Understanding the Possibility of Garnishment on Your Financial Aid Funds

Life often throws us financial challenges, and sometimes, we need a helping hand to navigate through them. It’s important to remember that even when we’re receiving support, outside factors can come into play that may affect our resources. In this discussion, we’ll explore various circumstances that could potentially influence the money you rely on during tough times.

Many individuals are often unaware of how external obligations can align with assistance they receive. Whether it’s debts or legal matters, the implications can vary significantly depending on your unique situation. Knowing how these factors interplay is essential for safeguarding your necessary resources.

Navigating this terrain can seem daunting, but it’s crucial to arm yourself with the right information. By understanding your rights and responsibilities, you can better protect what you need to thrive while addressing any obligations you might have. Join us as we delve deeper into this important topic and uncover the realities of external impacts on your support systems.

Understanding Assistance Deduction

Many individuals rely on various forms of support to help them navigate their educational journey. However, there are circumstances where these resources might be subject to claims by creditors. It’s essential to grasp the implications of this situation, as it can affect one’s ability to meet educational goals.

When someone receives monetary support for their studies, they might wonder how secure this funding truly is. Various factors come into play, especially concerning legal obligations and outstanding debts. Recognizing these influences can provide clarity on what to expect and how to best protect these resources.

If a person has unpaid debts, some of these funds may be at risk of being intercepted. It’s crucial to know the laws surrounding this topic, as regulations can vary significantly across different regions. Understanding your rights and responsibilities can make a huge difference in managing your finances effectively.

Prioritizing communication with creditors and staying informed about potential deductions is vital. Whether through legal advice or financial literacy resources, gaining knowledge can empower individuals. Keeping abreast of these matters not only safeguards available resources but also contributes to a more stable financial future.

Factors Leading to Garnishment of Support

There are several reasons why certain types of assistance may be subject to deduction. Understanding these factors can help individuals anticipate potential issues and navigate their circumstances more effectively. In many cases, the circumstances surrounding personal finances, outstanding debts, and even legal obligations play a significant role.

One common contributor to the reduction of support arises from unpaid tax liabilities. When individuals owe back taxes to government authorities, these debts can often lead to a portion of their benefits being withheld until the balance is settled. Similarly, defaulting on student loans can have consequences that extend to various forms of support. In such instances, the government may take action to recover amounts owed, ultimately impacting the assistance received.

Another factor involves court-ordered payments, such as child support or alimony. Failure to keep up with these obligations can trigger garnishment, with a percentage redirected to fulfill these responsibilities. Additionally, various legal processes can initiate the withholding of support, particularly when creditors pursue repayment for outstanding debts. This can create a complicated financial situation for recipients who may rely heavily on that support for their day-to-day needs.

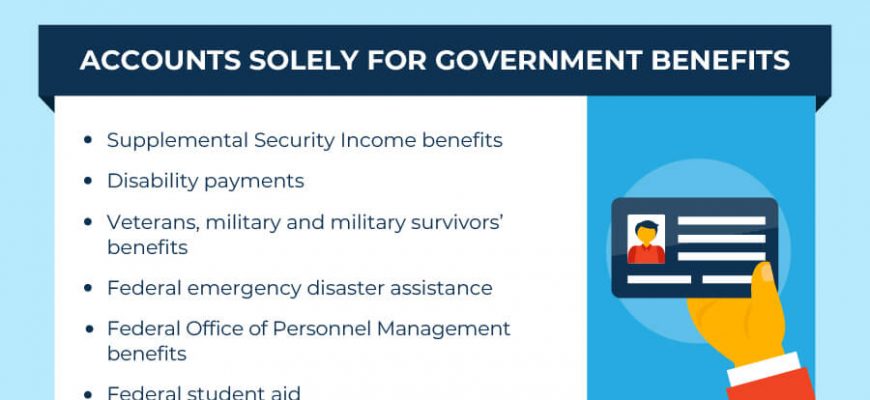

Moreover, the type of assistance received can influence whether it is susceptible to deduction. Certain forms of monetary support may have different protections under law, making it crucial for individuals to stay informed about their specific situation and potential risks. By understanding these elements, individuals can take proactive steps to safeguard their benefits and manage their finances prudently.

Protecting Your Assistance Rights

Understanding how to safeguard your support funds is crucial. Many individuals are unaware of the protections in place to prevent unwanted deductions from their essential resources. It’s important to know your entitlements and have clarity on what can and cannot affect your assistance.

Firstly, familiarize yourself with the regulations governing these resources. Certain types of support are shielded from debt collection actions, ensuring that you can continue to meet your needs without interruption. Being informed helps you to act confidently whenever issues arise.

Next, documentation plays a key role. Keep records of all communications and decisions regarding your support. This way, you can easily reference past conversations or agreements if disputes happen. If you ever find yourself in a challenging situation, having this information at your fingertips can make a significant difference.

Lastly, don’t hesitate to seek help. Numerous organizations advocate for individuals in your position, and they can provide guidance and support as you navigate these complexities. Reach out to them if you ever feel overwhelmed or unsure of your rights.