Is It Possible for Financial Aid to Access Your Bank Account Information?

In the world of educational support, many individuals often find themselves questioning the extent to which their personal financial resources are scrutinized. As students navigate their pathways to higher learning, understanding how various programs evaluate economic situations becomes crucial. This topic invites a closer look at the processes and criteria that come into play when seeking assistance for tuition and related expenses.

Many people worry about the level of transparency surrounding their private finances. With so much emphasis on providing accurate information during the application process, it’s natural to ponder whether institutions delve into not just income, but also the savings and assets that individuals may possess. The curiosity surrounding these matters often stems from the desire for clarity in what can sometimes feel like a complicated maze of requirements and evaluations.

As prospective students explore their options, delving into the nuances of this topic offers a chance to dispel myths and clarify uncertainties. Are there guidelines that dictate the level of scrutiny applied to an applicant’s financial resources? What role do personal savings play in determining eligibility for support? This discussion aims to demystify the process and help individuals better prepare for their educational journeys.

Understanding the Verification Process

Navigating the world of educational support can be a bit overwhelming, especially when it comes to the review procedures that may follow an initial application. It’s essential to grasp what happens after you submit your request for assistance. The following section sheds light on the steps involved in confirming the information you’ve provided, ensuring accuracy and eligibility for support.

When you’re selected for review, it’s not just a chance encounter; it’s a standard practice aimed at maintaining transparency and integrity. The reviewing body will typically request various forms of documentation that substantiate the details you’ve shared. This could range from income statements to various other financial documents that paint a fuller picture of your situation.

Why is this process important? Accuracy plays a crucial role in determining what resources can be allocated to help you achieve your educational goals. If any discrepancies arise during this examination, it could lead to delays or even affect the level of support you receive. As a result, cooperation and promptness in providing requested information are vital.

Moreover, being proactive can make a significant difference. Familiarize yourself with the types of documents that may be asked for, and have them ready when needed. This preparedness not only facilitates a smoother process but also shows your commitment and seriousness about your educational journey.

In summary, understanding the verification pathway is key. It not only helps you know what to expect but also empowers you to successfully navigate this essential phase in securing the resources you need.

Role of Bank Statements in Aid Assessment

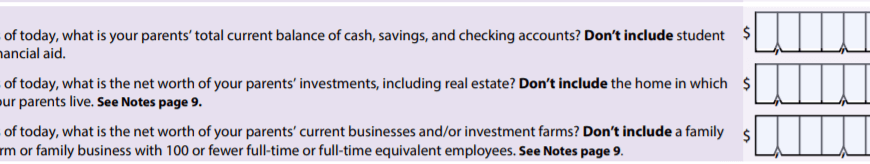

When it comes to determining eligibility for assistance, certain financial documents play a crucial part in the evaluation process. Among these, a detailed overview of one’s financial activities can provide essential insights into an individual’s economic situation. These records may contain valuable information that can help assess needs, ensuring that support is directed to those who require it the most.

Such statements typically reveal patterns in spending and saving, offering a snapshot of overall financial health. Analyzing this data can uncover whether applicants have sufficient resources to meet their educational expenses without additional support. This can include regular expenses, income sources, and any unexpected costs that might arise.

Moreover, the presence of consistent deposits or significant balances can indicate a level of stability that may impact eligibility for various programs. Evaluators may look for not just how much is there, but also how it reflects the individual’s financial strategy and commitment to managing resources effectively.

Ultimately, the examination of these documents is not just about numbers; it’s about understanding the broader financial landscape of each applicant. This allows decision-makers to allocate resources more judiciously, ensuring that assistance is provided to those who genuinely need it, fostering a more equitable environment for all involved.

Impacts of Financial Transparency on Assistance

When it comes to receiving support, understanding the role of openness in personal finances can make a significant difference. By sharing financial details, individuals not only clarify their situation but also enhance their chances of accessing resources that can help them succeed. This level of transparency allows organizations to assess needs more accurately and allocate resources where they are most required.

Greater clarity regarding one’s economic standing can lead to tailored solutions that fit unique circumstances. When entities can evaluate the true financial picture, they can provide more effective assistance that meets the specific challenges faced by individuals. This alignment benefits both parties, as it creates a pathway for meaningful and impactful support.

Moreover, being honest about financial matters fosters trust between applicants and support providers. When applicants demonstrate openness, it paves the way for a collaborative relationship, encouraging dialogue and understanding. Such rapport can lead to additional guidance and resources that extend beyond mere monetary support.

Ultimately, the influence of financial openness extends beyond immediate assistance. It cultivates a culture of accountability and responsibility, encouraging individuals to take charge of their economic journeys. Being transparent not only aids in securing necessary support but also empowers individuals to work toward long-term stability and growth.