The Impact of Your Credit Score on Job Opportunities and Employment Decisions

In today’s competitive landscape, many individuals seek to understand the intricate connections between their financial histories and employment opportunities. It’s a fascinating area that often raises questions and concerns among job seekers. The interplay between one’s financial behavior and the perceptions it creates in the eyes of potential employers is certainly a topic worth exploring.

As organizations strive to build trustworthy teams, some may delve into the financial backgrounds of applicants. It raises a crucial point: to what extent can past financial decisions impact job prospects? Understanding these nuances can help candidates navigate the hiring process with greater confidence.

While the idea of personal finances being scrutinized might seem daunting, a clearer perspective can provide valuable insights. It’s essential to differentiate between genuine qualifications and mere speculation based on financial history. This examination will shed light on the practices surrounding this topic, allowing individuals to better prepare for their future endeavors.

The Connection Between Employment and Credit Scores

Many people wonder how their financial history influences their professional life. There’s a delicate link between these aspects that can impact opportunities. Employers often take a closer look at applicants’ financial behavior to assess responsibility and reliability, which can have consequences for career advancement.

While not every workplace will check an applicant’s financial background, certain industries–like finance or those involving significant responsibilities–may use this information as a tool during the hiring process. A strong financial standing often indicates strong personal management skills, which are essential in many roles.

It’s crucial to understand that this isn’t just about past missteps; a comprehensive view of one’s financial health includes positive indicators as well. Individuals with a strong track record, character, and commitment can leverage this to their advantage.

Ultimately, a proactive approach to managing one’s finances can reflect positively in various aspects of life, including professional engagements. Preparing adequately by maintaining good financial habits can lead to a multitude of opportunities throughout a career.

Why Employers Check Credit Reports

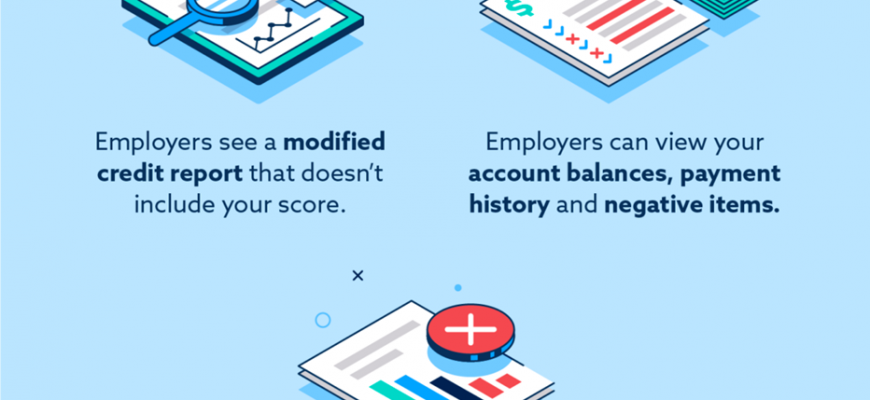

Employers often seek insights into a candidate’s financial history as part of their hiring process. This practice stems from the belief that an individual’s monetary management skills can reflect their overall character and reliability. After all, responsibility in handling personal finances might suggest similar conduct in a workplace setting.

Human resources departments look to this information to assess risk, especially for positions involving financial responsibilities or access to sensitive data. A solid financial background might indicate a trustworthy employee, while troubling financial issues could raise red flags. Thus, employers aim to cultivate a secure environment and mitigate potential challenges that may arise from poor judgment or irresponsibility.

Moreover, this evaluation can help determine how well candidates might fit into the corporate culture. For instance, a history of financial difficulties could hint at stress or distractions that might affect job performance. Ultimately, this examination is one of many tools companies utilize to ensure they are selecting the best possible candidates for their teams.

Impacts of Credit History on Hiring

When it comes to the selection process, many factors play a crucial role in decision-making. One aspect that often gets overlooked is an individual’s financial background. While personal finance might seem unrelated to professional capabilities, employers frequently consider this information when evaluating candidates.

Understanding this connection can shed light on why certain applicants are favored over others. A solid financial reputation may be perceived as a reflection of responsibility and reliability. In some industries, particularly those involving financial management or sensitive information, the background check can serve as a way to assess trustworthiness.

Employers may believe that someone with a problematic financial history could be more prone to internal risks, such as fraud or theft. Consequently, applicants with blemishes on their financial records might face additional scrutiny. This focus on fiscal behavior suggests that maintaining a healthy financial profile is not only important for personal stability but also for career advancement.

Ultimately, while qualifications and experience are vital, understanding the role of financial history in the hiring process can provide a competitive edge. Taking steps to cultivate a positive financial image may boost opportunities in the job market.