Exploring the Possibility of Using RuPay Credit Cards for UPI Transactions

In the digital age, the way we conduct transactions is constantly evolving. With numerous platforms and technologies at our disposal, the possibilities seem endless. Many individuals are curious about the ability to seamlessly integrate various financial tools within their daily routines.

One area of intrigue revolves around the compatibility of different payment methods with electronic wallet systems. As people seek to simplify their financial activities, understanding how these systems interconnect becomes increasingly important. It raises questions about whether traditional banking instruments can effectively communicate with more modern digital payment interfaces.

This conversation is particularly relevant for those looking to enhance their payment experience while maximizing convenience. Delving into this topic allows us to uncover the potential of merging different approaches and what that means for users navigating through their financial options.

Understanding Rupay Credit Cards

Let’s dive into the world of a payment solution that has been gaining traction among consumers. This type of financial instrument offers a convenient way to manage transactions while enjoying various perks. With increasing adoption, many people are turning to it as a reliable option for their spending needs.

What makes this option stand out is its strong focus on local markets, which allows users to have better access to various services. It streamlines payment processes, providing an efficient method for handling daily expenses. Users benefit from enhanced security features, making it a trustworthy choice for those who prioritize safety in financial transactions.

Moreover, the versatility of this option cannot be overlooked. It can facilitate a wide range of purchases, whether in-store or online, making it a preferred method for many shoppers. Additionally, it often comes with attractive rewards and cashback offers, adding even more value to the user’s experience.

As more individuals explore the advantages, it’s clear that this payment instrument represents a modern approach to managing finances, tailored to meet the demands of today’s consumers. With continuous innovations and expanding acceptance, it’s likely to play an even more significant role in the financial landscape moving forward.

UPI: A Payment Revolution in India

In recent years, a remarkable change has swept through the financial landscape of India. Individuals have embraced a new way of making transactions that enhances convenience and speed. This innovative method has transformed how people interact with money, simplifying everyday purchases and business dealings alike.

Gone are the days of waiting in long queues at banks or dealing with cash. With this groundbreaking approach, transferring funds or paying bills has become as effortless as a few taps on a smartphone. Users appreciate the transparency and security that come with it, making them feel more confident in their financial interactions.

Not only has this phenomenon impacted individuals, but it has also paved the way for small businesses to thrive. Entrepreneurs can now accept payments in real time, eliminating the hassle of managing cash flows. Innovation in technology has played a key role in ensuring that transactions are seamless and efficient, thereby fostering a more inclusive economy.

As this payment method continues to evolve, the future looks promising. With each passing day, more individuals and merchants are becoming participants in this digital revolution, contributing to a cashless society. It’s not just a trend; it’s a fundamental shift in how commerce is conducted in India.

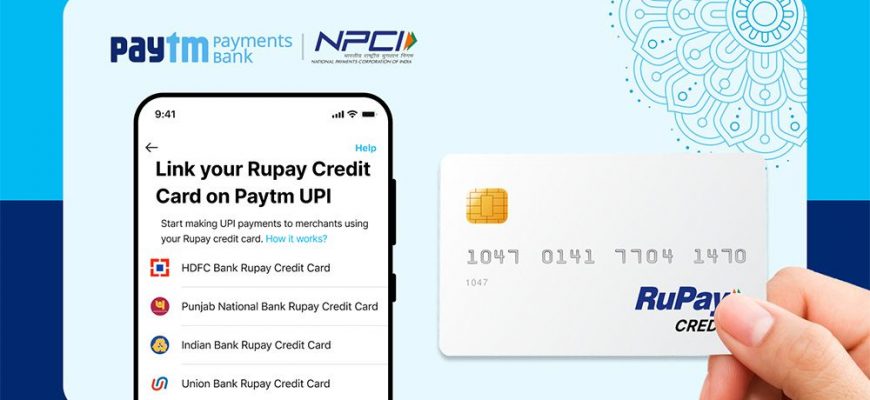

Connecting Rupay and UPI: How It Works

Have you ever wondered how two popular systems come together to enhance your payment experience? The integration of distinct financial platforms creates a seamless way to manage transactions in today’s digital landscape. Let’s dive into the details of how these systems function collectively.

The synergy between these platforms allows users to execute financial activities with ease. When you link your payment method to this system, it enables instant transfers and payments, making everyday transactions quicker and hassle-free. The process streamlines the way you handle your finances on the go.

To get started, users need to ensure their payment option is compatible with the payment ecosystem. Once connected, you can enjoy various benefits, including a wider range of merchants and enhanced transaction security. This integration empowers individuals, providing them with more control over their spending habits.

The beauty of this collaboration lies in its simplicity. With just a few taps on your device, you can make payments, send money, and manage your expenses without any complications. It’s a testament to how technology can bridge gaps and create efficient solutions for everyday needs.