Exploring Opportunities for New Businesses to Obtain Credit Cards

Starting a venture often comes with a myriad of financial considerations, and navigating the world of funding can feel overwhelming. One essential aspect that many entrepreneurs ponder is whether they can access flexible spending solutions that come with various benefits. Understanding the avenues available for securing such financial tools is crucial for those looking to enhance their operational efficiency and maintain cash flow.

Securing financial resources can significantly impact the growth trajectory of a venture. It’s important to recognize the difference between traditional forms of financing and alternative solutions that can offer more agility. As we delve deeper into these alternatives, we’ll uncover what factors influence accessibility and how entrepreneurs can position themselves favorably in the eyes of potential financiers.

Moreover, grasping the different criteria that financial institutions use to evaluate qualifications will provide insights into preparing for application processes effectively. Various elements, such as the structure of the enterprise, creditworthiness, and even personal financial history, play a pivotal role in determining eligibility. By addressing these facets, entrepreneurs can enhance their understanding of what it takes to secure favorable financial options.

Understanding Credit Card Options for Startups

Launching a venture is an exciting journey, filled with unique opportunities and challenges. One of the key aspects entrepreneurs must navigate is financing, particularly exploring various payment solutions available in the market. Knowing the right options can empower founders to manage expenses effectively and build their brand’s reputation.

There are several types of financial tools that can support young enterprises, allowing flexibility in spending while potentially offering reward programs and benefits. From traditional offerings to specialized solutions tailored for fledgling endeavors, the choices are diverse. It’s important to assess each option carefully, considering factors like interest rates, fees, and eligibility requirements to find the best fit for your goals.

Establishing a solid credit profile is crucial for attracting favorable terms. Ensuring timely payments and maintaining low balances can enhance your chances of qualifying for optimal solutions. Additionally, campaigns that focus on cultivating relationships with financial institutions can prove beneficial in the long run, as familiarity often leads to better offers.

Lastly, entrepreneurship is as much about strategy as it is about creativity. Understanding and navigating the landscape of financial tools can provide the necessary support for growth and success. Make informed choices that align with your vision, and leverage these resources to drive your venture forward.

Building Creditworthiness as a New Enterprise

Establishing a solid reputation for financial responsibility is essential for any entrepreneurial venture. By nurturing trust with lenders and institutions, your firm opens doors to various funding opportunities that support growth and operations. The journey to becoming a reliable candidate for financial resources can seem daunting, but with a strategic approach, it becomes achievable.

One of the first steps in this process is to ensure that all payments, whether for bills, suppliers, or services, are made on time. This punctuality plays a pivotal role in shaping your financial profile. Additionally, consider setting up a dedicated bank account under the name of your enterprise. This separation of personal and professional finances not only simplifies management but also reflects seriousness and commitment.

Another critical aspect involves actively engaging with trade creditors. Establishing accounts with suppliers who report to business credit bureaus can significantly bolster your standing. As you develop relationships with these vendors, timely payments will enhance your rating and showcase your dedication to financial health.

Monitoring your financial reports is equally significant. By regularly assessing the information available through credit bureaus, you can identify areas for improvement and ensure that your records accurately reflect your practices. If mistakes occur, addressing them promptly will prevent future complications.

Lastly, consider utilizing a business credit card, if accessible. This tool, when managed wisely, can contribute positively to your financial history while offering a convenient way to make necessary purchases. Combining these practices creates a robust framework, fostering a positive image and laying the groundwork for future financial endeavors.

Steps to Apply for Business Credit Cards

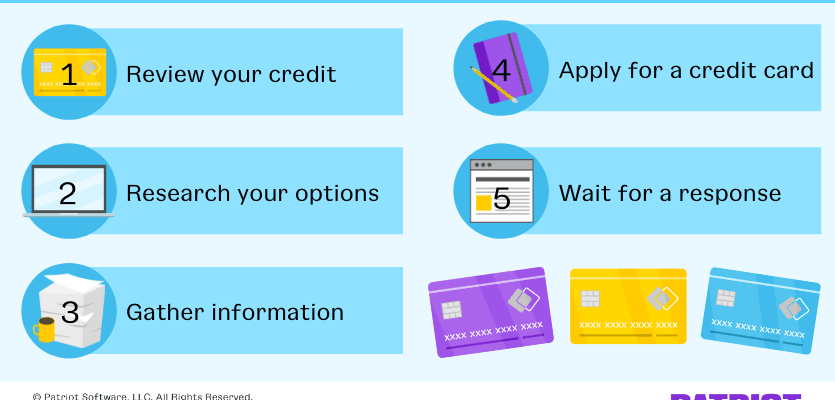

When it comes to financing ventures, exploring different options is essential. One popular route is obtaining a plastic solution tailored for enterprises. If you’re eager to embark on this journey, following a structured approach can make the process smoother and more successful.

First off, it’s crucial to gather all necessary documentation. This typically includes financial statements, tax returns, and identification details. Having these organized will streamline your application process. Next, it’s wise to assess your financial standing. Knowing your credit score can significantly impact the options available to you.

After evaluating your financial health, research various offerings on the market. Different institutions provide diverse terms, rewards, and interest rates, so it’s imperative to find the one that best aligns with your requirements. Comparing features side by side can help you determine the ideal fit.

Once you’ve settled on a suitable provider, it’s time to fill out the application. Ensure all details are accurate and comprehensive. Missing information can lead to delays or even rejections. After submitting, be prepared for a potential waiting period, during which the institution may conduct a thorough review of your submission.

Lastly, upon approval, review the terms carefully before diving in. Understanding the fine print ensures that your new financial tool serves you well in your ventures. Taking these steps can pave the way for a beneficial relationship with a financing option that meets your needs.