Exploring the Possibility of Using Financial Aid to Cover Rent Expenses

When it comes to pursuing education or training, many individuals often seek support that can alleviate the burden of costs. Among these, housing expenses can often become a significant financial challenge. It raises the question: how can one navigate through various resources and determine if they can help cover living arrangements? Exploring options might reveal surprising possibilities.

Many students are unaware that there are provisions available that can ease their monthly housing obligations. Understanding the eligibility criteria and the intent behind certain support systems is crucial in finding out what can be applied towards essential living costs. This examination can lead to a better grasp of budgeting and expense management while studying.

In this discussion, we’ll delve into the intricacies of various support mechanisms and their potential applicability to housing costs. By shedding light on the connection between educational support and everyday financial responsibilities, individuals can make more informed decisions about their budgets and financial strategies.

Understanding Financial Aid Basics

When it comes to pursuing your education, navigating the world of funding options can feel overwhelming. Knowing what types of support are available and how they can be utilized is crucial for anyone looking to enhance their learning experience without breaking the bank. Let’s dive into the essential elements that can help you grasp the principles behind these monetary resources.

Types of Support: There are various forms of support available to students, ranging from grants and scholarships to loans. Each type has its own set of rules and benefits, which can significantly impact your overall financial planning. Grants and scholarships are often considered free money, while loans require repayment, which can create obligations down the line.

Eligibility Requirements: To access these resources, it’s important to understand the criteria that determine eligibility. Factors such as income level, academic performance, and even field of study can influence the options available. Be sure to research and familiarize yourself with the specific qualifications needed for each funding opportunity.

Application Process: The journey doesn’t end with understanding what’s available. Completing the necessary applications accurately and on time is a vital step. Paying attention to deadlines and required documentation ensures that you maximize your chances of receiving the support you need.

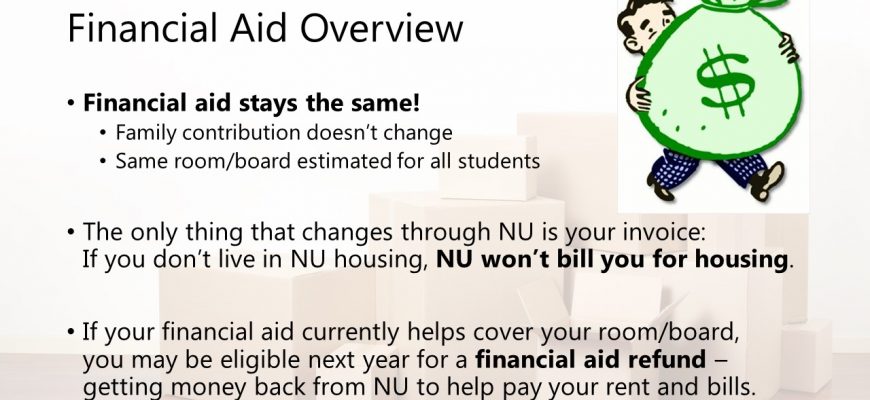

Making Sense of Allocations: Once granted, determining how the funds can be allocated is vital. While the primary goal is often tuition and associated fees, students often wonder about living expenses. Discovering how other costs can be covered by the support is part of the process, leading to more informed financial decisions.

By grasping the basics, you’ll be better equipped to manage your expenses while pursuing your academic goals. With the right approach, securing the resources needed for education becomes a much more achievable task.

Types of Financial Assistance Available

When navigating the complexities of managing living expenses, various forms of support are out there to help lighten the load. Each option caters to different needs and situations, making it important to explore what’s available. From government programs to community initiatives, there are resources designed to provide relief during tough times.

One common type of support comes from government entities, offering programs that aim to assist individuals and families in meeting essential costs. These may include grants and subsidies, which do not require repayment and can significantly ease the burden of monthly obligations.

Additionally, non-profit organizations often play a crucial role in providing resources. They may offer direct assistance or connect individuals with local services that can help cover necessary expenditures. Each organization may have different criteria, so it’s worth investigating the options available in your area.

Another avenue to consider is assistance through educational institutions. Many colleges and universities provide resources to students facing financial challenges, including special funds designed to help with essential living expenses.

Ultimately, understanding the different types of resources out there can empower individuals to take charge of their situations and find the support they need to thrive.

Utilizing Assistance for Housing Expenses

When it comes to managing living costs while pursuing education, many individuals seek avenues to lessen the financial burden. One area that often raises questions is whether support provided for educational purposes can also accommodate housing needs. Understanding the parameters and options available can help navigate this aspect effectively.

Many programs exist that offer resources to help stabilize your living situation while you focus on your studies. These resources can cover a range of costs associated with housing, including rent, utilities, and other necessary expenses. By exploring these opportunities, students can create a more manageable financial landscape.

It’s essential to be informed about the specifics of these programs. Each source of assistance may have different guidelines regarding what expenses are permissible. Research and communication with program administrators can clarify how these funds can directly impact your day-to-day living costs.

Incorporating these forms of support into your housing strategy can make a significant difference. Balancing educational obligations with the need for stable accommodation can lead to a more successful academic experience. Ultimately, prudent planning and awareness of available resources empower individuals to focus on their educational goals with less stress.