tools. This topic has sparked interest among consumers looking to streamline their purchases without resorting to traditional methods.

In the pursuit of flexibility, individuals frequently ponder whether certain forms of payment can seamlessly blend with newer transaction modalities. With a variety of choices on the market, it’s essential to understand the nuances of these interactions. Exploring this subject reveals a wealth of information that can aid in making informed financial decisions.

As the landscape of payment options continues to evolve, understanding how common tools can intersect with innovative methods is vital. Navigating through these possibilities opens up numerous avenues for users seeking practicality and efficiency in managing their finances.

Understanding Money Orders and Payment Methods

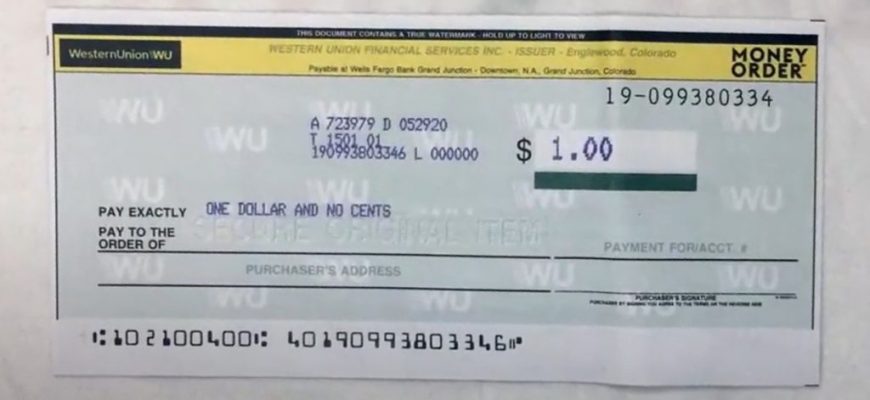

When exploring the landscape of financial transactions, various options come into play, each with its own advantages and nuances. Among them, one particularly intriguing method offers a reliable and secure way to transfer funds without the need for traditional banking channels. This alternative allows users to navigate their financial needs in a straightforward manner, catering to a wide range of scenarios.

Money transfers are often seen as an ideal choice, especially for those who seek anonymity or are hesitant to share personal banking information. These instruments provide a sense of security that online transactions sometimes lack. However, understanding the available pathways to acquire these instruments is crucial for effective financial management.

Exploring various options to obtain said instruments reveals a blend of traditional and modern methods. While some may prefer in-person purchases at designated outlets, others might find themselves pondering the possibility of alternative payment vehicles. This can lead to questions about how different payment options fit into the bigger picture.

Ultimately, grasping the intricacies of these financial tools empowers individuals to make informed decisions tailored to their unique circumstances. As we dive deeper into this subject, consider how various payment approaches influence the accessibility and convenience of conducting transactions in today’s fast-paced world.

Payment Methods Involving Plastic

When it comes to sending funds securely, many people explore various avenues. One option that often comes to mind is the possibility of utilizing a type of financial instrument commonly associated with purchases. This method offers an alternative way to facilitate transactions without relying solely on cash.

It’s essential to consider that not all locations or providers accept this mode of payment. Certain establishments may have restrictions or may not allow this approach at all. Therefore, checking beforehand is a smart move to avoid any surprises when trying to complete a transaction.

Another vital aspect is fees. Some companies charge additional costs for this arrangement, so comparison shopping may come in handy. It’s always a good idea to read the fine print and understand the potential charges involved.

Additionally, security is a top priority when opting for this payment type. The transaction is typically well-protected, but ensuring that you are dealing with a reputable vendor is crucial in safeguarding your financial details.

In summary, while this method of transaction can be beneficial, it’s important to do your homework. By arming yourself with information and understanding your options, you can make informed decisions that best suit your financial needs.

Alternatives to Credit Cards for Transactions

When it comes to managing payments, many individuals seek options beyond traditional plastic. There exists a variety of methods that can enhance convenience and financial flexibility. Whether it’s through digital wallets, bank transfers, or even cryptocurrency, the choices are diverse and accessible to a wide audience.

Digital wallets, such as PayPal or Venmo, allow users to send funds effortlessly, making online shopping and splitting expenses with friends a breeze. These platforms often come with user-friendly interfaces, enabling quick transactions that don’t require physical bank visits.

Bank transfers present another solid choice. Direct deposits and wires are reliable ways to move cash from one account to another, ensuring funds arrive safely. This method is especially useful for larger sums or business transactions where security is paramount.

Furthermore, the rise of cryptocurrency has introduced an innovative approach to exchanges. Digital currencies provide a decentralized alternative with the potential for lower fees and enhanced privacy. As more merchants start accepting these forms of payment, they become an increasingly viable option for tech-savvy consumers.

Lastly, prepaid options allow individuals to load a specific amount of funds onto a physical or digital medium. This method can help with budgeting, as it restricts spending to the available balance while also providing a safeguard against overspending.