Exploring Financial Aid Options for Part-Time Graduate Students

Stepping into higher education can feel like a thrilling adventure, but the journey often brings along a hefty price tag. Many aspiring scholars find themselves questioning how they can navigate the financial maze while balancing their studies with other commitments. It’s essential to know that there are resources available to assist individuals who focus on learning without embracing a full course load.

While attending classes less than full-time may appear to limit opportunities for support, the reality is more nuanced. Various programs and initiatives exist to lighten the financial burden for those who pursue knowledge at their own pace. Understanding these options can empower learners to take advantage of possibilities tailored to their unique situations.

The exploration of options designed for those who may not have the luxury to engage in studies full-time is an important topic. Scholarships, grants, and alternative financing avenues target those navigating a multifaceted life while striving for academic success. Knowing where to look and what to apply for can make a significant difference in transforming educational dreams into reality.

Understanding Financial Aid Options

When pursuing higher education while juggling other commitments, finding the right sources of support can seem daunting. Many individuals often wonder about the possibilities available to help alleviate the costs associated with their academic journey. It’s essential to explore the variety of funding avenues that may be accessible.

Scholarships represent one of the most sought-after forms of monetary assistance. These awards typically do not require repayment and are often based on merit, need, or specific criteria related to the field of study. Researching local organizations, community foundations, and university offerings can yield fruitful opportunities.

Grants are similar to scholarships in that they provide funds without the expectation of repayment, but they are often need-based. Various governmental and institutional grants can be available, so it’s wise to investigate eligibility requirements and deadlines to maximize benefits.

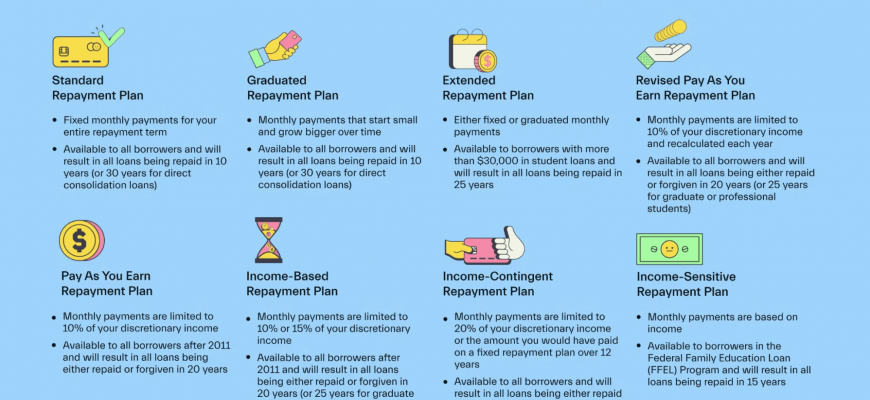

Another avenue worth considering includes loans. While these funds must be paid back, they can ease the immediate burden of tuition fees. Different types of loans, such as federal or private options, come with varying terms and interest rates. Understanding these distinctions is crucial before making a commitment.

Work-study programs offer a unique blend of employment and education by allowing individuals to work part-time while pursuing their academic goals. These roles often provide hands-on experience in the field of study, which can enhance learning and provide additional benefits.

Finally, don’t overlook the potential for tuition reimbursement through employers. Many companies offer programs that assist with educational expenses, helping employees further their learning while benefiting from enhanced skills in the workplace.

Exploring these various options can make a significant difference in managing educational expenses. Engaging with financial advisors and university resources can offer clarity on the most suitable pathways tailored to individual circumstances.

Eligibility Criteria for Part-Time Students

Understanding the requirements to secure funding can feel overwhelming, especially when juggling multiple responsibilities. Various factors come into play, influencing whether one qualifies for assistance while pursuing an education alongside work or other commitments.

Firstly, academic enrollments often determine eligibility. Many institutions specify a minimum number of credits to qualify for support, so checking this criterion becomes essential. Additionally, maintaining a satisfactory academic record is usually involved; a good GPA can be crucial in the assessment process.

Financial status also plays a significant role. Institutions frequently assess family income, assets, and other financial responsibilities to gauge need. This evaluation helps to create a fair distribution of resources among applicants.

Some programs may have specific requirements regarding residency or degree progression. Understanding these guidelines ahead of time can help avoid any surprises and streamline the application process.

Lastly, it’s wise to explore different funding sources, as each may have its unique set of regulations. Scholarships, grants, and even loans often come with their own prerequisites that can differ widely. Being proactive in researching these options is the key to unlocking potential opportunities.

Types of Financial Assistance Available

When it comes to pursuing higher education, various options can help lighten the burden of costs associated with learning. Understanding these resources is crucial, as they can make a world of difference in achieving academic goals.

Scholarships are often the first type of support individuals look into. These awards don’t require repayment and can be based on merit, need, or specific criteria set by the granting organization. The beauty of scholarships lies in their diversity; there’s something for everyone, whether you excel academically, possess unique talents, or belong to certain groups.

Grants function similarly to scholarships but are typically need-based. Governments and institutions provide these funds to help cover tuition and other related expenses. As with scholarships, the great thing about grants is that they do not need to be paid back, making them extremely desirable.

Loans can be another avenue to explore. Although these funds must be repaid, they often come with lower interest rates and flexible repayment plans. This can ease financial strain after completing studies, allowing time to secure a job and stabilize finances.

Lastly, many institutions offer work-study programs. These initiatives allow learners to work part-time on campus or in approved off-campus positions while enrolled. It’s a fantastic way to earn money while balancing academics, helping to alleviate some costs along the way.

You exude confidence and elegance. This video is pure magic – I’m absolutely captivated!