Exploring the Possibility of Using One Credit Card to Pay Off Another

In the realm of personal finance, people often find themselves wondering about the various possibilities that arise with financial instruments. Many transactions are straightforward, but sometimes we encounter scenarios that raise questions. It’s fascinating to explore the flexibility and limitations of these tools in managing finances.

Have you ever considered the dynamics between different financial instruments? Individuals frequently seek ways to optimize their payments or consolidate their obligations. The inquiries surrounding how funds can be transferred between these instruments are common, prompting curiosity about the underlying processes and allowable strategies.

Additionally, understanding the mechanics of movement within these financial structures can significantly impact everyday life. It’s essential to dissect the implications, advantages, and potential pitfalls, so that individuals can make informed decisions when it comes to their monetary dealings. The exploration of such topics helps demystify the financial landscape.

Understanding Balances on Plastic Money

When it comes to managing finances, grasping how outstanding amounts on your plastic funds work is essential. Those figures reflect what you owe, influencing your spending habits and overall financial health. A clear picture of these sums can guide better decisions, helping you maintain control over your monetary obligations.

Your total due typically includes various elements, such as purchases made, any accrued interest, and fees. It’s crucial to keep an eye on these aspects to avoid unwelcome surprises when the billing cycle comes to an end. Understanding the interplay of these components allows for smarter budgeting and debt management.

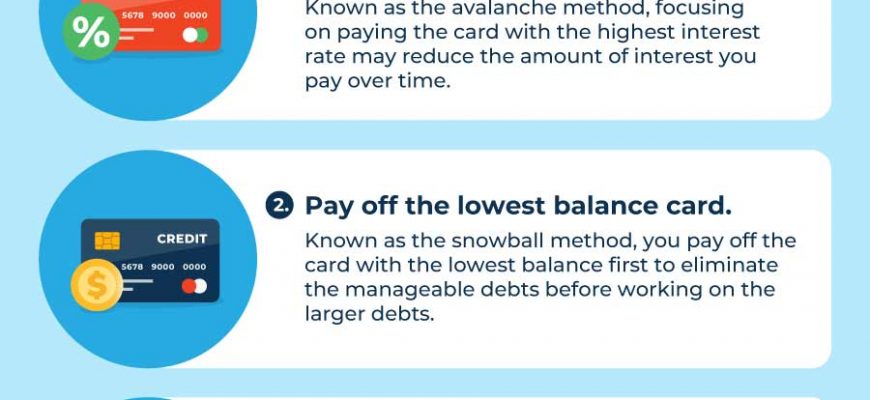

Many individuals often overlook the impact of interest rates on their remaining balances. The higher the percentage, the more you’ll end up paying in the long run. This knowledge empowers you to prioritize payments and potentially minimize the cost of borrowing.

Finally, tracking your remaining amounts is not just about numbers; it’s about creating a balanced strategy for future transactions. A proactive approach to your financial commitments can lead to greater stability and peace of mind in your monetary journey.

Payment Methods for Credit Card Debts

When it comes to settling outstanding balances, various options exist that can help manage and alleviate financial burdens. Individuals often seek alternative ways to tackle their obligations, and understanding these methods can empower better decision-making in times of need.

One popular approach involves utilizing a balance transfer, where an individual shifts the remaining amount from one account to another, typically taking advantage of promotional low or zero-interest rates. This strategy can provide immediate relief and a more manageable payment plan.

Another option is to consolidate debts through personal loans. By borrowing funds to pay off multiple liabilities, one can simplify their finances, ideally resulting in lower interest rates and a clear repayment schedule.

Additionally, some may opt for establishing a payment arrangement with the issuing institution. This could involve negotiating a plan that better aligns with one’s current financial situation, potentially including reduced payments or interest rates.

Lastly, seeking assistance from credit counseling services might provide valuable insights and help design a tailored repayment strategy. These professionals can guide individuals through the available choices and create a plan that meets their needs.

Risks of Transferring Balances Between Cards

Moving debt from one financial option to another can seem like a smart strategy for managing expenses. However, it’s important to be aware of potential pitfalls that may arise during this process. While it might provide temporary relief, some risks could lead to greater financial struggles down the road.

Hidden Fees are a common concern. Sometimes, promotional offers come with fine print that includes charges you may not notice at first. These costs can quickly add up, diminishing the benefits of transferring your balance.

Impact on Credit Score is another factor to consider. Opening a new account or increasing the usage on an existing one can affect your credit utilization ratio. This might lead to a dip in your credit rating when you least expect it, especially if you’re not diligent about handling your finances.

Lastly, interest rate surprises can derail your plans. After an initial teaser rate expires, your remaining balance might start accruing higher interest than you anticipated. This can result in paying more in interest over time than if you had maintained your original arrangement.