How Can Experian Help Me Freeze My Credit to Protect My Financial Information

In today’s world, protecting your personal financial information is more important than ever. As identity theft and fraud become increasingly common, individuals are looking for ways to secure their sensitive data from potential threats. One effective method to safeguard your financial standing involves restricting access to your personal information, ensuring that unauthorized parties cannot easily obtain it.

There are various institutions that offer services to help manage and control your financial details. By taking advantage of these services, individuals can have greater peace of mind knowing that their sensitive information is protected. Whether you’re facing uncertainties or simply wish to enhance your privacy, exploring your options can lead to a more secure financial future.

Understanding how to navigate these protective measures can empower you to make informed decisions. With the right knowledge, you can effectively manage your personal data and mitigate risks associated with financial vulnerabilities. Don’t wait until a situation arises–be proactive in fortifying your financial wellbeing.

Understanding Credit Freezes

When it comes to safeguarding your financial identity, there’s a tool designed to help you take control of your personal information. This option allows you to stop any unauthorized individuals from accessing your financial profiles, giving you peace of mind. It’s like putting a lock on a door that shouldn’t be opened without your consent.

Essentially, this protective measure restricts access to your financial data, making it challenging for anyone to open new accounts in your name. By employing this strategy, you can significantly reduce the risk of becoming a victim of identity theft. It’s a proactive step that can save you a lot of headaches down the road.

So, if you’re looking to enhance your security and keep your information safe, understanding how this option works is crucial. Knowing the ins and outs will empower you to make informed decisions about your personal finance management. It’s not just about security; it can also offer you greater control over your financial landscape.

How Experian Handles Credit Security

When it comes to safeguarding your financial information, understanding how protection mechanisms work is essential. It’s all about ensuring that personal data remains secure from unwanted access and potential fraud. Various strategies are in place to help individuals manage their information and restrict unauthorized inquiries into their financial profiles.

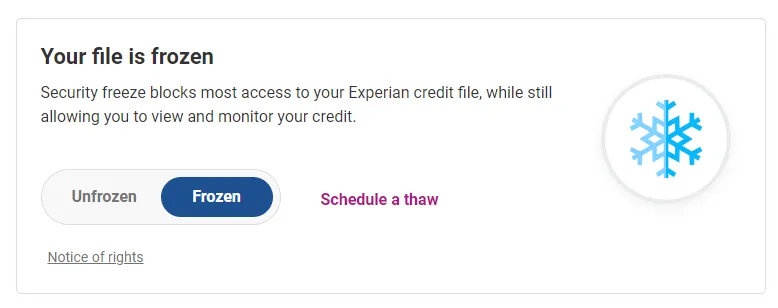

One of the primary methods employed to enhance security is a process that limits access to sensitive information. This allows individuals to take control of who can view their financial history, providing peace of mind. By implementing these protective measures, one can effectively create a barrier against identity theft and other malicious activities.

Moreover, ongoing monitoring services play a critical role in keeping tabs on changes that may indicate suspicious behavior. Alerts and notifications about unusual activity further empower individuals to act swiftly if something appears amiss within their financial background. Through these proactive steps, people can feel more secure about their personal data.

Ultimately, it’s all about giving individuals the tools they need to manage their financial profiles responsibly. By taking advantage of the available resources, anyone can significantly enhance their protection against potential threats in the financial landscape.

Steps to Request a Security Hold

If you’re looking to enhance your financial security, placing a hold on your record can be a great decision. This action can protect you from unauthorized access and potential fraud. Below are the straightforward steps you’ll need to follow to initiate the process effectively.

- Gather Your Information: Collect necessary details such as your full name, address, date of birth, and Social Security number. Having these on hand will make the process smoother.

- Visit the Official Website: Head to the official site of the agency responsible for managing your financial information. Look for the section that deals with safety measures.

- Fill Out the Form: Complete the required form for placing a hold. Take your time to ensure all information is accurate to avoid any delays.

- Submit Your Request: After filling out the form, submit it through the recommended method–whether online or via mail. Make sure to keep a copy of your submission.

- Receive Confirmation: Wait for a confirmation that your request has been processed. This could take anywhere from a few minutes to several days, depending on various factors.

Following these steps will help you secure your personal information effectively. By taking this precaution, you can ensure that unauthorized individuals cannot access your financial history.