Understanding Whether Landlords Have the Right to Access Your Credit Score

When looking for a new rental space, many individuals find themselves wondering about the evaluation process that property owners undergo. It’s not uncommon for prospective occupants to have concerns regarding the financial scrutiny they may face before being granted a lease. This aspect of the renting journey can feel overwhelming, especially if you’re unsure what factors might influence a property owner’s decision.

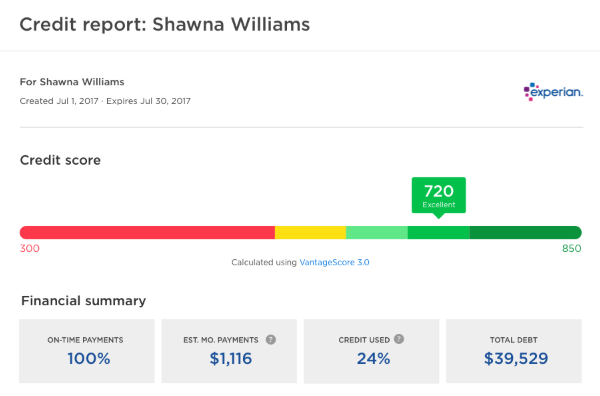

Financial evaluations serve as a tool for real estate proprietors to gauge potential renters’ reliability. The assessments often focus on past behavior, including payment history and overall financial stability. While these evaluations may seem intrusive, they are designed to protect both parties in the rental transaction.

In this discussion, we will delve deeper into the procedures associated with these assessments, why they are important in the rental ecosystem, and what individuals can do to prepare themselves prior to engaging with a property owner. Let’s unpack the intricacies of this often-misunderstood process and shed some light on what you might expect when navigating your next rental experience.

Understanding Owners’ Right to Financial Assessments

When it comes to renting a property, it’s essential to know that property owners often want to ensure their investments are protected. One common practice they employ involves scrutinizing the financial background of potential tenants. This process can provide valuable insights into a person’s reliability and ability to meet rental obligations.

The ability to evaluate an applicant’s financial history serves several purposes. It helps property owners gauge the likelihood of timely payments and reduces the risk of future disputes. Additionally, this assessment can reveal patterns of financial responsibility or issues that might raise red flags for the owner.

Before applying for a rental agreement, it’s crucial to understand not only the process involved but also the reasons behind it. Being aware of this can empower individuals to present themselves in the best possible light, showcasing their financial stability and commitment to honoring a lease.

Furthermore, laws regulating these evaluations vary by region, and it’s wise for prospective tenants to familiarize themselves with their rights. Knowing what can be examined and how that information is utilized can lead to more informed conversations with potential property owners.

Impact of Credit Scores on Rental Agreements

When it comes to securing a lease, those numbers reflecting your financial behavior play a significant role in shaping the outcome. They can influence not only whether a potential tenant is approved but also the conditions surrounding the lease itself. Understanding how this evaluation affects options is essential for anyone looking to rent.

A positive evaluation often leads to more favorable terms, like lower deposits or better rental rates. On the other hand, a problematic financial history may result in stricter requirements or even denial of the application. Many individuals may not realize how deeply their financial patterns can sway negotiations, impacting everything from monthly rates to the type of rental properties available.

Moreover, knowing how these factors impact relationships with property owners can guide individuals in managing their finances to create a better standing. Preparing ahead of time can open doors to opportunities and potentially save money in the long run. Awareness of this connection between financial history and housing options is key for those in the market for a new place to call home.

How to Prepare for a Financial Inquiry

Getting ready for an assessment of your financial history can feel a bit daunting, but it doesn’t have to be. Understanding what to expect and taking a few steps in advance can make the whole process smoother. Whether you’re looking to secure a new residence or simply wanting to showcase your financial reliability, preparation is key to presenting yourself favorably.

1. Review Your History

Start by examining your financial background. Obtain reports from various agencies to see what information is out there. This helps you identify any inaccuracies or issues that need addressing. Plus, knowing where you stand will boost your confidence going into any discussion.

2. Clear Up Debts

If you have outstanding balances or unresolved accounts, working on those can significantly improve your overall standing. Make a plan to settle any debts, as this demonstrates responsibility and stability, making you a more attractive candidate.

3. Organize Documentation

Gather essential documents that showcase your financial reliability. This can include pay stubs, bank statements, and previous agreements. Having these ready not only speeds up the process but also proves your preparedness and seriousness.

4. Maintain Consistent Payments

Ensure that all your obligations are met on time leading up to the assessment. Timely payments reflect well on your management skills and can significantly impact how you are perceived.

5. Communicate Openly

If you have questions or concerns, don’t hesitate to ask. Open communication can help clarify any issues and allows for transparency, which is often appreciated and respected.

By taking these proactive steps, you can alleviate some of the stress surrounding the evaluation of your financial history. Being prepared not only showcases your reliability but also builds trust with those who are assessing your financial responsibility.