Struggling to Cover College Costs Despite Receiving Financial Aid

In today’s world, many individuals encounter significant challenges when it comes to pursuing higher education. Despite various assistance options available, numerous students find themselves in a bind, facing mounting costs that stretch beyond their budgets. This situation leaves them feeling overwhelmed and questioning their ability to chase their dreams.

The reality is that tuition and related expenses can create a financial strain that is hard to navigate. While there are programs designed to help lighten this load, they often fall short in providing comprehensive coverage for all necessary fees. As a result, a considerable number of aspiring learners grapple with the daunting prospect of funding their academic journey.

Finding a pathway to success amidst these hurdles requires creativity and determination. By exploring alternative solutions and reassessing priorities, students can uncover strategies that might lighten the burden. Understanding the nuances of available options is crucial for those who seek to bridge the gap between financial resources and their educational ambitions.

Understanding Higher Education Expenses Beyond Tuition

Enrolling in an academic institution involves much more than just paying for classes. There’s a whole world of additional expenses that can catch students off guard. From study materials to living necessities, individuals must navigate a complex landscape of costs that can quickly add up.

Books and supplies often represent a significant part of the overall expenditure. Whether it’s textbooks, lab equipment, or software needed for specific courses, these items can strain budgets considerably. Additionally, housing costs, whether on-campus or off-campus, play a crucial role. Rent, utilities, and food expenses can lead to financial challenges that many may not anticipate.

Transportation, too, is an element that can’t be overlooked. Whether commuting by public transport or maintaining a vehicle, travel expenses can greatly impact a student’s finances. Furthermore, fees associated with various services, such as technology access, health care, and recreational activities, can contribute to the overall budget.

Given all these factors, it’s vital to evaluate the complete picture when planning for educational pursuits. By being informed and proactive, students can better prepare for the financial realities that lie ahead, ensuring a more manageable experience as they pursue their academic goals.

Exploring Alternative Education Options

In today’s fast-paced world, traditional pathways to learning aren’t the only routes available. Many individuals are discovering diverse avenues that can lead to fulfilling careers and personal growth without the conventional structure. These alternatives often provide unique experiences and valuable skills that can be just as effective, if not more so, than traditional programs.

One notable option is vocational training, which focuses on equipping students with specific skills for particular trades. From plumbing to graphic design, these programs often provide hands-on experience and can lead directly to employment opportunities. Additionally, online courses offer flexibility for those balancing work or family commitments. Platforms such as Coursera and Udacity allow learners to study at their own pace, exploring topics that ignite their passions.

Another avenue to consider is apprenticeships, where individuals gain practical experience while working under the guidance of seasoned professionals. This model not only fosters real-world skills but also builds essential networks within industries. Self-directed learning is also growing in popularity, as many take advantage of resources available through libraries, community centers, and online platforms to create tailored educational experiences.

In an era of rapid technological advancement, learning through non-traditional means has never been more accessible. Embracing these varied paths can lead to exciting opportunities and a fulfilling journey in both personal and professional life.

Strategies to Manage Student Debt Effectively

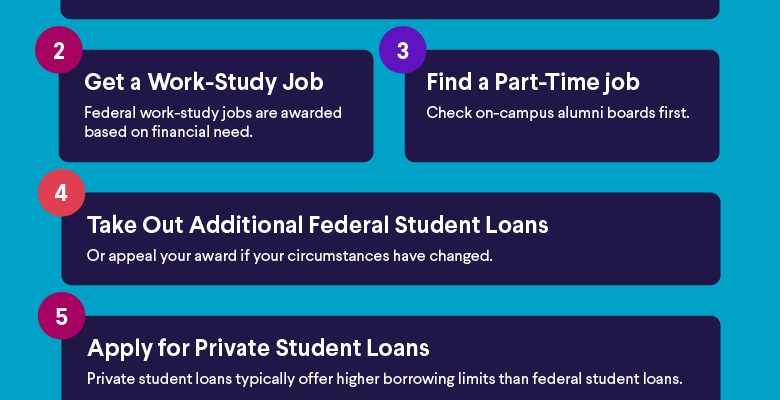

Navigating the world of higher education financing can be challenging, but there are practical approaches to ensure a more manageable repayment journey. With the right strategies, individuals can better handle the burdens of educational expenses without feeling overwhelmed.

Prioritize Your Payments: Start by understanding which loans carry higher interest rates. Focus on paying these down first to minimize the total interest paid over time. By channeling extra funds toward these loans while maintaining minimum payments on others, you can expedite the reduction of your overall debt.

Consider Refinancing: Refinancing your loans can potentially lower your interest rates, leading to significant savings. Shop around for lenders offering favorable terms. However, be cautious as this may affect your eligibility for certain repayment programs or loan forgiveness options.

Create a Budget: Establishing a clear budget that outlines your income and expenses can help you allocate funds more effectively. Track your spending, and look for areas to cut back. Direct any savings towards loan repayment to speed up the process.

Explore Income-Driven Repayment Plans: Many lenders offer repayment plans tailored to your income level. These options adjust monthly payments based on what you earn, making it easier to stay on track financially during periods of fluctuating income.

Stay Informed About Forgiveness Programs: Certain professions may qualify for loan forgiveness after meeting specific criteria. Research these opportunities to see if your career path aligns with any of these programs, as they could significantly alleviate your financial burden in the long run.

Build an Emergency Fund: Having a financial cushion can prevent you from falling behind on payments due to unexpected expenses. Aim to save a small amount regularly, so you’re prepared for any financial emergencies that might arise.

Seek Professional Advice: If managing debt feels overwhelming, consider consulting a financial advisor. They can provide personalized guidance and help you create a tailored strategy to improve your financial situation.