Understanding the Possibility of Minors Obtaining a Credit Card

Navigating the world of personal finances can be quite confusing, especially for those who are just starting their journey into adulthood. As young individuals begin to explore their independence, they may encounter various financial tools that promise convenience and flexibility. However, this raises several questions about the appropriateness of such options for younger demographics.

In this discussion, we will delve into the various pathways available for the youth when it comes to financial instruments that allow them to make purchases, build credit histories, and learn money management skills. It’s essential to understand the implications, requirements, and potential risks involved in accessing these financial solutions.

Moreover, we will highlight the alternatives that exist for young individuals to embark on their financial journey responsibly. With the right knowledge and support, they can cultivate a healthy relationship with their finances while making informed choices about their future.

Understanding Eligibility for Young Individuals

Navigating the world of financial products can be quite an adventure, especially for younger individuals looking to explore their options. It’s essential to grasp the criteria that determine suitability for various types of financial tools. Understanding what is required can help set the stage for future financial independence and responsible management of money.

Generally, to qualify for these financial instruments, applicants must meet specific requirements related to age, income, and credit history. It’s important to recognize that the financial industry often has guidelines that cater to younger applicants differently than adults. Learning about these regulations can empower young adults to make informed decisions about their financial future.

Many financial institutions provide options that allow young people to step into the realm of financial responsibility while still having support from a guardian or parent. These arrangements often help in building a solid foundation for sound financial habits, teaching the principles of budgeting, and the importance of timely payments.

Ultimately, understanding these eligibility guidelines can open doors to opportunities that contribute to personal financial growth. By leveraging available resources and fostering good money management practices early on, young individuals can pave their way toward a secure financial future.

Options for Teenagers to Access Financial Resources

As young individuals approach adulthood, exploring ways to handle finances responsibly becomes essential. While traditional methods of managing money, like cash or debit accounts, are common, there are also alternative paths for those in their teenage years to expand their purchasing power. Understanding these avenues can empower them to develop solid financial habits early on.

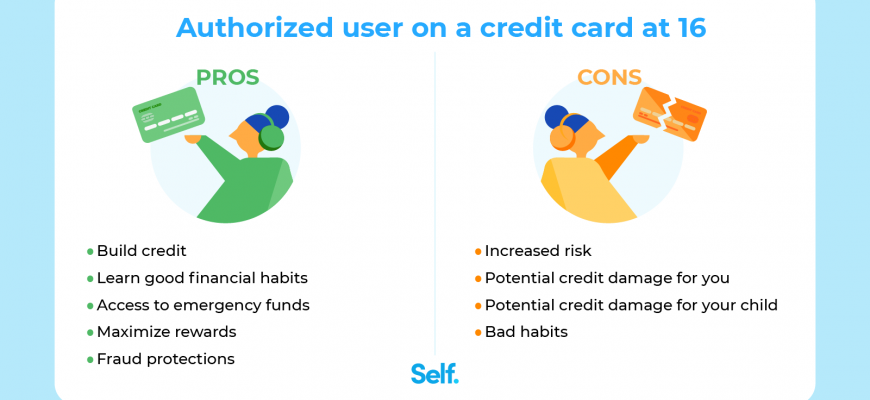

One popular option is to become an authorized user on a parent or guardian’s account. This arrangement allows teens to make purchases while benefiting from the primary cardholder’s established credit history. It’s a great way to learn financial responsibility under supervision, as parents can monitor spending and guide their teens on managing expenses.

Another route involves specific banking products designed for younger users. Some institutions offer tailored accounts that come with a debit feature, allowing for safe online transactions and in-store purchases. These accounts often include educational resources about budgeting and saving, which can be invaluable as one prepares for financial independence.

Moreover, prepaid solutions present an exciting opportunity. With a prepaid solution, teens can load a specific amount onto a card and spend within that limit. This helps instill discipline regarding spending and avoiding debt. Plus, many of these cards can be used similarly to traditional payment methods, making them convenient for everyday transactions.

Lastly, financial literacy programs and workshops can play a significant role. Local institutions often provide sessions focused on managing money, understanding financial products, and building a strong credit profile. Engaging in these educational experiences equips young individuals with the knowledge they need to make informed decisions in their financial journey.

Implications of Having a Financial Tool Early

Starting to manage a financial instrument at a young age can lead to a mix of advantages and challenges. It’s an exciting opportunity to learn about money management, the importance of credit scores, and making informed decisions. At this stage, individuals may gain valuable experience that paves the way for future financial literacy, but it also comes with responsibilities and potential pitfalls.

Understanding Financial Responsibilities is crucial when venturing into this territory. Young individuals might experience newfound independence in spending, but without proper knowledge, it’s easy to fall into debt. Paying attention to payment schedules, interest rates, and balances can seem daunting. Early exposure can foster a sense of accountability, but it requires guidance and education to navigate effectively.

Engaging with a financial tool also teaches the importance of building a positive credit history. Establishing a good record early on offers long-term benefits, like favorable loan terms and ease of purchasing a car or house later in life. However, it’s essential to maintain discipline to avoid mistakes that could harm one’s financial reputation.

Long-term Financial Habits can be influenced by experiences gained through early interactions with financial products. Those who learn to budget, save, and manage expenses effectively may develop skills that carry into adulthood. Conversely, if mismanagement occurs, it can lead to habits that are hard to break and potentially cause lifelong challenges.