How Hospital Bills Might Impact Your Credit Score and Financial Health

Dealing with unexpected health issues can be daunting, and the aftermath often leaves individuals in a precarious financial position. It’s not just the physical recovery that demands attention, but also the monetary implications that come into play. Many people find themselves wondering how unpaid healthcare costs could ripple through their financial lives, affecting the way lenders perceive their monetary responsibility.

When it comes to managing finances, the shadow of outstanding healthcare charges looms large for countless individuals. The insights into how these expenses intertwine with financial assessments are crucial for anyone looking to safeguard their economic future. Understanding these connections might help in making informed choices, potentially leading to better long-term outcomes.

In this exploration, we will delve into the various routes these medical payments can take and how they might influence one’s overall financial profile. From the initial handling of these costs to the potential consequences of neglect, gaining clarity on this subject is vital for anyone navigating the complexities of their financial landscape.

How Medical Debt Affects Credit Scores

When it comes to managing finances, outstanding healthcare obligations can play a significant role in determining a financial profile. Understanding the impact of these debts on overall financial health is crucial for informed decision-making. Many individuals may not realize that medical obligations can have a long-lasting influence on their financial standing and borrowing potential.

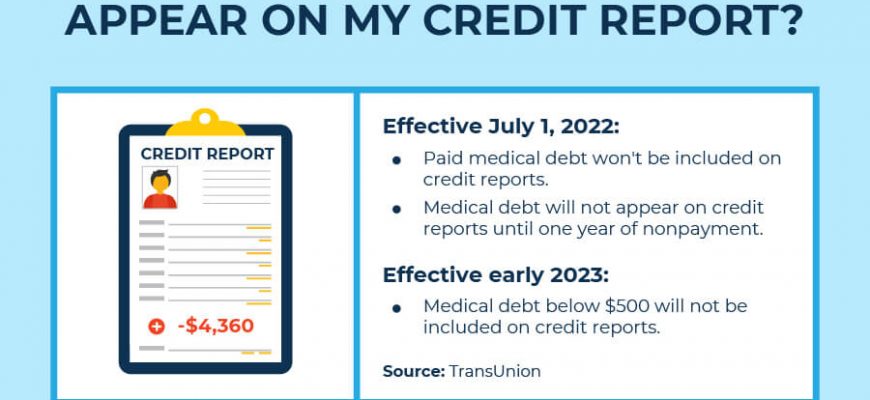

One of the key aspects to consider is how these types of debts are reported to credit agencies. Unlike traditional loans, medical finances may not show up immediately. However, once they reach a certain threshold or are sent to collections, it can lead to a negative mark on your financial report. This can lower the overall score significantly, making it harder to secure loans or favorable interest rates in the future.

Even if one pays off medical expenses, the initial inquiries or late payments could still linger in the credit history for a time. This can create unnecessary obstacles when applying for mortgages or car loans. It’s essential to be proactive–monitoring medical invoices carefully and addressing any discrepancies can help in maintaining a healthier financial outlook.

Additionally, some credit scoring models take into account the difference between paid and unpaid medical debt. This means that if an individual manages to clear their previous obligations, it may not entirely erase the footprint left behind but could mitigate some of the negative effects over time.

In summary, staying vigilant about medical obligations is vital for preserving a strong financial reputation. With awareness and a strategic approach, one can navigate the complexities of medical expenses without damaging their financial future.

Understanding Medical Billing Practices

When it comes to the world of healthcare, the way charges are presented can be quite complex. Many individuals find themselves navigating a maze of invoices after receiving treatment. This process is often filled with jargon and varying fees, making it challenging to grasp what you’re truly responsible for paying. Understanding the nuances behind these invoices is essential for anyone who wants to manage their expenses effectively.

Billing procedures often differ from one facility to another, creating a diverse landscape of payment structures. Each department may have its own set of costs, and additional fees can pop up depending on various services rendered. It’s not uncommon for patients to receive multiple statements from different parts of a medical establishment, leading to confusion about total amounts due.

Moreover, the timing of these invoices can also add to the uncertainty. Charges might arrive well after the service was provided, leaving individuals scrambling to comprehend what they owe. Knowledge of this cycle can help in planning financially and ensuring that all obligations are met in a timely manner.

In addition, knowing how these costs are processed and the potential for negotiation can empower patients to take charge of their finances. Many institutions offer payment plans or financial assistance, so it’s worth exploring all available options. Being proactive about understanding this aspect of healthcare is crucial in maintaining financial peace of mind.

Steps to Manage Medical Expenses

Dealing with healthcare costs can be overwhelming, but there are effective ways to take control of your finances. Understanding the options available and being proactive can make a significant difference in managing those expenses.

1. Evaluate Your Bills: First things first, closely examine all charges. Look for any discrepancies or errors that might inflate your costs unnecessarily. Don’t hesitate to reach out for clarification if something doesn’t look right.

2. Communicate with Providers: Opening a dialogue with doctors or treatment facilities can be beneficial. They may offer payment plans or discounts for upfront payments. Many providers are willing to work with patients to find a feasible solution.

3. Explore Financial Assistance: There are various programs available that can help ease the burden of high costs. Research grants, charities, or local organizations dedicated to assisting individuals facing extraordinary healthcare fees.

4. Prioritize Payments: It’s important to determine which expenses require immediate attention. Focus on critical treatments and deadlines so that you don’t find yourself in a worse predicament.

5. Set Up a Budget: Crafting a financial plan can provide clarity. Allocate a certain amount each month to cover outstanding expenses, ensuring that you don’t fall behind and can manage payments comfortably.

6. Use Health Savings Accounts: If available to you, consider using Health Savings Accounts or Flexible Spending Accounts. These can provide tax advantages that help offset overall costs more efficiently.

7. Stay Educated: Keeping yourself informed about healthcare options, insurance policies, and your rights as a patient can empower you. This knowledge allows you to navigate through potential financial challenges effectively.