Am I Eligible to Receive Universal Credit Benefits?

Many individuals find themselves facing challenging circumstances that impact their financial well-being. Navigating the maze of assistance programs can often feel overwhelming, but understanding what options are available is the first step towards regaining stability. Whether you’re seeking support due to employment changes, health issues, or other life events, exploring various avenues for aid is essential.

It’s natural to wonder about eligibility for these financial resources, especially when the future seems uncertain. Different criteria and regulations apply, but it’s crucial to familiarize yourself with the requirements that may apply to your specific situation. Staying informed can empower you to make the best decisions for your needs.

As you delve into the specifics, consider the various types of support tailored for people in diverse situations. Each program comes with its own set of rules and benefits, reflecting the unique challenges faced by individuals and families. By gathering the right information, you’ll be better equipped to determine what assistance might be available to you.

Understanding Eligibility for Benefits

Determining who qualifies for financial assistance can feel overwhelming for many. It’s essential to grasp the various aspects that influence your suitability for this type of support. Numerous factors, such as personal circumstances, income levels, and existing responsibilities, play a significant role in the evaluation process. Getting to know these elements can help shed light on your individual situation.

First, it’s important to examine your living arrangements and financial standing. Your income and savings can significantly affect your eligibility, as the program is designed to support those who require additional help. Moreover, your age and family situation may also come into play, as different criteria apply to various demographics.

Another crucial aspect involves residency. Those applying must be living in the United Kingdom, and compliance with certain legal requirements is necessary. Being aware of these regulations ensures that you are on the right path when seeking assistance.

Lastly, while navigating through the requirements, it might be wise to seek guidance from local organizations or online resources. These can provide additional clarity and support as you work through the qualification criteria. Understanding the bigger picture will empower you to make informed decisions about your financial future.

How to Apply for Financial Assistance

Starting the process of seeking support can seem overwhelming, but it doesn’t have to be. The initial steps are designed to help you understand what is required and make it as simple as possible. You’ll be guided through the necessary information and documentation needed to submit your application successfully.

First things first: gather your personal details. This includes your address, bank account information, and identification. It’s essential to have all your documents ready, as this will speed up the process. The online application is the primary method, making it convenient to fill out everything from the comfort of your home.

Once you’ve prepared your information, visit the official government website. There, you will find an easy-to-follow questionnaire that leads you through the procedure step by step. Pay close attention to each question and provide accurate answers to avoid delays. If you run into any confusion, there are numerous resources and helplines available to assist you.

Don’t forget: after submitting your request, keep an eye on your email or online account for updates or additional instructions. You may be asked to provide more documents or clarify certain points. Staying proactive in your communication will ensure a smoother experience overall.

Ultimately, the key is to approach the application with patience and clarity. With the right preparation, navigating this process will be much easier, and you’ll be one step closer to receiving the support you need.

Common Questions About Financial Support

In this section, we’ll tackle some frequently asked questions regarding assistance programs designed to help individuals and families. Many people find themselves curious about eligibility, application processes, and available resources. Understanding these aspects can make navigating financial support much smoother.

One of the biggest inquiries revolves around who qualifies for these benefits. Eligibility often depends on various factors such as income, family size, and personal circumstances. It’s essential to gather all relevant information before applying to ensure you meet the requirements.

Another common question relates to the process of applying. Many wonder how to start and what documentation is necessary. Typically, online applications are available, and you may need to provide proof of identity, income details, and any relevant expenses.

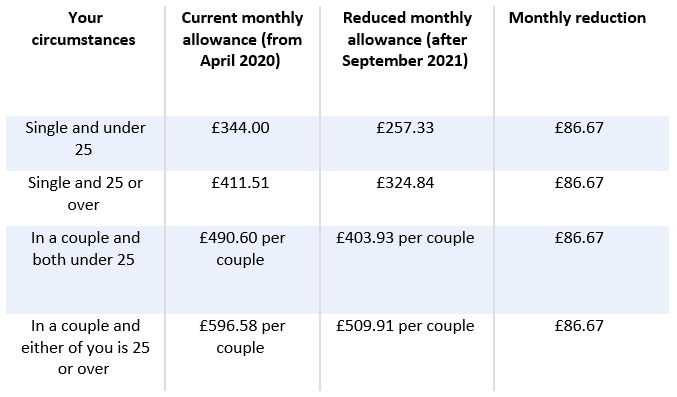

People also frequently ask about how much assistance they might receive. The amount often varies based on individual needs and financial situations. It’s important to check the specific guidelines to get a clearer picture of potential help.

Lastly, many individuals seek advice on managing their payments once the support is received. Knowing how to budget effectively can make a significant difference in making the most out of the available resources.