Exploring the Possibility of Building Credit with Klarna’s Services

In today’s fast-paced financial landscape, many individuals are seeking ways to enhance their economic standing and cultivate a solid financial reputation. The emergence of alternative payment solutions has sparked interest in their potential impact on one’s fiscal journey. With options that promise flexibility and convenience, it’s crucial to understand how these services might influence your financial health over time.

People often wonder whether using modern payment platforms can favorably affect their financial profiles. As individuals navigate through various expenditures while managing their budgets, the interplay between different payment methods and their long-term effects becomes an important topic. Understanding the nuances of these services can help users make informed decisions that align with their future goals.

As we delve deeper into this discussion, it’s essential to explore different facets of these financing approaches. From user experiences to expert insights, the journey reveals not only the mechanics of these systems but also their potential implications on one’s overall fiscal narrative. With so many options available, aligning your choices with your aspirations is key to achieving financial well-being.

Understanding Klarna’s Credit Impact

Many consumers often wonder how using a certain payment service affects their financial reputation. It’s essential to grasp the nuances of how such platforms operate and their potential influence on one’s financial standing. This knowledge can help individuals make informed decisions regarding their purchasing habits and payment methods.

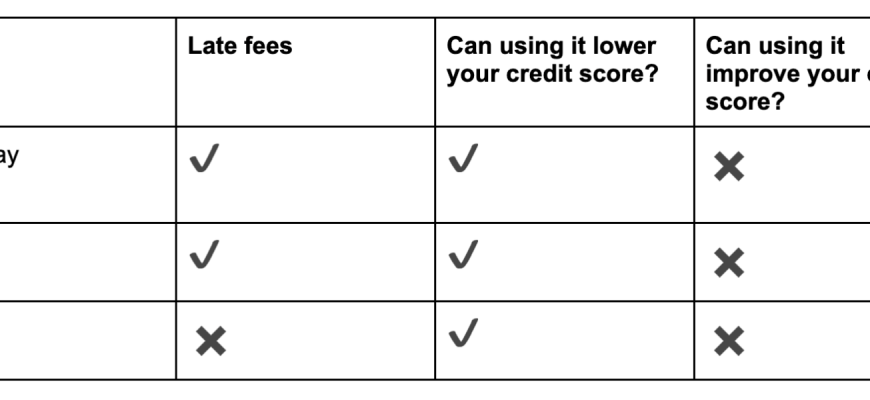

When engaging with these services, the way payments are managed plays a crucial role. While some platforms report user behavior to financial institutions, others may not. Understanding this distinction is vital for anyone wishing to enhance or maintain their financial profile. Regular, timely payments often reflect positively, while missed payments could lead to adverse effects.

It’s also important to consider how hard inquiries might come into play. Every time a consumer applies for credit through a service, it could trigger a hard pull on their financial record. These inquiries can temporarily affect scores, making it essential to assess the timing and necessity of such applications.

Ultimately, staying informed about how your choices today could shape your financial landscape tomorrow is key. Monitoring your activities and understanding the policies of the service you use can lead to smarter decisions and a stronger financial future.

How Klarna Works for Consumers

When it comes to shopping, many individuals seek flexibility and convenience in their payment options. This service provides an innovative approach that allows users to make purchases while managing their expenses effectively. With a user-friendly interface and seamless integration, this solution caters to the needs of today’s consumers.

At its core, this platform allows shoppers to buy items and decide whether to pay immediately or spread the cost over time. This flexibility can ease financial pressure, especially for those making significant purchases. By selecting a repayment plan that suits their budget, users can enjoy their new items without the worry of upfront costs.

Additionally, the application process is typically straightforward. Consumers can easily sign up online and link their preferred payment methods. Once registered, they can begin shopping at partnered retailers, choosing how and when to pay for their purchases.

Moreover, this service often features transparent fee structures. Users appreciate knowing exactly what to expect, helping them avoid hidden charges. With notifications and reminders, it keeps individuals informed about upcoming payments, promoting responsible spending habits.

In summary, this payment solution empowers users by offering them control over their purchases, making the shopping experience both enjoyable and manageable. It’s all about providing an innovative way to handle expenses without sacrificing the thrill of buying something new.

Building a Positive Credit History with Klarna

Creating a solid financial reputation is essential for future endeavors. When individuals engage in responsible financial practices, it can open doors to better opportunities. This section focuses on how utilizing certain payment services can contribute to a wholesome financial profile.

One approach to ensuring a favorable standing involves timely repayments. Meeting deadlines not only showcases reliability but also fosters trust with lenders. Here are some effective strategies to enhance your financial image:

- Make Payments On Time: Set reminders and stick to a schedule to avoid late fees.

- Avoid Overextending: Keep spending within manageable limits to maintain balance.

- Utilize Payment Reminders: Use tech tools or alerts to keep track of upcoming dues.

Engagement with various financial services can also play a role. Regularly using specific platforms and making consistent payments can contribute positively. Consider the following benefits:

- Enhances your financial profile through demonstrated responsibility.

- Encourages disciplined spending habits.

- Allows tracking of your financial journey over time.

Ultimately, embracing responsible financial behavior is key. By taking advantage of available options and remaining consistent in payments, a sturdy financial reputation can be established and maintained.