Exploring the Possibility of Paying Your Income Tax with a Credit Card

When it comes to fulfilling financial responsibilities, modern technology has opened up a treasure trove of methods. From digital wallets to instant transfers, the landscape of monetary transactions has evolved significantly. Now, individuals can look beyond traditional avenues to settle their dues, making the process more convenient and accessible.

One of the intriguing possibilities that many are curious about involves using unconventional instruments to handle these payments. The flexibility of today’s financial tools allows for various approaches towards managing fiscal commitments. But is it really feasible to employ such options for meeting one’s obligations? Let’s delve deeper into the mechanics, exploring the advantages and potential hurdles of utilizing these innovative solutions.

For those contemplating this method, understanding the intricacies of how it works is essential. There are several facets to consider, including the associated costs and the processing mechanisms involved. This discussion aims to illuminate the options available, guiding individuals through the potential benefits and drawbacks they may encounter on their journey to fulfilling their financial duties.

Understanding Payment Options for Tax Obligations

When it comes to settling financial responsibilities with the government, there are several avenues available for individuals. Exploring these methods can help simplify the entire process and ensure that your contributions are made on time, without unnecessary stress. Each option offers its own set of advantages, so it’s worth taking a closer look at what’s available.

One common choice involves utilizing modern digital payment methods that many are already familiar with. This can include transactions through various online platforms, making it convenient for those who prefer to handle their finances remotely. These systems often provide quick confirmations, allowing taxpayers to feel secure in their submissions.

Another option is to use traditional methods, such as checks and money orders. While this may seem a bit outdated, it remains a reliable approach for those who value having a physical record of their submission. Different individuals have unique comfort levels with various methods, so evaluating personal preferences is key to making the right decision.

Additionally, some services offer installment plans, which can alleviate the burden of one-time payments. This could be particularly beneficial for individuals facing larger obligations, as it allows them to distribute payments over a set period. It’s always advisable to review all available resources to find the method that aligns best with your financial situation.

Benefits of Using Plastic for Obligations

Utilizing financial plastic for your obligations can offer a variety of advantages that might make the process more manageable and even beneficial. Many people appreciate the convenience and flexibility it can provide, allowing for smoother transactions while juggling financial responsibilities.

One significant perk is the opportunity to earn rewards or cashback on your expenditures. Depending on the specific financial product, it’s possible to accumulate points that can be redeemed for travel, merchandise, or even statement credits. This turns a necessary obligation into a chance to gain something back.

Another factor is the ease of tracking expenses. A digital statement can help keep a comprehensive record of what has been spent over time, simplifying budgeting and financial planning. This organized approach can lead to better financial decisions down the line.

Additionally, for individuals who may encounter tight cash flow situations, utilizing financial plastic gives them the ability to manage their obligations without immediate depletion of funds. Some may find this especially helpful when balancing various financial commitments throughout the month.

Lastly, many options come with added layers of protection against fraud. This can give peace of mind when completing such transactions, as most platforms have measures in place to safeguard users against unauthorized activity. These factors illustrate why using financial tools for obligations can be a smart choice for many individuals.

Potential Fees and Considerations to Know

When opting for methods involving financial instruments, it’s essential to be aware of various implications. Many individuals may be tempted to utilize modern solutions for their obligations; however, doing so comes with its own set of factors to weigh carefully.

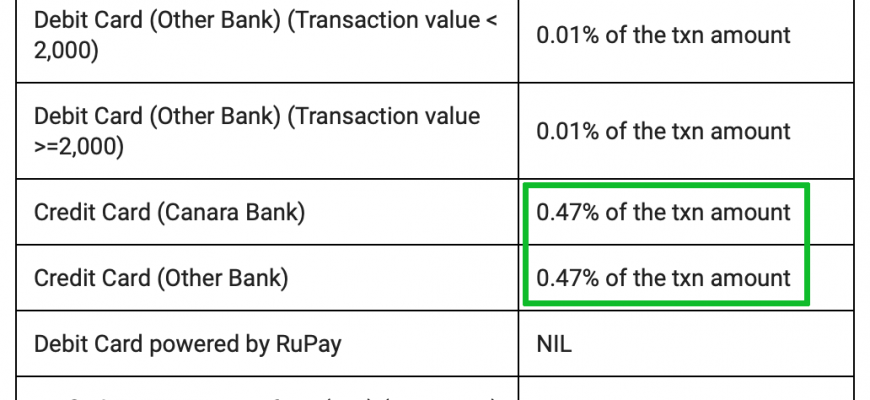

Transaction Fees: Just like with any service, fees might be imposed for using certain facilities. These charges could add up quickly, turning what initially appeared as a convenient option into an expensive choice. Always check beforehand to see if your selected provider levies any fees.

Beneficial Points: On the flip side, utilizing this approach can offer rewards or cashback from your payment provider. If you are someone who manages payments effectively, this can help you accrue benefits while fulfilling your responsibilities.

Payment Processing Time: It’s crucial to keep in mind that some platforms may not process your transaction immediately. This lag could potentially lead to penalties if deadlines are not adhered to. Planning ahead is vital to avoid any unwanted surprises.

Impact on Credit Utilization: Using this option can also affect your credit utilization ratio. If you decide to charge a substantial amount, it may influence your credit score, which is worth considering if you’re managing your financial standing.

In summary, while modern payment methods can provide convenience, it’s important to evaluate associated costs and circumstances. Understanding these elements will help you make more informed financial decisions.