How Overdraft Usage Might Impact Your Credit Score

Managing personal finances can sometimes feel like walking a tightrope. Unexpected expenses often crop up, leading individuals to dip into their available funds beyond their original plan. While this might seem like a quick fix for a temporary situation, it’s essential to take a step back and evaluate how such actions can ripple through one’s financial life.

Many people may not realize that these little missteps can have lingering consequences. It’s not just about immediate convenience; there’s a larger story being told. When you engage in borrowing more than what you’ve initially budgeted, the implications could extend far beyond that moment of relief. Understanding these nuances is crucial for making informed choices.

Ultimately, having a grasp on how your financial decisions intertwine with your overall financial reputation can save you from potential pitfalls down the road. With each choice bearing weight, being proactive in understanding the repercussions can lead to more favorable outcomes in the long run.

Understanding Overdraft and Credit Impact

Managing finances can be a bit tricky sometimes, especially when you find yourself spending more than you have in your account. This situation often leads to a scenario where your spending exceeds your available balance, posing important questions about how it influences your financial reputation. It’s essential to grasp the nuances of this concept and its potential ramifications on your overall financial health.

When you tap into an arrangement that allows you to go beyond your account balance, it might provide short-term relief. However, lingering in that state can lead to unexpected repercussions. Your financial behavior is commonly evaluated by various lending institutions, and the implications of exceeding your limits might not always be favorable. It’s crucial to understand how your habits in this area could reflect on your overall financial standing.

Many individuals assume that just utilizing this financial tool won’t have any long-term implications. However, the reality is that these practices are closely monitored, and any consistent patterns may indicate risk. This can make it more challenging to secure favorable terms in future borrowing or generate interest from potential lenders. Hence, maintaining a keen awareness of your financial activities is key.

In essence, it’s vital to review your spending habits and how they align with your broader financial strategy. By doing so, you can navigate potential pitfalls and safeguard your reputation in the financial realm. Understanding the relationship between your bank account activities and future borrowing opportunities will ultimately empower you to make informed choices.

How Overdrafts Influence Credit Ratings

When it comes to managing personal finances, the way you handle your accounts can have wider implications than you might think. One specific aspect that often goes unnoticed is how certain financial behaviors can impact your overall trustworthiness as a borrower. This section delves into those subtle yet significant connections between account management and your financial reputation.

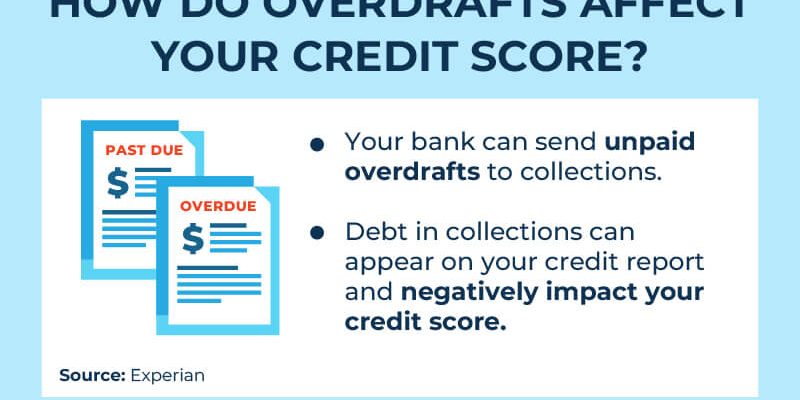

Utilizing your account beyond its balance can create a sense of immediate relief in times of need, but it’s essential to understand the potential long-term consequences. Lenders often examine your past financial activities, and patterns of exceeding your available funds may raise red flags. Such habits can give the impression of poor financial management, which could lead to a decrease in your perceived reliability.

Your financial habits aren’t just numbers; they tell a story. Frequent instances of tapping into that extra cushion may signal that you’re struggling to keep your finances in order. This narrative can influence how future lenders view your capability for repayment. It’s not just about the current situation; it’s about building a trustworthy account history.

To ensure a positive portrayal in the eyes of financial institutions, maintaining a balanced approach to spending can be beneficial. By keeping your accounts in good standing and avoiding situations where you rely heavily on the financial safety net, you can cultivate a more favorable image. After all, establishing solid financial practices today can pave the way for better opportunities tomorrow.

Managing Overdrafts for Financial Health

Staying in control of your finances is essential for achieving long-term stability. One key aspect of this is understanding how to responsibly handle situations where you spend beyond your available balance. With a little awareness and planning, you can navigate these scenarios without letting them impact your overall financial wellbeing.

Awareness is the first step. Keeping an eye on your spending habits and remaining informed about your account balances can help you avoid unpleasant surprises. Regularly checking your statements and utilizing mobile banking apps can aid in tracking your expenditures effectively.

Creating a budget can be incredibly helpful in managing your funds. By knowing how much you can afford to spend each month, you minimize the likelihood of going beyond your financial limits. Allocate a portion of your budget for unexpected expenses; this can act as a cushion for those moments when life throws you a curveball.

Additionally, consider setting up alerts. Many financial institutions offer notifications for low balances or when transactions occur. These reminders can prevent you from slipping into a challenging situation and keep you informed at all times.

Another practical solution is establishing an emergency savings fund. Having a designated amount set aside gives you peace of mind and ensures that you’re prepared for unexpected financial obligations, reducing reliance on credit when it’s not necessary.

Lastly, open communication with your bank can lead to various options that might ease the pressure. They may offer flexible terms or features that suit your financial style, allowing you to stay ahead without unnecessary stress.