Understanding the Impact of Medical Bills on Your Credit Report

Facing unexpected expenses in the realm of health can be a daunting experience for anyone. When such costs accumulate and remain unpaid, they can bring about a range of consequences that many might not fully understand. It’s essential to navigate this complex landscape carefully, as it can have implications not just for your finances but also for your overall well-being.

Many individuals are unaware of how these outstanding amounts can influence their financial standing. The potential for these unpaid amounts to be documented by financial institutions raises questions and concerns. It’s crucial to grasp the nuances of how these charges are handled and what can happen if they are left unresolved.

As we delve deeper into this topic, we’ll explore various aspects that play a role in this intricate situation. From the processes involved in transitioning these charges into formal notifications to the implications for your overall financial profile, understanding the details can empower you to make informed decisions moving forward.

Understanding Medical Debt Reporting

When it comes to outstanding healthcare expenses, many people find themselves in a confusing situation. It’s essential to grasp how these obligations can affect your financial standing and overall creditworthiness. The nuances of how this type of financial burden is communicated to credit agencies can significantly impact your ability to secure loans, make major purchases, or even rent an apartment.

Typically, unpaid healthcare expenses may be sent to collection agencies if they remain unresolved for a certain period. Once this happens, the collection may be listed in your financial dossier, which could influence how lenders perceive you. Understanding the timeline and process of this reporting is crucial. It varies from one situation to another, and being informed can help you take proactive steps if necessary.

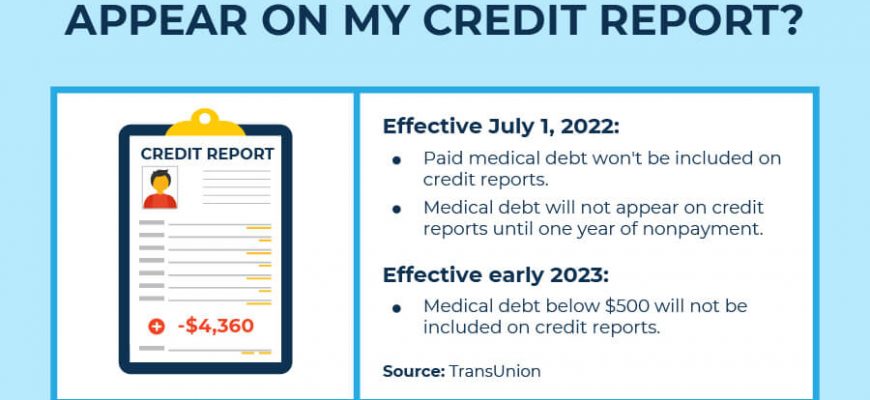

It’s also worth noting that the rules governing the disclosure of these obligations have changed in recent years. New guidelines have been introduced to give individuals a better chance to resolve their debts before they negatively affect their financial history. Knowing these changes can empower you to manage your obligations more effectively and mitigate potential damage to your financial future.

Impact of Unpaid Obligations on Credit Scores

Unsettled financial responsibilities can significantly affect your overall financial health. When payments fall behind, it can lead to a ripple effect that not only strains personal finances but also tarnishes your reputation in the eyes of lenders. Understanding the implications of these overlooked duties is essential for maintaining a strong financial standing.

The moment a payment is missed, it can trigger a series of negative consequences. Late payments are often reported, and this can lead to a decrease in your overall financial rating. A diminished score can hinder your ability to obtain loans, increase interest rates on future borrowings, and may even affect rental applications. Essentially, the longer an obligation remains unresolved, the more damaging its impact can become.

Moreover, the presence of outstanding amounts can linger in financial records for years, creating challenges well beyond immediate payment issues. It’s crucial to be proactive in addressing any overdue accounts, as resolving these matters promptly can mitigate their adverse effects on your financial profile.

In conclusion, staying on top of financial commitments is vital. By prioritizing timely payments, individuals can safeguard their financial integrity and ensure that they remain in a favorable position for future borrowing opportunities. Awareness and action are the keys to navigating this complex landscape.

How Medical Collections Affect Financial Record

When it comes to managing personal finances, unexpected expenses can create significant stress. One of the key issues arises when unpaid charges find their way into the collections system. This situation often leads to questioning how such debts influence overall financial health and reputation in a broader economic landscape.

Collections have a profound impact on an individual’s financial standing. When outstanding payments are sent to collection agencies, they may be reported to specialized databases that lenders often check. This action can lead to negative consequences, such as a reduced likelihood of securing loans or even being approved for rental agreements.

Additionally, these entries can linger for several years, diminishing trustworthiness in the eyes of potential creditors. This stigma can affect not just large purchases like homes or cars, but also smaller, everyday transactions. Consumers may find themselves facing higher interest rates or stricter terms due to a tarnished financial track record.

Properly managing outstanding debts early on can alleviate some of these concerns. Engaging proactively with creditors to negotiate payment plans or settlements can greatly enhance prospects for maintaining a positive financial image. It’s essential to remain informed and take steps to counteract any negative effects as soon as possible.