Exploring the Challenges of Securing Financial Aid for College Education

Starting your journey toward higher learning can be exhilarating, but it often comes with its own set of obstacles. Many individuals quickly realize that the path to obtaining essential resources to help ease the burden of expenses isn’t always straightforward. Navigating the various options can sometimes feel overwhelming, leaving prospective students unsure of where to turn.

When expectations meet reality, the frustration can be disheartening. So many people have dreams of enhancing their knowledge and skills, yet they find themselves struggling to secure the necessary backing to make those aspirations a reality. Whether it’s due to a lack of information, eligibility issues, or other unforeseen factors, the challenges can be significant.

Understanding the nuances of available options is crucial. By identifying the reasons behind the obstacles and exploring alternative avenues, one can pave the way toward more informed decisions and, ultimately, success in achieving academic ambitions.

Understanding Eligibility Criteria

When considering options to support educational endeavors, it’s essential to grasp the factors that influence who qualifies for assistance. Many individuals often overlook certain elements that play a crucial role in determining eligibility. A clear comprehension of these components can significantly enhance the chances of securing necessary support.

Typically, various stipulations come into play, including income levels, family situation, and the type of educational institution one intends to attend. Each of these aspects contributes to a broader picture of need, which is evaluated by different organizations and programs. Moreover, timing and specific applications can also affect how and when assistance is distributed.

Beyond financial considerations, performance metrics like academic achievements and enrollment status can influence prospects. Understanding these metrics and their implications helps individuals navigate the application process more effectively. Hence, being well-informed about eligibility standards is the first step toward unlocking valuable resources available to aspiring learners.

Common Reasons for Financial Aid Denial

Understanding why some applications may face rejection can be crucial. Various factors can lead to denial, and being aware of them helps applicants prepare better. Often, misunderstandings or misinterpretations of guidelines can impact eligibility.

One frequent reason for rejection is incomplete or inaccurate information on the application form. Even minor errors can create significant issues. Additionally, failure to meet the required academic standards may disqualify students from receiving support. Each institution has its criteria, and maintaining good grades is essential.

Another common cause relates to the overall family income. If the declared income exceeds the institution’s threshold, assistance options can diminish. Furthermore, not documenting certain expenses or debts could lead to a miscalculation of need, which may affect the decision.

Lastly, timing plays a role in the application process. Missing deadlines can result in automatic disqualification. Being proactive and ensuring all materials are submitted on time is critical. By understanding these factors, students can better navigate the complexities of funding their education.

Alternative Funding Options for College Students

Finding ways to support your education can sometimes feel overwhelming, especially when traditional methods are out of reach. However, there are numerous creative avenues to explore that can help alleviate the costs associated with your studies. These options can offer a more tailored approach, allowing you to pursue your academic goals without the hefty price tag hanging over your head.

One notable route is through scholarships. Many organizations, businesses, and institutions offer scholarships based on various criteria such as ethnicity, field of study, or extracurricular activities. Taking the time to research and apply can lead to significant resources that require no repayment.

Another viable option is crowdfunding. Platforms dedicated to supporting educational endeavors have emerged, where you can share your story and invite friends, family, or even strangers to contribute. It’s a modern approach that taps into the community and facilitates connections that might not have been possible otherwise.

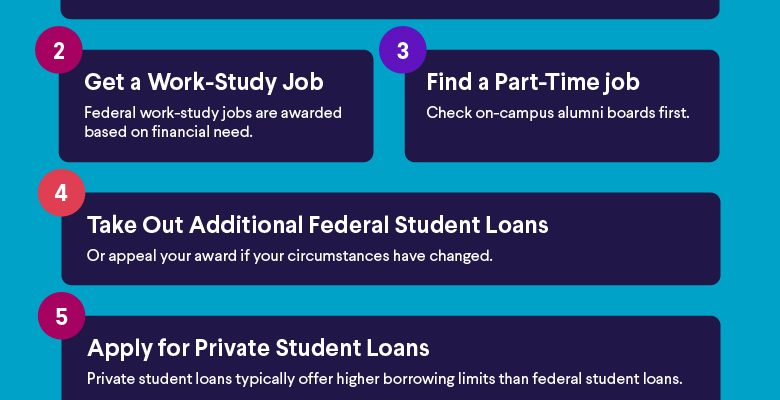

Moreover, consider work-study programs or part-time positions in your field of interest. This not only helps with expenses but also provides valuable experience, making you more appealing to future employers. Balancing work with study can be challenging, but the skills and connections you gain are often worth it.

Lastly, don’t overlook grants from local governments or non-profit organizations. These funds often cater to specific demographics or majors and can provide essential support without the burden of repayment. Investigating these options can yield surprising benefits.

In essence, exploring these alternative avenues can lead you to the necessary resources, ensuring that your educational journey remains within reach. Stay proactive and open-minded, as you might discover unexpected help along the way!