| Compare | First free* | Max amount | Min amount | Max term |

|---|---|---|---|---|

| Yes | 1200 € Contratar | 50 € | 5-62 day |

| Compare | Processing time | Max amount | ARP(%)* | Min amount | Age limit | Max term | Schedule |

|---|---|---|---|---|---|---|---|

| 10 min. | € 300 Get | 10 % | € 3000 | 18-75 | 1-3 years | 08.00 - 20:00 10:00 - 20:00 |

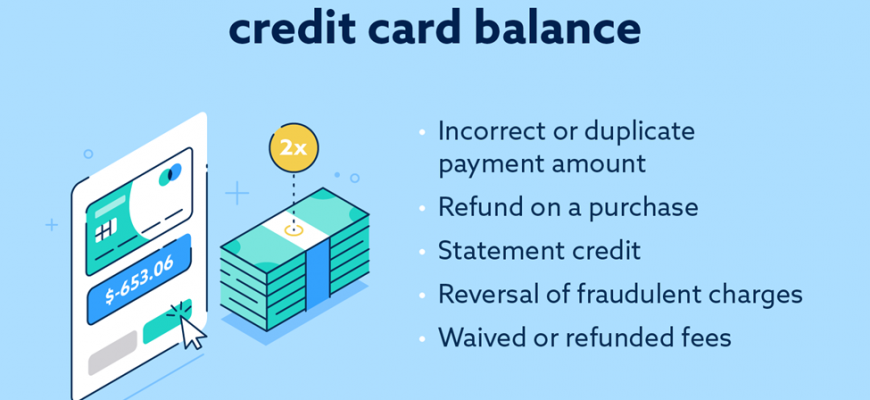

Exploring the Possibility of Overpaying My Credit Card Balance

Living in today’s world often means juggling multiple financial obligations, which can sometimes lead to confusion about how to manage payments. One common question that arises is what happens when you pay more than what is owed on your borrowing account. It’s important to clarify the implications of such actions and to understand the potential benefits and pitfalls they may entail.

Many individuals consider making additional payments as a means to alleviate future financial burdens, but the reality can be more nuanced. Depending on the policies of your issuer, there may be specific guidelines outlining how excess payments are treated. Navigating these waters requires a bit of diligence.

Whether you’re trying to maximize your financial health or simply avoid unnecessary fees, grasping the details surrounding these transactions can empower you. Dive into this topic to learn how to handle payments effectively and keep your finances on track.

Understanding Extra Payments

When it comes to personal finance, many individuals might wonder about the implications of paying more than the minimum required amount on their revolving accounts. This practice often leads to confusion and various questions about how it affects one’s financial standing. It’s essential to grasp the nuances surrounding this topic to manage your funds effectively.

What happens when you pay more? By making additional payments, you might reduce your outstanding balance more quickly, which could potentially decrease interest charges over time. It’s a strategy that not only helps in managing your expenses but can also boost your credit reputation by demonstrating responsible financial behavior.

However, it’s important to clarify what’s permissible. Some institutions provide the option to pay ahead on your balance, while others may have specific rules regarding excess payments. Checking the terms of your agreement with the lender is crucial to avoid any unexpected issues.

Additionally, consider the timing of your payments. Making extra contributions before a due date can yield positive results, but if done after, it may not have the desired impact on your upcoming statements. Understanding how these payments are credited helps in planning your financial strategy more efficiently.

In summary, while paying beyond the required amount could have its benefits, it’s wise to know the intricacies involved. A little knowledge goes a long way in making informed decisions that can enhance your financial health.

Implications of Excess Payments

Making payments that exceed your overall balance can lead to a variety of outcomes, both positive and negative. This practice might seem harmless or even beneficial at first glance, but it’s important to consider the potential effects on your financial situation.

On the bright side, an extra payment can help reduce the overall debt faster, leading to less interest paid in the long run. This approach can also provide a sense of relief, knowing you’ve paid more than required. However, it’s crucial to stay informed about the policies of the financial institution managing your account. Some companies might treat additional funds as a prepayment, which could impact future billing cycles.

Additionally, putting forth more money than necessary may inadvertently disrupt your budgeting plans. Allocating funds towards higher-than-required payments might deprive you of the flexibility to allocate resources to other essential areas. Finally, always keep an eye out for any unexpected fees or issues that might arise from such actions, as these could counteract the initial benefits.

How to Manage Your Credit Balance

Maintaining a positive balance can often feel like a juggling act. It’s essential to keep track of your finances while ensuring you’re not leaving too much money tied up in an account. Understanding this responsibility can help you make informed choices and ultimately reap the benefits of your financial habits.

First, you should regularly check your statements. This helps you stay aware of your available funds and any transactions that may have gone unnoticed. Having a clear understanding of your expenses can prevent unwanted surprises.

Next, set a budget. Allocating a specific amount for your monthly expenditures allows you to control your spending and maximize the use of your available balance. It’s all about striking a balance between enjoying your money and ensuring you don’t go overboard.

Additionally, consider using alerts. Many financial institutions offer notifications for various activities, such as approaching your spending limit or unusual transactions. These alerts can serve as helpful reminders, ensuring you stay on top of your finances.

Finally, think about your future goals. Whether it’s saving for a vacation or paying off a loan, having clear objectives will keep you motivated and help you manage your available resources more effectively. By staying organized and proactive, you’ll create a healthier financial landscape for yourself.