Is It Possible to Use One Credit Card to Pay Another Credit Card Bill?

In today’s fast-paced financial landscape, many individuals seek ways to manage their obligations more effectively. The question often arises about whether one can transfer funds from one revolving account to another, allowing for easier oversight of outstanding debts. This scenario piques the interest of those looking for financial relief or strategic maneuvers within their personal budgets.

Understanding the mechanics behind these transactions unveils a plethora of options, each with its own advantages and potential pitfalls. Exploring the concept opens a dialogue about responsible usage, interest rates, and the implications of these actions on one’s overall financial health. With the right knowledge, individuals may find themselves equipped to make informed decisions about their monetary strategies.

As we delve deeper, we will examine various methods, benefits, and considerations associated with this practice. It’s crucial to navigate this territory wisely and weigh the pros and cons to determine the best course of action for one’s unique financial situation.

The Mechanics of Card Transactions

When it comes to using a financial tool, many people wonder how the entire process unfolds. The interaction between various entities is crucial in determining how funds are transferred and what systems are at play. Understanding this intricate dance can help demystify the world of transactions and shed light on how balances can shift from one account to another.

At the heart of the system lies the relationship between the consumer, the issuer, and the merchant. Each time a purchase is made or an obligation fulfilled, information is shared across secure networks to facilitate the exchange. The involved parties must verify identities and ensure accounts are in good standing. This process happens so quickly that it often feels seamless to the end-user.

The backend is a complex web of technology and agreements. Payment processors handle the logistics, while gateways act as bridges between the consumer’s financial institution and the vendor. Each click or tap sends signals through this network, allowing the user to complete transactions without a hitch.

Additionally, the verification steps include authorization and settlement. These not only help prevent fraud but also provide peace of mind to all parties involved. By ensuring funds are available and obligations are met, this intricate framework supports a thriving commerce ecosystem.

In essence, what may seem like a straightforward action involves a multitude of components working harmoniously. This behind-the-scenes activity is vital for a smooth financial experience, highlighting the importance of trust and technology in the everyday use of modern financial solutions.

Understanding Balance Transfers and Fees

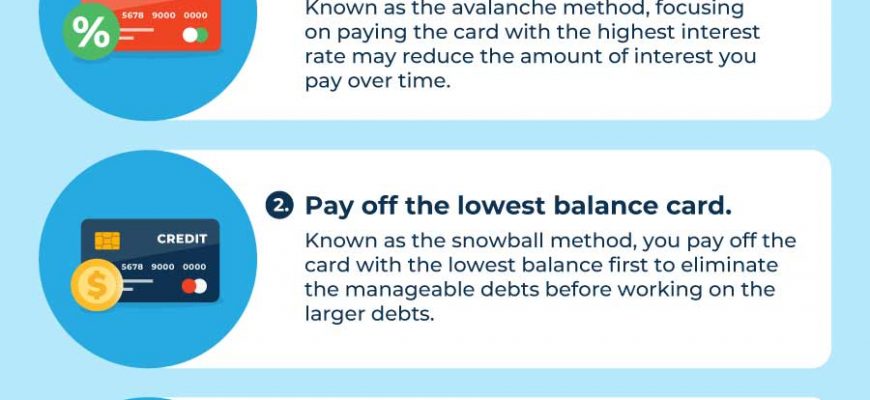

When it comes to managing your financial obligations, the idea of shifting balances between various accounts can be both appealing and daunting. This process often involves moving outstanding amounts from one provider to another, aiming to consolidate debt or reduce monthly payments. However, while the concept seems straightforward, there are intricacies that warrant a closer look, especially about potential costs involved.

Transfer fees can lurk in the fine print, and it’s vital to understand how they might impact your overall financial situation. Some institutions might offer introductory periods with enticingly low rates, but the attached expenses can undermine those benefits. Before proceeding, always take a moment to evaluate the total costs and weigh them against the advantages you’re hoping to gain. Transparency is key, and being informed about what’s at stake will help you navigate this process with confidence.

Alternatives to Paying with Credit

Exploring different methods for managing expenses can be quite insightful. Instead of relying solely on plastic payment methods, there are various options that might suit your financial lifestyle better. Let’s dive into some of these alternatives that can help you handle your obligations more effectively.

One popular choice is utilizing debit options linked directly to your bank account. This way, you can spend only what you have, minimizing the risk of overspending or accruing unnecessary debt. It’s a straightforward approach that many find comforting.

Another interesting method is using personal loans for larger purchases. This option often comes with clearly defined repayment terms, allowing for structured payments over time. It can be a viable solution when facing significant expenses and might even come at a lower interest rate compared to routine borrowing methods.

If you’re looking for a more modern solution, consider digital wallets and mobile payment applications. They allow for quick transactions and often include budgeting tools, making it easier to keep track of spending habits. Plus, the convenience of having multiple accounts in one app can save you time.

Lastly, cash remains a dependable option. While it may seem old-fashioned, handling physical money can enhance your awareness of spending and reinforce a budget-conscious mindset. It’s a classic choice that still holds relevance in today’s financial world.