Exploring the Possibility of Financial Aid for Married Couples

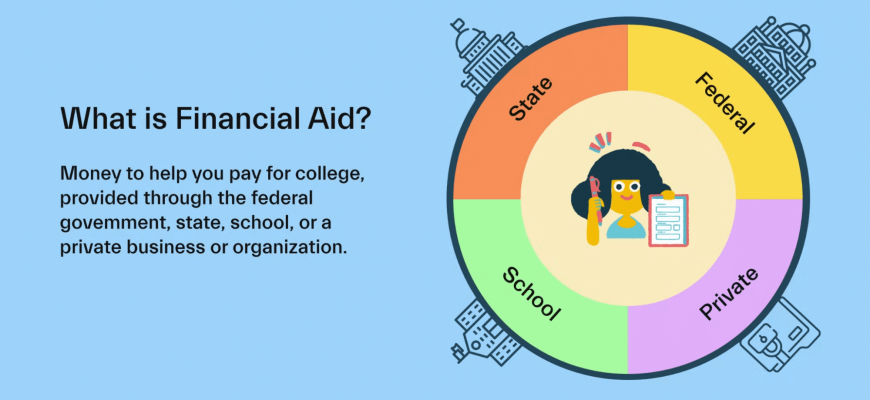

The journey toward higher education can be both exhilarating and overwhelming, especially when it comes to navigating the complexities of assistance programs available to those who require a little extra help. It’s a common misconception that certain relationships or statuses automatically disqualify individuals from receiving support. In reality, there are many factors to consider.

Understanding the guidelines and eligibility criteria can shed light on a path that many might not realize exists. It’s essential to explore the various options and uncover potential resources that could ease the burden of educational expenses. Often, people overlook the subtleties of these programs and miss out on opportunities that could significantly impact their futures.

Through this discussion, we will dive into the nuances that affect eligibility for these supportive resources. It’s about more than just filling out forms; it’s about understanding how life circumstances intertwine with potential opportunities for assistance. So let’s demystify this process and unlock the secrets to maximizing available options.

Understanding Financial Assistance for Couples

When two individuals decide to unite their lives, their financial landscape can become quite intricate. Many factors come into play when navigating the world of monetary support for education or other pursuits. It’s essential to grasp how combined resources, income levels, and various applications influence the availability of assistance.

One significant aspect to consider is how joint income may affect eligibility for programs designed to provide support. In some scenarios, the income of both partners is combined, which can lead to a higher threshold for receiving assistance. However, understanding specific programs and their requirements is crucial, as there are often variations based on unique circumstances.

Additionally, shared expenses and responsibilities play a vital role in shaping the financial situation. Balancing bills, loans, and savings can influence decisions regarding applying for support. It’s also key to communicate openly about finances, since transparency can help in assessing the best possible options available to achieve educational goals.

Ultimately, exploring potential resources requires diligence and an understanding of how each partner’s financial standing interacts. By collaborating and aligning their financial goals, they can better navigate the complex world of assistance opportunities that may be available to them.

Eligibility Criteria for Married Applicants

Understanding the requirements for financial support can be a bit tricky, especially for those who are in a partnership. The criteria often take into account various factors, such as income, family size, and other personal circumstances. It’s essential to have a clear grasp of what is expected, so you can assess whether you meet the necessary conditions.

Income Assessment: One of the primary aspects evaluated is the combined income of both partners. This can significantly influence your chances of receiving assistance. Make sure to gather all relevant financial documents to have a precise overview of your situation.

Dependency Status: The number of dependents you have can also play a vital role in determining eligibility. More dependents typically mean that your financial needs could be seen as greater, impacting the support you may qualify for.

Application Process: Both individuals might need to provide information during the application. It’s crucial to ensure that all details are accurate and up to date. Inconsistencies can create delays or even lead to denial of assistance.

Being informed about these criteria can make the application process smoother and less stressful. Take the time to understand your financial landscape, and consult resources or advisors if needed.

Impact of Joint Income on Assistance Amounts

When two people share their lives, their earnings often combine as well. This joint financial picture significantly influences the sum of support they might receive. Understanding how shared income can affect potential benefits is crucial for those navigating these waters.

Here’s what to consider regarding combined earnings:

- Income Levels: Higher total incomes may lead to reduced eligibility for available resources.

- Asset Assessment: Joint assets are often evaluated to determine overall financial need.

- Deductions: Some programs may account for additional costs such as dependents or specific living expenses.

Many assistance programs take a broader view, examining not just the income, but also various factors that reflect overall financial circumstances. This comprehensive approach can either enhance or limit the level of support accessible.

- Review combined income carefully before applying.

- Understand how income brackets influence eligibility criteria.

- Consider consulting financial advisors for personalized guidance.

Ultimately, grasping how collective income affects available options can pave the way for making informed choices and maximizing potential resources.